So, how's "gasoline demand" going? Link here.

Economy:

- someone over on twitter yesterday said the US was probably already in a recession:

- look at airline earnings this morning

- UAL and AAL are surging

- WTI up slightly

- market up huge in pre-market trading

- BRK-B up nicely in pre-market trading

- KMI tops estimates

- JNJ tops estimates

- AAPL might have a good day

- doesn't look like a recession to me

- everything suggests the economy is on fire

- April 18, 2022: masks off

- dividends raised: Sunoco; KMI (albeit, incredibly, incredibly small)

- mask mandate ended April 18, 2022

- stock of the day: NFLX

- Ackman liquidated his NFLX position; see letter here;

- in pre-market trading, down 3%; down $7; trading at $219.50

- reader has an interesting take on Netflix that I completely missed;

- will get back to this later

US LNG exports:

- I think this has been forecast / telegraphed for the past several months, if not the past year:

- US to become world's top LNG exporter this year; links to Alex Kimani, one of the very good contributors over at oilprice.

Ghost stories for OPEC+:

- US running the show when it comes to oil.

Horror stories for US consumers, US oil:

- White House: two competing factions

- politically pragmatic: hate Big Oil -- they think they can thread the needle

- left/green ideologues: hate Big Oil -- will do anything to kill Big Oil

- high price gasoline: about the only option left -- ban US exports of crude oil / refined products

- that would push US into recession

- left/green ideologues: don't care; price to pay to kill Big Oil

- politically pragmatic: panic setting in;

- gasoline really does cost $6 / gallon in California

- unlike past periods when gasoline was this high, this time it's not transitory

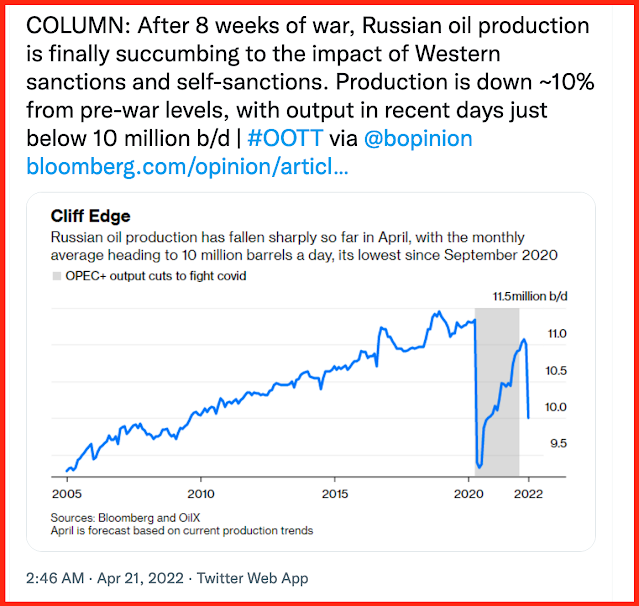

Russian oil production: sanctions starting to bite;

- short term: uncertainty among buyers to buy Russian oil at this point; compounded by simple issue of paying for Russian oil; rubles issues; Russia cut off from western banking system

- long term: Russian oil needs western technology; give it six months and rigs start breaking; won't get fixed;

DOE crude oil inventory: including the SPR, is dropping like a rock;

- releasing record amount of SPR will be seen to be as big a mistake as shutting down the Keystone XL

- going back to pre-Trump environmental rules, regulations will make things worse;

TSLA: blow-out earnings: others starting to weigh in;

Natural gas: drops below $7.

********************************

Back to the Bakken

Legacy Fund deposits, for April, due out yesterday, not posted, maybe today or tomorrow. Link here.

Active rigs:

| $102.90 | 4/21/2022 | 04/21/2021 | 04/21/2020 | 04/21/2019 | 04/21/2018 |

|---|---|---|---|---|---|

| Active Rigs | 37 | 16 | 30 | 63 | 59 |

Thursday, April 21, 2022: 37 for the month, 37 for the quarter, 196 for one year

- 38457, conf, Slawson, Cougar Federal 1 SLH,

- 38454, conf, Slawson, Rainmaker Federal 5-25-36TFH,

- 36520, conf, Hess, BB-State A-LS-151-95-1615H-1,

RBN Energy: can eastern Canada's LNG export projects pass muster, part 3?

Increasing global LNG supplies has become of paramount importance given Europe’s decision to move away from pipelined imports of Russian natural gas. As such, any and all LNG export projects — from the expansion of existing sites to proposals for greenfield terminals — are getting a fresh look. As always, though, only the projects that make the most economic sense are likely to advance to a final investment decision (FID), construction and operation. Which raises the question, where do things stand with the handful of LNG export terminals proposed for Eastern Canada, which offers the shortest, most direct access to Europe? In today’s RBN blog, we conclude our series on Canada’s LNG export potential by assessing several greenfield export sites on its East Coast.