Locator: 46875INV.

The Fed needs to cut rates but not to appease investors.

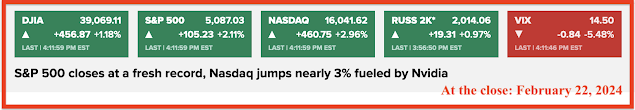

At the close:From a post on February 15, 2024:

- the question: has the Fed waited too long to cut rates? The answer: yes.

- the two observations:

- the gap between Wall Street and Main Street is widening; and,

- the gap between Main Street and Oak Street is also widening.

We'll talk about this later tonight if we have time, but I think anyone paying attention can see what I'm seeing.

WTI: up over half a percent; closed at $78.45.

- Chevron down one cent today, but up 9% this past month:

Enbridge: my problem

- I've held it forever

- cost basis is so low, not worth calculating

- for the longest time, I had automatic dividend reinvestment

- I stopped that a few years ago

- dividend: just declared 68 cents / share; historic high

- according to Google charts, cost basis for ENB bought in 2001 = $7.00 / share

- that's as far back as Google charts go; I would have started accumulating ENB back in the 1990s

- so, let's say, cost basis is $5

- annual dividend at 68 cents / quarter = $2.72 annual

- 2.72 / 5 = 54% (yeah, I know, there's more to it than that)

- Enbridge may or may not have much appreciation in its future, but it tends to raise its dividend on a "more than" regular basis; and,

- then, of course, there's the capital gains tax if I were to sell