Locator: 48402B.

Trump: day 7. Yesterday was an incredibly good day for President Trump. He got in a round of golf and schooled Colombia. Which gave him an opportunity to remind folks he's serious about doing the same to Canada and Mexico.

Media: Fox News broke the story on Colombia first.

The New York Times didn't report the story until several hours later. The story broke just before the Kansas City Chiefs took the field; Fox News appeared to be the first major news outlet that reported the story. About a half hour later The NYT reported the story -- the story that Colombia was standing up to Trump. By the end of the game -- the Chiefs won, 32 - 29 -- Colombia had backed off; Trump won. Fox News reported it immediately; perhaps even before it was confirmed by a second source. Incredibly -- well, maybe not so incredibly, The New York Times did not mention that Colombia backed off until several hours later, and all they did was change the headline. The NYT story linked to the headline remained the same, except a paragraph was added deep inside the story mentioning in passing that Colombia had backed down.

Recession:

This is really, really cool.

Finally, I can agree with al of those folks predicting a recession for the past four years. We're finally going to see it. It? A recession.

Well, at least we're going to start hearing the word "recession" this week, and, of course, "sticky inflation," which has never gone away.

The US won't actually have a recession this year -- if recession is defined by two consecutive quarters of negative growth -- a negative GDP -- as with a "minus sign" in front of "1% GDP," for example.

But we will have a marked decreased in GDP.

GDPNow was forecasting a wonderful 3% GDP for Biden's last quarter. By the end of the year, GDPNow will be forecasting a 1% GDP growth -- that's not negative but going from 3% to 1% is going to feel like a recession. Price of eggs? Don't even get me started.

The market is ready to sell off; it already has in some sectors. We're going to be told it's all about the Chinese LLM DeepSeek. Okay. But what really go the market spooked over the weekend was the tariff story.

It looks like Trump is serious.

It looks like Trump is sticking to his 25% tariffs on Mexico and Canada. His advisors (and he himself) may want tariffs delayed until we see what Mexico and Canada will do with regard to cross-border fentanyl and human trafficking but in the big scheme of things, that's just the flag leading the troops. Fentanyl and human trafficking are the flags leading this "economic war." Does anyone really think the guy who wrote the book on "the art of the deal" is really worried about fentanyl and human trafficking?

The real story is exactly what Trump has been saying for years: he's tired of jobs going to Mexico and he's tired of the trade imbalance with Canada, especially when it comes to cars.

We had three hours of "high anxiety" yesterday when Trump slapped 25% tariffs on Colombia -- say what? Colombia? I can't even identify where Colombia is on a South American map -- I know it's near Central America -- I think it's to the left of Venezuela; it may be the last SA country bordering Central America -- where the soon-to-be-US-owned Panama Canal is -- going north from the rest of the banana republics -- but a trade war with Colombia? Wow, I hope folks can "diagram" that sentence.

Colombia shot back with 50% tariffs on coffee and flowers.

That's what really spooked investors. Traders weren't spooked. They love this. Buy low, sell high. But I digress.

Back to tariffs.

AOC made it really, really, really worse and really, really, really scary for investors when she said that tariffs on Colombia would increase the cost of coffee at Starbucks and .... drum roll .... the cost of flowers. Wedding season is coming up in June.

The tariffs on Colombia may still be in place -- that was a bit hazy by the end of Trump's round of golf early Sunday evening. I can't make this up. On the third hole Trump got word that Colombia would not allow US military a/c to land in his country carrying hard-working Colombians back to their home country; by the eighth hole the Colombian president said he would send his own "presidential" plane to America to pick up the outcasts -- what was I saying?

Oh, yes, the tariffs on Colombia may still be in place, that was a bit hazy last evening -- SecState Rubio will sort that out this morning, I'm sure -- but to traders and investors that was just a foreshadowing -- my favorite word used in college literature courses -- no, not a foreshadowing of what 25% tariffs on Canada or Mexico would do -- no one really knows what that would do to Canada (I guess Trudeau knows -- that's why he stepped down) -- but the fact that Trump had tariffs on Colombia in less than a New York minute told traders, investors, Xi, Trudeau, and anyone else who was listening now know that he's serious. If Trump wakes up on February 1, 2025, on the bad side of bed: wham! 25% tariffs on Canada. 25% tariffs on Mexico. Add 10% more on Chinese tariffs.

So far he's kept all his campaign promises, except the one about ending the war in Europe, but Putin is eager to talk and Zelenskyy knows he's on borrowed time. The last of Biden's money will run out by the end of the month. By the way, Putin and Trump are up to something big -- really, really big -- and Denmark is worried that Greenland might be collateral damage. LOL.

So, from DeepSeek to Greenland, that's where we are today.

Wow, after all that, I better put remind folks of the disclaimer. See below.

This commentary will be re-posted elsewhere as a stand-alone to be linked to twitter.

Chart of the day, link here:

*****************************

Back to Sanity

ISO-NE, link here. See also, the RBN Energy deep dive into PADD1 -- they stories are related:

**************************************

Back to the Bakken

WTI: $74.23.

New wells:

- Tuesday, January 28, 2025: 44 for the month, 44 for the quarter, 44 for the year,

- 38939, conf, CLR, Harms West Federal 3-32HSL1,

- Monday, January 27, 2025: 43 for the month, 43 for the quarter, 43 for the year,

- 35508, conf, Enerplus, FB Clinton 148-94-29B-32-6T,

- Sunday, January 26, 2025: 42 for the month, 42 for the quarter, 42 for the year,

- 40574, conf, Empire North Dakota LLC, Red Horse 32 1H,

- 40224, conf, Hess, GO-Dustin Brose-LE-156-98-2932H-1,

- Saturday, January 25, 2025: 40 for the month, 40 for the quarter, 40 for the year,

- 40454, conf, Hess, GO-Dustin Brose-156-98-2932H-5,

RBN Energy: what's behind PADD 1's reliance on imported crude oil and refined products? Archived.

PADD 1 — the East Coast — represents about 31% of total U.S. consumption of refined products (and 37% of its population) but is home to just 5% of U.S. refinery capacity. With only minimal in-region crude oil production, PADD 1 refineries are almost entirely dependent on imported and domestic inflows of both crude oil and products like gasoline, diesel and jet fuel. In the early years of the Shale Era, large volumes of domestic crude were railed or barged to these refineries, but in recent years they’ve again become largely reliant on imports from OPEC, Canada and other foreign sources. In today’s RBN blog, we’ll look into PADD 1’s changing crude oil and refined products supply and demand balance.

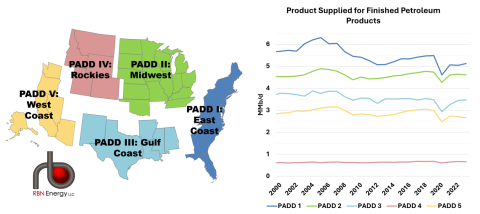

Figure 1. U.S. PADD Map and Product Supplied for Finished Petroleum Products by PADD. Source EIA

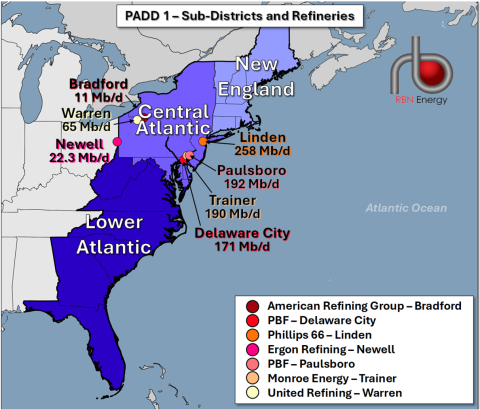

The U.S.’s Atlantic Coast, stretching from picture-perfect coastal towns in Maine to the tropical Florida Keys, is the home of New York City’s iconic skyline, Philadelphia’s historic landmarks, and Atlanta’s vibrant nightlife — and more than 125 million people, almost all of them relying on refined products for many aspects of their lives. The East Coast also represents the first of five Petroleum Administration for Defense Districts (PADDs; colored regions in Figure 1). Created in World War II to manage the country’s refined product demand, PADDs now serve the purpose of regionalizing data. PADD 1 (blue region in map on left side of Figure 1 above) is further divided into three regional groupings: PADD 1-A (New England; light-blue area in Figure 2 below), PADD 1-B (Central Atlantic; medium-blue area), and PADD 1-C (Lower Atlantic; dark-blue area).

Figure 2. Map of PADD 1 Sub-Districts and Refineries. Source: RBN

With PADD 1’s population density, it should come as no surprise that the region is the largest consumer of refined products. As shown in the chart on the ride side of Figure 1, demand for petroleum products (blue line) refined from crude oil (primarily gasoline, diesel and jet fuel, and excluding biofuels) has diminished somewhat, from an annual average of 6.3 MMb/d in 2005 to 5.1 MMb/d in 2024. That being said, the PADD’s regional refinery capacity has also been dwindling, which has led to its continued reliance on imported gasoline and diesel, as well as increasing amounts of refined products being piped in from PADD 3 (Gulf Coast) — up by roughly 500 Mb/d since 2010.

**********************************

Disclaimer

Brief Reminder

- I am inappropriately exuberant about the Bakken and I am often well out front of my headlights. I am often appropriately accused of hyperbole when it comes to the Bakken.

- I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- See disclaimer. This is not an investment site.

- Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here. All my posts are done quickly: there will be content and typographical errors. If something appears wrong, it probably is. Feel free to fact check everything.

- If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

- Reminder: I am inappropriately exuberant about the Bakken, US economy, and the US market.

- I am also inappropriately exuberant about all things Apple.

- And now, Nvidia, also. I am also inappropriately exuberant about all things Nvidia. Nvidia is a metonym for AI and/or the sixth industrial revolution.

- I've now added Broadcom to the disclaimer. I am also inappropriately exuberant about all things Broadcom.

- Longer version here.