Locator: 48896B.

CSX: faces mounting pressure to pursue a railroad merger -- Barron's. To compete with the proposed UNP-NSC merger it would only make sense for CSX to merge with Warren Buffett's owned BNSF. I added to my position in CSX on August 20, 2025, when the market had a significant pullback. Note the blog's disclaimer.

Target: sales fall again, but retailer sticks by its outlook.

- shares drop almost 10% after earnings release; pre-market.

CoreWeave: for all the "grief" the stock is currently getting, it really hasn't done that bad; my biggest problem with CoreWeave: I don't understand how it differentiates itself from all the other cloud-AI tech companies. And HQ in Livingston, NJ, is not particularly "helpful."

TikTok: no change in status but Trump has continued to keep his account. Link here.

Netflix codes: link here.

CVX / Hess:

- from SeekingAlpha:

- Chevron plans to merge the Hess exploration team with its own to "challenge some of our conventional thinking" and make new discoveries, CEO Mike Wirth

- Chevron is cutting ~650 Hess jobs as a result of its $53B takeover, but exploration is one area likely to be spared,

- Hess bought a 30% stake in Guyana's Stabroek Block just months before Exxon drilled its first well, leading to the biggest oil discovery in a generation - the block was the main reason Chevron bought Hess in its largest-ever deal.

- Chevron plans to drill an exploration well in Suriname well later this year.

- CVX-Hess merger: analysis. Same thing: this is a big story.

************************************

Back to the Bakken

WTI: $63.00.

New wells:

- Thursday, August 21, 2025: 39 for the month, 87 for the quarter, 517 for the year,

- 40899, conf, Hess, BL-Blanchard-LW-155-96-2215H-1,

- 35237, conf, CLR, Michael State Federal 7-16H,

- Wednesday, August 20, 2025: 37 for the month, 85 for the quarter, 515 for the year,

- 41211, conf, Slawson, Daredevil Federal 1-2-14H,

- 40855, conf, Oasis, Van Berkom 5793 13-11 2B,

- 40683, conf, Hess, BL-Banchard-155-96-2215H-2,

- 37543, conf, Hess, AN-Lone Tree-152-95-1207H-9,

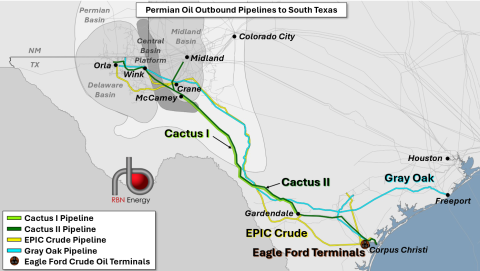

RBN Energy: Cactus I and Cactus II pipelines remain ke to Corpus Christi's role as crude export hub. Archived.

The original Cactus Pipeline was a pioneer in moving large volumes of crude oil from the Permian and the Eagle Ford to the Corpus Christi area, which quickly became a leader in U.S. crude exports. Cactus II, an even longer and larger pipeline that came online in H2 2019, only added to Corpus Christi’s export prominence. But the competition with Permian-to-Houston pipelines is fiercer than ever and negotiated rates on pipelines to the Texas Gulf Coast are under pressure. In today’s RBN blog, we look at the Cactus I and Cactus II pipelines and their significance.

This is the latest in our series on crude oil pipelines traveling from the Permian Basin to the Gulf Coast. Today’s blog focuses on the last of the Corpus-bound pipes. Previously, in Bustin' Out, we looked at the EPIC Crude Pipeline (yellow line in Figure 1 below), which has been operating at full capacity, and then told the story of Gray Oak Pipeline (aqua line) in Movin' On Up. We recently wrapped up our Permian-to-Houston series with a new Drill Down Report, West Texas Highway, where we detailed how Corpus Christi is competing head-to-head with the Houston area to attract Permian barrels. Corpus Christi surpassed Houston as the top dog in Q1 2025, with Permian-to-Corpus flows averaging 2.5 MMb/d compared to Houston’s 2.4 MMb/d, according to RBN’s weekly Crude Oil Permian report. (In 2024, Houston outpaced Corpus for half of the months.) Combined, the two regions receive about three-quarters of the Permian’s output. Corpus Christi is an ideal spot for crude because it’s home to 857 Mb/d of refining capacity and has extensive export options, including Enbridge Ingleside Energy Center (EIEC) and Gibson’s South Texas Gateway (STG), the top two crude export terminals along the Gulf Coast by volume. (More on those in a bit.)

Figure 1. Permian Oil Outbound Pipelines to Corpus Christi. Source: RBN

Before diving into the details of Cactus I and Cactus II (light-green and dark-green lines, respectively, in Figures 1 and 2), which account for more than one-third of Permian-to-Corpus volumes, let’s discuss the origin story of Plains All American and how the ownership of the Cactus pipelines, which don’t share the same infrastructure, has morphed over time. Back in the 1980s and early ’90s, Plains Resources, a small E&P, expanded into the midstream sector, and in 1998 the company’s midstream subsidiary was spun off via an initial public offering (IPO) and simultaneously acquired All American Co. Ever since, it’s been Plains All American.