Locator: 47083B.

Personal investing: today, will be adding positions STR, SCCO, and TSM.

Most important interview: CNBC interview with Eric Schmidt on AI.

- "under-hyped," not over-hyper

- "blue links": let's start here.

- names:

- NVDA: so far ahead it will be difficult to catch up

- CNBC: will INTC ever figure it out?

- Amazon: partnership with Google

- Apple

- incredible amounts of money pouring into AI

- particularly Elon Musk

- energy companies -- but the right energy companies

- Schmidt gets it; no fears of AI; Buffett does not get it

- most articulate former CEO I've heard in a long time

- TikTok: not social media; it's television

- US has a shot at dominating AI, quantum for the next ten, twenty years

AAPL: today at 9:00 a.m. CDT.

DIS: The new darling on Wall Street?

Cramer, et al, are apoplectic on Disney ticker action pre-market. Cramer is about to go ballistic. David Faber can't believe how far DIS fell despite earnings beat. They simply don't get it. Cramer mentions Morristown in passing. Wow, I miss Linda. Life is too short.

SRE: has reported.

CHRD: Anticipation.

Cash. Whatever.

Women working: another bragging point.

DEI: DOA.

WHOA: it's gonna be one of those days. Whoo-hoo!

Only in America:

Reminder:

I am inappropriately exuberant about the US economy and the US market, I

am also inappropriately exuberant about all things Apple.

See disclaimer. This is not an investment site.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

All my posts are done quickly: there will be content and typographical errors. If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them. Reminder: I am inappropriately exuberant about the US economy and the US market, I am also inappropriately exuberant about all things Apple.

An "artificial intelligence conference" in Washington, DC: is that an oxymoron?

Burn After Reading: great movie last night. "Free" on Amazon Prime last night.

JPow: I agree completely with Jim Cramer and his remarks on JPow. Cramer's got it right. Again.

Tyson: mentioned in passing by Cramer.

The collapse of the "news industry": link here. I normally don't follow Politico but this is a must-read essay. Mentioned Hunter S. Thompson.

Lucid, pre-market:

******************************

Back to the Bakken

WTI: $78.31. Israel begins Rafah invasion and WTI falls. Okay. Saudi continues to struggle.

Wednesday, May 8, 2024: 9 for the month; 73 for the quarter, 272 for the year

40119, conf, Neptune Operating, Heen South 5-8-17 7H,

Tuesday, May 7, 2024: 8 for the month; 72 for the quarter, 271 for the year.

37106, conf, BR, Carlsbad 3A UTFH,

RBN Energy: combination of factors pull US crude oil exports back from record highs. Archived.

The U.S. has become an oil-exporting powerhouse in recent years, propelled by booming shale production, notably from the Permian Basin. U.S. crude oil now flows more freely than ever to help meet global demand, including to Europe, which increasingly turned to the U.S. following Russia’s invasion of Ukraine two-plus years ago, but exports have slowed recently. In today’s RBN blog, we examine a half-dozen reasons why the export surge has tapered off and why it may not change much in the weeks ahead.

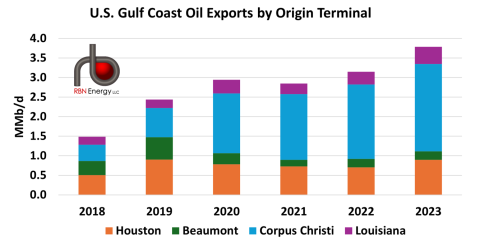

According to our weekly Crude Voyager report, where we track individual vessels leaving the U.S. Gulf Coast with crude oil, exports established an annual record in 2023, averaging 3.8 MMb/d (far-right bar in Figure 1 below), 20% more than the previous annual record set in 2022. Except for COVID-impacted 2021, U.S. crude oil exports have increased every year since 2015, when the ban on most crude oil exports was lifted.

Figure 1. U.S. Gulf Coast Oil Exports by Year by Origin Terminal. Source: RBN