Locator: 48730B.

Updates

June 12, 2025: cash burn search today revealed this --

Original Post

GDPNow: 3.8%, unchanged from previous estimate.

TSM / TSMC: the big story today. Huge jump in revenue. But a lot of this was the pull-forward effect caused by tariff talk.

Germany: Nvidia and HPE to build new supercomputer in Germany. Link here.

- Blue Lion supercomputer

- to be online in early 2027

- will use Nvidia's "Vera Rubin" chips

Narrative from previous link:

The announcement, made at a supercomputing conference in Hamburg, Germany, follows Nvidia's announcement that the Lawrence Berkeley National Lab in the United States also plans to build a system using the chips next year.

Separately, Nvidia also said that Jupiter, another supercomputer using its chips at German national research institute Forschungszentrum Julich, has officially become Europe's fastest system.

The deals represent European institutions aiming to stay competitive against the U.S. in supercomputers used for scientific fields from biotechnology to climate research.

Supercomputers are tracked here.

EOG: a reminder from yesterday -- full blog now available for a few days --

RBN Energy: EOG Resources, upbeat on Utia condensate, doubles down with Encino deal. Archived.

There’s been a surge in E&P interest in the Utica Shale’s volatile oil window the past couple of years, and EOG Resources has been particularly optimistic about its potential for producing large volumes of condensate, the lightest of superlight crude oils. A few days ago, EOG — known for growing its business organically, not via M&A — announced one of the largest acquisitions of the year so far: the planned purchase of Encino Acquisition Partners (EAP), the Utica’s #1 condensate producer by far, for $5.6 billion, including the assumption of EAP’s debt. As we discuss in today’s RBN blog, the deal will give EOG its third “foundational” focus area (the others are the Eagle Ford and the Permian's Delaware Basin) and supports the view that the Utica really is an up-and-comer.

And then there's this, link here, be sure to listen to the back-up vocalist:

California: best news so far today. Unless you're looking for it, there are not headlines on ICE-riots in California. Speaks volumes.

More At The Bakken

WTI: $65.57.

New wells:

Wednesday, June 11, 2025: 38 for the month, 191 for the quarter, 405 for the year,

- 41119, conf, Oasis, Sawtooth 5202 24-20 5B,

- 41011, conf, Oasis, Sawtooth 5202 24-20 4B,

- 40606, conf, Enerplus, Danielle 145-97-12-1-4H,

- 40605, conf, Enerplus, Danielle 145-97-12-1-5H,

- 41118, conf, Oasis, Sawtooth 5202 24-20 3B,

- 41178, conf, CLR, Helen 5-8H,

Enerplus Danielle wells: tracked here. Too early for much new data.

RBN Energy: data centers, LNG exports and souteast demand key to Marcellus / Utica growth. Archived.

Marcellus/Utica natural gas production grew by leaps and bounds in the 2010s, but the pace of growth has slowed dramatically in recent years, mostly due to takeaway constraints. Finally, the prospects for renewed growth are improving. New pipeline capacity out of Appalachia is coming online — especially to the booming Southeast, and maybe the Gulf Coast too. New LNG export capacity is about to be commercialized. And a lot of new gas-fired generating capacity — much of it tied to planned data centers — is under development within (or very near) the Marcellus/Utica region. In today’s RBN blog, we examine the three big gas-demand drivers behind the shale play’s impending renewal.

As we said in Part 1, the Marcellus/Utica is by far the most prolific gas production area in the U.S., accounting for about one-third of the nation’s daily output. The shale play’s gas production soared from less than 2 Bcf/d to more than 33 Bcf/d over that decade, but its output through the first half of the 2020s has stayed close to flat, averaging about 35 Bcf/d over that period — ~24 Bcf/d from the NGL-rich “wet Marcellus/Utica” in southwestern Pennsylvania, northern West Virginia and eastern Ohio and ~11 Bcf/d from the “dry Marcellus” in northeastern Pennsylvania.

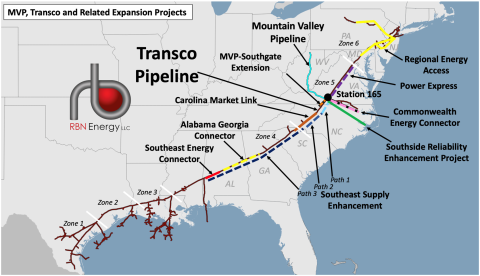

The primary hurdle to further growth has been takeaway capacity; there hasn’t been enough space on pipelines out of Appalachia to move more of the shale play’s gas to demand centers hundreds of miles away. That’s been changing, however, mostly due to the June 2024 startup of the 2-Bcf/d Mountain Valley Pipeline (MVP; aqua line in Figure 1 below) from northern West Virginia to Transco Station 165 in south-central Virginia and the advancement of several capacity-expansion projects on or near Transco itself. A few of these projects (Regional Energy Access, Southside Reliability Enhancement Project, Carolina Market Link, and Southeast Energy Connector) came online over the past 18 months, and others (Commonwealth Energy Connector, MVP Southgate, Southeast Supply Enhancement, and Alabama Georgia Connector) will follow later this year and in 2027-28. (See Part 1 for details.)

Figure 1. MVP, Transco and Related Expansion Projects. Source: RBN