Locator: 48477B.

Super Bowl: news cycle for others will be put on hold for the next several days as all attention turns to the Super Bowl. There will be some exceptions. As for the blog, it continues unabated. I'm lovin' it.

Trump: incredibly refreshing to have a president that talks to the American public 24/7.

Equinor: Nordstream 1 natural gas pipeline completely destroyed.

AMD's earnings: why is x so much better reporting these numbers than mainstream media? Link here. AMD to to partner with MSFT on "copilot."

Disney earnings: link here.

EV wrap:

Ford: will sell these things at a loss to maintain leadership. Link here. From x.

January, 2025, sales in the U.S. fell 6.3% owing to lower demand for its internal combustion (ICE) vehicles, the company said on Monday.

The automaker sold a total of 142,944 units - including ICE and electrified vehicles - in January, compared to the 152,617 it sold a year ago.Sales of its electrified vehicles, which include both electric and hybrid vehicles, rose about 20% to 18,961 units.

Honda - Nissaan: merger deal appears to be "off."

Focus on dividends: TotalEnergies -- to increase its dividend by 7%.

Coal, link here:

***********************************

Back to the Bakken

WTI: $71.83.

New wells:

- Friday, February 7, 2025: 8 for the month, 54 for the quarter, 54 for the year,

- 40438, conf, Enerplus, Strength 150-94-06B-18H,

- Thursday, February 6, 2025: 7 for the month, 53 for the quarter, 53 for the year,

- 40456, conf, Hess, GO-Beck Living TR-156-98-2017H-4,

- 39390, conf, CLR, Goodson 2-21H,

- Wednesday, February 5, 2025: 5 for the month, 51 for the quarter, 51 for the year,

- None.

RBN Energy: new NGL pipes, fracks, and LPG export terminal give MPLX, ONEOK what they've wanted. Archived.

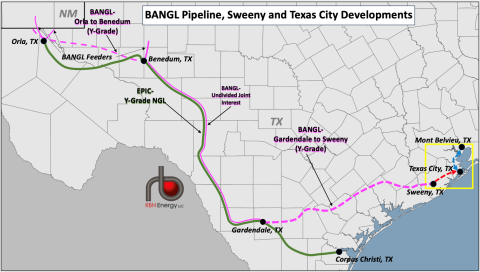

It finally happened. And it’s a very big deal for MPLX and ONEOK, both of which have been working for years to become full-fledged members of the elite “NGL wellhead-to-water club.” But the companies’ announcements that MPLX will build two fractionators at the terminus of a new NGL pipeline from Sweeny to Texas City and that ONEOK and MPLX will joint build a new LPG export terminal nearby (and a new purity-product pipeline between Mont Belvieu and the terminal) doesn’t just fill in the missing pieces of the puzzle they’ve been assembling. The plans also will give Gulf Coast LPG exporters the additional capacity they desperately need and — no small thing — create another fractionation hub. In today’s RBN blog, we discuss what MPLX and ONEOK are planning and why it matters.In a Drill Down Report in late 2023, we described the NGL networks owned and operated by the four large midstream companies (Enterprise Products Partners, Energy Transfer, Targa Resources and Phillips 66) that currently provide wellhead-to-water services — everything from gas processing plants in the Permian and other plays to long-haul NGL pipelines to the Gulf Coast to fractionation plants (almost all of them in Mont Belvieu) and export terminals for purity NGL products. As we said then, “That start-to-finish management of the NGL stream provides a number of important benefits — chief among them, the ability to operate with extraordinary efficiency, collect fees from shippers each step of the way, and feed pipelines, fractionators, storage and export terminals along the network’s value chain.”

In several RBN blogs and Analyst Insights since then, we’ve discussed the need for more NGL export capacity and plans for projects to meet those needs. We've also looked at plans by ONEOK and MPLX to expand the NGL side of their businesses, many of them aimed at enhancing the companies’ operational optionality and wellhead-to-water capabilities.

Two recent ONEOK deals are most relevant to our discussion today. First, in June 2024, ONEOK closed on the purchase of 450 miles of NGL and other liquids pipelines in the greater Houston area from Easton Energy and announced plans to connect the NGL system to ONEOK’s Mont Belvieu assets. Then, in a two-step deal — the latter part of which closed on January 30 — ONEOK acquired EnLink Midstream, which, among other things, gave ONEOK 1.6 Bcf/d of gas processing capacity in the Permian. ONEOK already owned a host of valuable NGL-related assets, including several gas processing plants in the Rockies and Midcontinent; a handful of NGL pipeline systems (West Texas NGL, Elk Creek and Bakken NGL among them); more than 1 MMb/d of fractionation capacity (more than two-thirds of it in Mont Belvieu, where it owns six fracs); and 30 MMbbl of salt-cavern storage capacity for NGLs.

Figure 1. BANGL Pipeline, Sweeny and Texas City Developments. Source: RBN