Locator: 48599B.

Real ID: kicks in today. Law passed in 2005. Every president kicked the can down the road. President Trump? First 100 days.

UK wind: top story of the day. Orsted cancels major UK offshore wind farm. Link here.

Rivian: unlike Lucid, having a few problems. Link here. Cuts EV delivery outlook; cites tariff impact.

AMD: huge jump in revenue, q/q. Link here. $3.7 billion vs $610 million one year ago.

Vistra: swings to 1Q25 loss. Link here.

*****************************

Back to the Bakken

WTI: $59.64.

New wells:

Thursday, May 8, 2025: 23 for the month, 123 for the quarter, 315 for the year,

41141, conf, CLR, Stangeland 11-7HSL,

41261, conf, BR, Tilton Diamond Forest 2A-ULW-R,

40714, conf, Silver Hill Energy, Tank E 156-98-1-12-5MBH,

RBN Energy: Whitewater and Company-led JV expand role in moving Permian gas to coast. Archived.

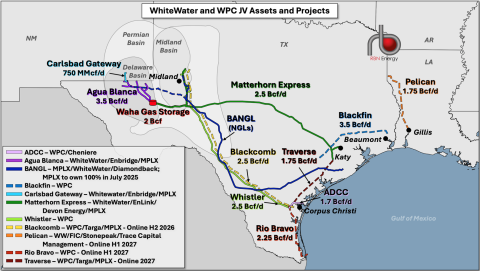

Several large, publicly held midstream companies play critical roles in transporting crude oil, natural gas and NGLs from the Permian Basin to markets along the Gulf Coast, and all of them are investing hundreds of millions or even billions of dollars to expand their Permian-to-Gulf infrastructure. But there’s a privately held outlier among them — WhiteWater Midstream, which has developed key gas pipelines in Texas and has been partnering with MPLX, Enbridge and others to own and develop a few more. In today’s RBN blog, we look at the growing portfolio of WhiteWater and the WPC joint venture (JV) and discuss highlights from our new Drill Down Report on Permian-to-Gulf infrastructure projects.Even amid the economic uncertainty triggered by the ongoing trade war, a long list of publicly held midstreamers — Enterprise Products Partners, Energy Transfer, Targa Resources, Phillips 66 (P66) and ONEOK among them — are developing an even longer list of crude-, gas- and NGL-related projects in the Permian and from West Texas to the Gulf Coast. Gathering systems. Gas processing plants. Pipelines. Fractionators. Export terminals.

WhiteWater Midstream, whose name is familiar to everyone interested in the Permian, is a different animal — a giraffe among zebras, you might say. Austin-based and with financial backing from I Squared Capital and other private-equity sources, WhiteWater was formed in 2016 and has been involved in developing several key gas pipelines and other gas-related assets between the Permian and the Gulf Coast.

Figure 1. WhiteWater and WPC JV Assets and Projects. Source: RBN

First came Agua Blanca (dark-purple line in Figure 1). This pipeline system delivers natural gas from a number of processing plants in the Permian’s Delaware Basin to the Waha Hub. Agua Blanca started in 2018 as a 72-mile system with a capacity of 1.4 Bcf/d; it has been expanded several times since then and now has more than 200 miles of pipe and a capacity of more than 3 Bcf/d. The pipeline is currently owned by WhiteWater (75%), Enbridge (15%), and MPLX (10%). The three companies also share ownership of the 400-MMcf/d Carlsbad Gateway gas pipeline system (light-blue line) in the Delaware, which feeds residue gas into Agua Blanca.