Updates

Later, 2:04 p.m. CT: this is a most interesting day. The stock market has had a very bad week; down 200 points one day earlier this week, and then down another 120 points today. My hunch: RECESSION talk. Revised 1Q15 GDP shows significant contraction -- almost 1% -- and the "excuses" were laughable: a harsh winter, folks not spending money saved on cheap gasoline, and foreigners not buying US products. The "market" saw right through those laughable excuses.

Oil is more interesting. Up almost 5%. And this occurs almost the same week that Iraq said that it was going to flood the market with crude oil and OPEC gave Iraq "high fives" all around. I can only assume the price of oil went up 5% due to financial and economic factors of which I understand nothing. However, if one looks at the data below, the 5% rise makes all kind of sense. Remember, this data came out late yesterday / early today (depending on when you found the data) and within hours oil rose 5% -- one of the biggest jumps ever.

Possibly the 5% rise in the price of WTI has to do with the ethanol announcement by the EPA.

A reader tells me (4:00 p.m. CT) that it's due to the rig count going lower. That's very possible; North Dakota active rigs tied a post-boom low, I believe: 80.

Data from Baker Hughes showed that the number of oil rigs fell by 13 to 646, the lowest level since August 13, 2010.

The tally of combined oil and gas rigs fell by 10 to 875, the lowest since January 31, 2003. Last week, the oil rig count fell by just one, the slowest pace in 24 weeks.

The price of West Texas Intermediate crude has rallied from the year-to-date low it reached in May. Following the data on Friday, it jumped as much as 4%, back above $60 per barrel.The reader appears to be correct.

This is so prescient, posted back on August 8, 2013: the Bakken could threaten the future of OPEC.

Original Post

Saudi oil imports into the US:

For all their talk about losing market share, Saudi oil imports into the US in March, 2015 (most recent data available) almost matches that of March, 2010, and March, 2011. The US economy contracted by 0.7% in 1Q15 -- a very inconvenient truth.

Total crude oil imports into the US:

I suppose I'm missing something, and I suppose I'm the only one, but it seems all this talk about decreasing imports is a bit overdone. Of course, the data is old, back to March, 2015, and this is already June (almost) but look at the numbers (and note that March is not exactly the high driving season in the US):

- total crude oil imported to US jumps from 276 million bbls to almost 300 million bbls over past six months

- OPEC imports jump from 81 million bbls to almost 88 million bbls over same period

- Saudi Arabia imports back up to 32 million bbls after drop to 26 million bbls six months ago

- Venezuela is hanging in there

- Angola drops significantly (for that country, not for the US)

- Nigeria rises significantly (for that country, not for the US)

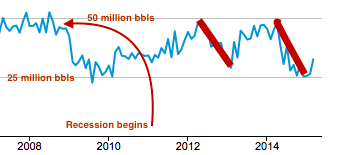

Saudi crude oil imports into US in graphic form:

Saudi blames the plunge in market share in late 2014 to US shale. How then do we explain the same drop in 2012 - 2013, and then the subsequent rise back to almost the 50-million-bbl line in 2014? Throughout that entire period, from 2011 on, US shale oil production was increasing significantly.

I still maintain that "we're" being set up for a price spike before the end of 2017. Saudi is not going to continue giving their oil away at $60; and, off-shore CAPEX won't turn on a dime.

But regardless of where the price of oil ends up, there is no question:

a) we're not running out of oil; and,

b) global appetite is insatiable