Locator: 48745B.

Inflation numbers today: even better than yesterday. Tariffs? LOL. DJIA, pre-market, up 145 points.

Oracle: link to TWSJ.

BRK-B: holy mackerel. I didn't see this until this morning.

BRK-B dropped an almost-unbelievable $6.18 yesterday. Amazing. Absolutely scary. A lot of folks are not happy with their 401(k)'s, IRAs, Roths, etc. April 2, 2025, $537; yesterday, $470 --> down almost 15% in three months. I'm sure BRK-B will close higher than last year for full year (December 31, 2025) but compared to the NASDAQ .... up 17%....maybe compare BRK's top holdings with the top ten tech stocks.

- S&P 500:

- April 2, 2025: 5,671

- July 15, 2025 (yesterday): 6,244

- percent change over three months: down 10% (again, vs almost 15% down for BRK during same time span)

********************************

Back to the Bakken

WTI: $65.69.

New wells:

- Thursday, July 17, 2025: 27 for the month, 27 for the quarter, 457 for the year,

- 40863, conf, Grayson Mill, Martin 32-36 2H,

- Wednesday, July 16, 2025: 26 for the month, 26 for the quarter, 456 for the year,

- 40850, conf, Grayson Mill, Bice 18-17 8TFH,

- 40789, conf, Oasis, Merlin 5602 43-15 4B,

- 40787, conf, Oasis, Merlin 5602 43-15 3B,

RBN Energy: future looks bright for CITGO's three US refineries as courtroom drama nears end.

The bitter, eight-year battle to control CITGO Petroleum’s three U.S. refineries could soon be coming to an end. A Delaware court has recommended a $7.38 billion bid from Dalinar Energy Corp., the U.S. subsidiary of Canadian miner Gold Reserve Ltd. There’s opposition, but a final decision could be just weeks away. In today’s RBN blog, we’ll discuss what a resolution would mean for the three refineries, which have a combined capacity of more than 800 Mb/d.

Let’s start with some background. As we detailed in I’ll Be Around, there’s been a primarily below-the-radar battle playing out in the U.S. District Court for the District of Delaware since 2017 about how best to help satisfy the claims of a dozen-plus creditors who collectively lost more than $20 billion when the government of Venezuela — the de facto owner of CITGO Petroleum and its parent company, PDV Holding (PDVH) — defaulted on its bonds. (In 2019, control of CITGO was transferred away from the ruling Maduro regime in Venezuela to the opposition “shadow” government, then led by Juan Guaidó.) In May 2021, U.S. District Court Judge Leonard P. Stark appointed Robert B. Pincus as a special master tasked with devising a plan to sell PDVH/CITGO. After a two-round bidding process that concluded in June 2024, Pincus recommended on September 27, 2024, that the district court approve Amber Energy and its $7.3 billion bid for CITGO and its three refineries (Lake Charles, LA; Lemont, IL; and Corpus Christi, TX). However, instead of ending the drama, the court restarted the bidding from scratch in December 2024, citing issues with the auction process.

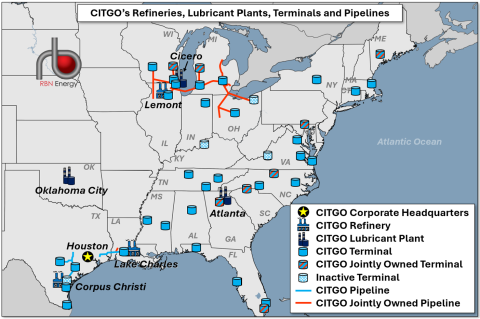

Figure 1. CITGO’s Refineries, Lubricant Plants, Terminals and Pipelines. Source: CITGO

The winner of the auction will get three impressive U.S. refineries (dark-blue refinery icons in Figure 1 above) in addition to a number of lubricant plants, terminals and pipelines. While we predict there will be refineries shutting their doors in the coming years, we expect all three of the CITGO refineries to be survivors over the next two decades. We also see them benefiting from a variety of market factors we expect to develop, including a modest widening heavy/light crude differential from the record tightness seen so far this year, strong middle distillate margins, and continuing demand for U.S. products in key export markets.