Locator: 46281ENERGY.

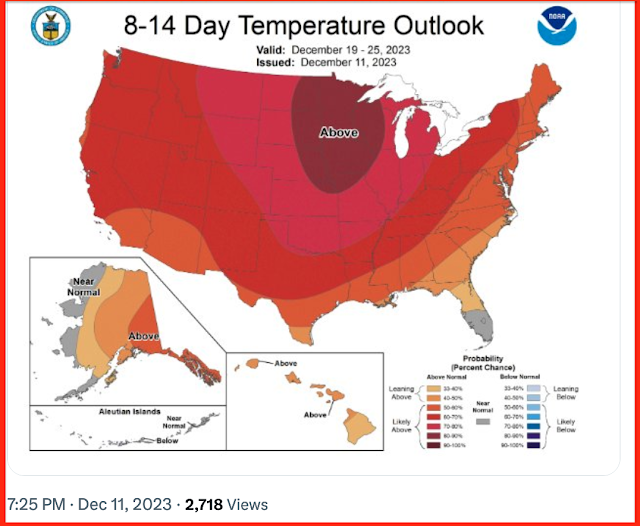

Forecast explains a lot:

***************************

Back to the Bakken

WTI: $70.92.

Wednesday, December 13, 2023: 18 for the month; 167 for the quarter, 737 for the year

39716, conf, Petro-Hunt, Joel Goodsen 149-102-32C-29-1H,

Tuesday, December 12, 2023: 17 for the month; 166 for the quarter, 736 for the year

39715, conf, Petro-Hunt, Joel Goodsen 149-102-32C-29-2H,

39312, conf, Hess, SC-JW Hamilton-LN-153-99-1314H-1,

RBN Energy: dock coast LPG export dock capacity maxing out; what happens to US markets? Based on his comments this morning, Jim Cramer reads RBN Energy daily.

Gulf Coast LPG export capacity is tight again, and it’s going to get worse before it gets better — terminal capacity to load more barrels of propane and butane simply has not kept up with production gains.

A number of new LPG dock expansions and greenfield projects are in the works, but they are 18 months or so away. In the meantime, production keeps rising, inventories are high, and it’s very unlikely we will see enough cold weather to balance the propane market. Bottom line: 2024 is shaping up to be a tough year for propane and butane prices. In today’s RBN blog, we examine what has been happening with exports, the looming dock capacity constraints, and the projects that will eventually relieve the imbalance.

NGL export markets are a frequent topic in the RBN blogosphere, especially when LPG export capacity gets tight — such as the first round of export capacity constraints in 2012-16 when shale production was just kicking in, and then again in 2019-20. This year we’ve posted a number of blogs that considered the impact of increasing NGL production and the implications for exports. In Ready For It? we looked at what increases in Permian NGL production has meant for mixed NGL (aka Y-grade) takeaway capacity out of the basin — the market needs a lot more. Then, in in It's A Mystery, we questioned why, with all the new gas processing plants coming online, NGL production wasn’t growing even faster. (That mystery was solved as production statistics ramped up during the second half of the year.)