Locator: 48722B.

From Hart Energy, happy anniversary:

From Hart Energy: It was 25 years ago, in a nondescript corner of eastern Montana, that wildcatters unlocked the recipe that would turn the U.S. into the world’s top oil producer.

On May 26, 2000, the first stimulated horizontal oil well was landed targeting the middle Bakken Formation in Montana’s Elm Coulee Field.

My dad and I drove by that well many, many times over the years; paid no attention to it. We were watching the river, the sugar beets, the beautiful scenery. It was amazing how flat, expansive that area was, perfect for really, really good farming.

Locator: 48722B.

China - US: "first" Boeing plane lands in China for delivery as tariff war eases. Link here. In addition, China-US trade talks to begin in London today. Boeing shares are up 34% in past six months and are up slightly this morning in pre-market trading.

Sunnova files for bankruptcy: link here. Add it to the list. Wiki.

- founded in Houston, 2012;

- solar panel installations, battery storage and repair serves to homeowners and businesses;

- nationwide footprint;

- share prices plunged below $1 in March, 2025.

- traded for as much as $54 back in late January, 2021, but was down to $11 last summer and falling fast.

EVs: link here.

Rivian R2 will nnderpin all future EV projects at Volkswagen.

Audi? Porsche? Yes, Yes. Don't forget newcomer Scout, plus Lamborghini, Skoda, Seat and all of the others under the VW group umbrella.

Yes, you read that right—the R2's DNA will be in not just one future product, but all of Volkswagen's new battery-powered models moving forward.

That all starts with the upcoming affordable VW Every1 (which will have a new name by the time it releases), which will use an off-the-shelf version of the zonal architecture, and then trickle into newly-released models thereafter.

R2 is the platform that will underpin actually all future EV products at VW. So it's really that modular, scalable technology stack that we will take into VW brands, and we will do it in a way where we will still allow each of the brands to express their own identity.

****************************************

Back to the Bakken

WTI: $64.92. Saudi has not appeared to increase production. BofA suggests oil prices could ump on coming short covering. Story at oilprice.

New wells:

- Tuesday, June 10, 2025: 34 for the month, 187 for the quarter, 401 for the year,

- 41118, conf, Oasis, Sawtooth 5202 24-20 3B,

- 41178, conf, CLR, Helen 5a-8H,

- Monday, June 9, 2025: 32 for the month, 185 for the quarter, 399 for the year,

- 41179, conf, CLR, Kenneth 5-17H1,

- 41117, conf, Oasis, Sawtooth Federal 5202 24-20 2BX,

- 40685, conf, Hess, GO-Skjei MW TR-158-98-3526H-3,

- 40608, conf, Enerplus, Danielle 145-97-12-1-2H-WLL,

- 40607, conf, Enerplus, Danielle 145-97-12-1-3H,

- 40516, conf, BR, Keene 14-36 TFH,

- 40338, conf, Hess, GO-Skjei MW TR-158-98-3526H-2,

- Sunday, June 8, 2025: 25 for the month, 178 for the quarter, 392 for the year,

- 41355, conf, Five States Operating, BC 2-21H,

- Saturday, June 7, 2025: 24 for the month, 177 for the quarter, 391 for the year,

- 41180, conf, CLR, Helen 6-8H1,

- 40517, conf, BR, Keene 14-36 MBH-ULW,

Enerplus Danielle wells: tracked here. Too early for much new data.

RBN Energy: EOG Resources, upbeat on Utia condensate, doubles down with Encino deal. Archived.

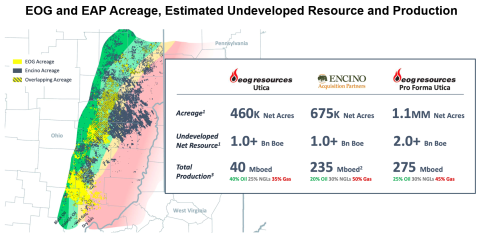

There’s been a surge in E&P interest in the Utica Shale’s volatile oil window the past couple of years, and EOG Resources has been particularly optimistic about its potential for producing large volumes of condensate, the lightest of superlight crude oils. A few days ago, EOG — known for growing its business organically, not via M&A — announced one of the largest acquisitions of the year so far: the planned purchase of Encino Acquisition Partners (EAP), the Utica’s #1 condensate producer by far, for $5.6 billion, including the assumption of EAP’s debt. As we discuss in today’s RBN blog, the deal will give EOG its third “foundational” focus area (the others are the Eagle Ford and the Permian's Delaware Basin) and supports the view that the Utica really is an up-and-comer.

In our three-part Hit the Lights blog series a few months ago, we took an in-depth look at condensate production growth across a swath of eastern Ohio, as well as the leading E&Ps in the play and the pipelines and other infrastructure on which they depend. In Part 1, we said that while the broader “wet Marcellus/Utica” is famous for producing vast quantities of natural gas and NGLs, a handful of dogged, innovative E&Ps have concentrated primarily on producing fast-rising amounts of superlight crude — better described as condensate (condy or conde for short) — in the Utica Shale’s volatile oil window, focusing primarily on Ohio’s Carroll, Columbiana, Guernsey, Harrison and Noble counties. Most of the condensate has an API gravity of 55 to 59 degrees, but an increasing share is “heavy condensate” with an API closer to 50.

We noted that after ups and downs through the 2010s, Ohio’s crude oil production — almost all of it condy — is up nearly 3X from July 2022, when it averaged only 48 Mb/d; the state produced 136 Mb/d in March, according to the most recent data available from the Energy Information Administration (EIA). Admittedly that’s only a small fraction of what the Permian is churning out (about 6.5 MMb/d lately, according to RBN’s weekly Crude Oil Permian report) and barely one-tenth of Bakken production. But EOG has said the eastern Ohio wells it’s drilled over the past couple of years have IP30 (initial production over 30 days) rates that compare favorably with the best wells in the Permian: 1,425 b/d to 3,250 boe/d, with crude oil/condensate’s share of the Utica wells’ production ranging as high as 70% on a boe/d (barrels of oil equivalent per day) basis.

In Part 2, we discussed the six largest condensate producers in eastern Ohio, starting with #1 EAP and followed by #2 Ascent Resources, #3 EOG, #4 Infinity Natural Resources (which launched a well-received initial public offering, or IPO, in January), #5 Expand Energy (the recently merged Chesapeake Energy and Southwestern Energy) and #6 GulfPort Resources. Part 3 focused on the uses for condensate produced in eastern Ohio and other parts of the Marcellus/Utica and how the condy is transported from wellsites to refineries and other end users.

Long story short (see Part 3 for details), Utica condensate is in demand — it can either be run as a feedstock at refineries, condensate splitters or petchem plants, blended into heavier crude or (in a pinch) used as diluent. As for infrastructure, a couple of things are worth pointing out. First, a good bit of the condensate emerging from eastern Ohio wells needs to have its light ends (propane/butanes) removed; some producers do this themselves at the well pad with heater treaters and some turn to centralized condensate stabilizer sites in Ohio (like MPLX’s at Cadiz, Williams Companies’ at Scio and Ergon Inc.’s at Marietta). Second, there are no condy gathering pipelines in the Utica — the volumes are too small (at least so far) to justify investments in them. Instead, condensate is stored at or near the wellhead in tank batteries, then loaded onto tanker trucks and driven either to the end user (typically a refinery or condensate splitter) or, more frequently, to the next mode of transport (a rail terminal, a marine terminal or a pipeline intake point). Part 3 discusses these takeaway options in depth.

Figure 1. EOG and EAP Acreage, Estimated Undeveloped Resource and Production. Source: EOG