Monday, June 30, 2025

Five New Permits; Two Permits Renewed; What's This About Peak Oil? -- June 30, 2025

Peak oil? Say What? Charles Kennedy is reporting that US crude oil output hits record in April. Wow. Link here. The EIA page shows 13.468 million bopd. US field production of crude oil has exceeded 13 million bopd for the past 21 months with one exception, January, 2024, 12.554 million bopd.

U.S. crude oil production surged to an all-time high of 13.24 million barrels per day (bpd) in April, according to newly released data from the Energy Information Administration.

The increase of 0.4% over March volumes reinforces America’s standing as the world’s top oil producer and follows months of steady gains driven by improved drilling efficiencies and stronger prices.

Texas led the charge with an output of 5.7 million bpd, up 1.6% from March, while New Mexico, the second-largest producing state, posted a 0.7% increase to 1.95 million bpd. Gulf of Mexico volumes dipped slightly, but the national gain offset offshore slippage.

Back to the Bakken

WTI: $64.78. Right back where we started.

Active rigs: 32.

Five new permits, #42067 - #42071, inclusive:

- Operator: Phoenix Operating

- Field: Skabo (Williams County)

- Comments:

- Phoenix Operating has permits for five Terry Nelson wells, lot 2, section 3-159-98,

- to be sited 410 FL and 2184 / 2304 FEL.

Two permits renewed:

- KODA Resources, two Stout permits, Fertile Valley, Divide County;

Personal Utility Bill -- Electricity -- For Month Of June -- June 30, 2025

Locator: 48626ELECTRICITY.

Our only utility bill is electricity, for a small one-bedroom-one-bath-one-den/office apartment in north Texas. We have no natural gas.

Monthly bill was significantly more this month compared to last month. With all fees, taxes, etc., we're average about 19 cents / kWh:

- three more days in the billing cycle

- average use went from 18 kWh to 22 kWh / day

- starting sometime this past year, I have purposely ignored "severe" control of thermostat

Manic Monday — June 30, 2025

Locator: 48625B.

Harvard: Trump administration finds Harvard University guilty of violation of federal civil rights laws. Link here. For the archives. See also this note: University of Virginia president resigns under pressure from Trump.

Market: AVGO and ORCL are surging in early morning trading.

- US equity markets are hitting new highs.

Apple: Home Depot buying GMS for $4 billion helps put Apple’s quandary into perspective. It’s almost a no-brainer. In fact, it is a no-brainer. With 15 billion shares outstanding, $1 / share would cover an AI purchase. Apple has about $50 billion in cash.

Apple: "F1: The Movie" roars to top of US, Canada box office. Link here.

Apple:

NYTimes on Trump's judicial nominee: link here.

With confirmation of Ketanji Brown Jackson to the US Supreme Court, the bar was lowered significantly. Good, bad, or indifferent with regard to Judge Bove (I have no dog in this fight), let's compare the Ketanji Brown Jackson nomination. Even Ketanji's fellow judges are shocked by her written opinions, generally losing dissents.

************************

Back to the Bakken

WTI: $64.91. Peace breaking out in the Mideast.

New wells:

- Tuesday, July 1, 2025: 2 for the month, 2 for the quarter, 439 for the year,

- 41251, conf, CLR, Thronson FIU 12-28HSL,

- 40796, conf, Grayson Mill, Bice 18-17 9H,

- Monday, June 30, 2025: 70 for the month, 223 for the quarter, 437 for the year,

- 41252, conf, CLR, Sorenson FIU 12-21HSL2,

- 40897, conf, Hess, EN-McKenna-157-93-3328H-4,

- 40801, conf, Grayson Mill, Bice 18-17 5H,

- 40767, conf, Oasis, Olson State Federal 5399 41-9 5B,

- 40633, conf, Oasis, Olson State Federal 5399 41-9 4B,

- 26158, conf, Grayson Mill, Johnston 7-6 3TFH,

- 26157, conf, Grayson Mill, Johnston 7-6 4H,

- 26155, conf, Grayson Mill, Johnston 7-6 6H,

RBN Energy: with ethane as a bargaining chip, energy become a weapon in talks with China.

The details of a trade deal between the U.S. and China, announced June 26 by Commerce Secretary Howard Lutnick and confirmed by China, remain sparse. Once they are finalized, the requirement for U.S. exporters to obtain a Bureau of Industry and Security (BIS) license to send ethane to China should be lifted, but the effect on trade flows is already apparent. In today’s RBN blog, we review the impact of the BIS license requirement, the still-pending imposition of fees on vessels owned or operated by China, and the risk that comes with using the energy industry as a bargaining chip in trade talks.

Let’s look at the impact of the requirement for export licenses to start. Enterprise Products announced May 29 that it had received a notice from the BIS stating that ethane exports to China posed an “unacceptable risk of use or diversion to a military end use” and that they would require specific licenses per cargo in order to be delivered. Energy Transfer said in a filing with the Securities and Exchange Commission (SEC) on June 3 that it had received a similar letter.It looked like the industry was going to dodge a big bullet when, on June 10, China and the U.S. reached a tentative agreement aimed at defusing the latest round of trade tensions between the two countries. According to reports, the agreement included revised tariff rates, a six-month relaxation of Chinese export license requirements for rare-earth elements (especially magnets) and a reciprocal easing of U.S. export restrictions on semiconductor technology. Dropping the BIS license requirement for ethane was also part of the deal, although the initial announcement did not lead the BIS to start issuing licenses. As of June 27, that agreement appears to have been signed, although licenses have not yet been granted for ethane exports to China. Reuters reported June 25 that companies will be allowed to load ships and send them to China, just not unload them, a potential indication that the license requirement may be coming to an end. Satellite Chemical USA and Vinmar both received letters last week allowing them to load vessels bound for China but denying them the ability to unload without permission.

The Trump administration has increasingly used U.S. energy — especially commitments to purchase U.S.-sourced LNG — as an element in trade negotiations (see Road to Alaska), and it appears to have used the withholding of ethane as a cudgel during talks with China in a way that it hasn’t before (more on that in a bit). The impact of the license requirement can be clearly seen in the export data.

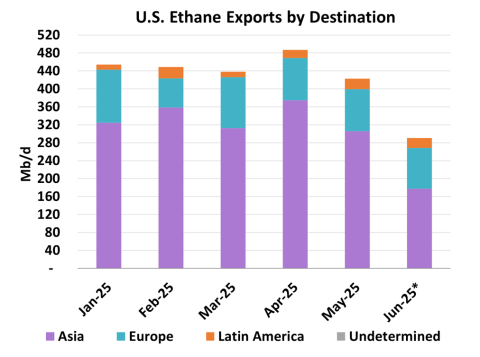

With the negotiations between the U.S. and China continuing in June, U.S. ethane exports slowed significantly. Figure 1 below shows U.S. ethane exports by stated destination for January through the first half of June, with the vast majority headed to Asia (purple bar sections), followed by Europe (teal bar sections) and Latin America (orange bar sections). It’s important to note that the destination is what’s indicated by ship-tracking data and may not be the actual final destination, as most of the vessels that departed in June and were headed to Asia have not arrived yet. In addition, there are ethane vessels in the Gulf that are laden and awaiting orders. According to Kpler data, there are at least three laden ethane vessels sailing in circles off the coast of China. What’s important, however, is that at least for the first half of June, exports were down to around 280 Mb/d from the previous peak in April of more than 480 Mb/d. When they left the port, about 180 Mb/d of the ethane was slated to go to Asia. Some of those vessels will be headed toward India, but volumes “headed” to China will not be allowed to unload there — at least not yet. If the barrels are unable to be unloaded, the nature of the ethane market means that most of these U.S. volumes will not find a home outside of China, and China will not be able to source its ethane from elsewhere.

Figure 1: Ethane Exports by Destination. Source: RBN

* Data is for first half of June

Sunday, June 29, 2025

The Week Hasn't Even Begun --- And Already --- June 29, 2025

Locator: 48624CANADA.

For the archives: Trump abruptly announced trade talks with Canada would cease immediately two days ago after Canada announced a Digital Services Tax on US services.

Trump is schooling future American presidents.

Trump: "speak loudly, quickly, and decisively. Not everything requires a big stick."

And don't call him TACO.

LOL.

****************************

A Musical Interlude

CLR To Drill Six Wells On A 640-Acre Unit, Todd Oil Field, West Of Williston -- June 29, 2025

Locator: 48623B.

See NDIC hearing dockets, July, 2025. Link here.

The case, not a permit:

31911, CLR, Todd-Bakken, six wells on an existing 640-acre unit; Williston, Williams County;

Application of Continental Resources, Inc. for an order authorizing the drilling, completing and producing of a total not to exceed six wells on an existing 640-acre spacing unit described as Section 12, T.154N., R.102W., Todd-Bakken Pool, Williams County, ND, and such other relief as is appropriate.

The maps:

**********************

A Well of Interest

The original Weisz well, a singleton:

- 18955, 2,003, Grayson Mill, Weisz 11-14 1-H, Painted Woods, t8/10; cum 402K 4/25; a jump in production, back in 2018:

| BAKKEN | 1-2019 | 31 | 5039 | 4849 | 14132 | 3875 | 3254 | 497 |

| BAKKEN | 12-2018 | 31 | 5412 | 5466 | 15334 | 3949 | 3606 | 219 |

| BAKKEN | 11-2018 | 30 | 5454 | 5345 | 17634 | 4188 | 3542 | 526 |

| BAKKEN | 10-2018 | 29 | 4634 | 4681 | 16681 | 3546 | 2743 | 687 |

| BAKKEN | 9-2018 | 30 | 6232 | 6212 | 21938 | 5174 | 5054 | 0 |

| BAKKEN | 8-2018 | 29 | 6418 | 6351 | 27295 | 5256 | 5059 | 89 |

| BAKKEN | 7-2018 | 22 | 3348 | 3298 | 25760 | 2622 | 731 | 1807 |

| BAKKEN | 6-2018 | 13 | 1859 | 1953 | 8796 | 1478 | 731 | 655 |

| BAKKEN | 5-2018 | 18 | 3273 | 3324 | 25326 | 2140 | 767 | 1281 |

| BAKKEN | 4-2018 | 22 | 4003 | 3750 | 41073 | 2312 | 1946 | 286 |

| BAKKEN | 3-2018 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 2-2018 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 1-2018 | 31 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 12-2017 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 11-2017 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 10-2017 | 3 | 117 | 160 | 228 | 179 | 177 | 0 |

| BAKKEN | 9-2017 | 29 | 1059 | 1066 | 1768 | 1957 | 1815 | 112 |

| BAKKEN | 8-2017 | 31 | 1257 | 1322 | 1738 | 2514 | 2463 | 23 |

| BAKKEN | 7-2017 | 31 | 1265 | 1215 | 1849 | 2500 | 2462 | 7 |

| BAKKEN | 6-2017 | 30 | 1207 | 1195 | 2165 | 2090 | 2045 | 15 |

| BAKKEN | 5-2017 | 31 | 1459 | 1434 | 1952 | 2673 | 2568 | 74 |

| BAKKEN | 4-2017 | 30 | 1308 | 1323 | 1926 | 1812 | 1703 | 79 |

Anticipation -- June 29, 2025

Locator: 48622ARCHIVES.

Markets, futures, Sunday night:

Jane Austen: yet another review of one of this author's books. Link here.

*****************************

The Top 100 Movies Of The 21st Century

Top ten: #1 -- #10 -- my favorite, #2 David Lynch's Mulholland Drive.

- Parasite

- Mulholland Drive

- There Will Be Blood

- In The Mood for Love

- Moonlight

- No Country For Old Men

- Eternal Sunshine of the Spotless Mind

- Get Out

- Spirtied Away

- The Social Network

Others I've enjoyed:

#21: The Royal Tenenbaums

#22: The Grand Budapest Hotel

#30: Lost In Translation

#41: Amélie

#50: Up

#57: Best in Show

#61: Kill Bill, Vol. 1

#63: Little Miss Sunshine

#65: Oppenheimer

#71: Ocean's Eleven

#73: Ratatouille

#76: O Brother, Where Art Thou?

#83: Inside Llewyn Davis

#85: Anchorman: The Legend of Ron Burgundy

#87: The Lord of the Rings: The Fellowship of the Ring

Yuval Noah Harari -- Again -- June 29, 2025

Locator: 48621BOOKS.

Yuval Noah Harari is back in the news with an interview in the weekend edition of The WSJ, link here.

I've written about this author before, link here, after reading his first book a year or so ago. Actually, I read it twice, thinking I must have missed something when the likes of Bill Gates and Barack Obama thought it was a great book.

This is how Harari viewed mankind in his #1-selling book, Sapiens, page 415 in the afterword:

Unfortunately, the Sapiens regime on earth has so far produced little that we can be proud of. We have mastered our surroundings, increased food production, built cities, established empires and created far-flung trade networks. But did we decrease the amount of suffering in the world? Time and again, massive increases in human power did not necessarily improve the well-being of individual Sapiens, and usually caused immense misery to other animals.

Besides ending the theme sentence with a preposition ... but I digress.

At the time I read that, I pointed out:

- Carnegie libraries across the US

- vaccines eradicated smallpox, tetanus, and polio

- art by Monet

- Tesla

- the Bible, the Odyssey, the Iliad, the Aeneid, Shakespeare

- the iPhone

- martinis

- the Kentucky Derby

- Olga Kern and the Santa Fe Orchestra

- life expectancy and quality of life

- Neil Armstrong

- the Rolls Royce

- We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness

- cowboy boots and cowboy hats

- equal rights for women

- the horse would have gone extinct without Homo sapiens: Tim Winegard, 2024.

And now he's worried about AI. If nothing else, he knows how to sell books.

The Algore of AI prognostications.

Biggest Tech Story Of The Week? I Think So -- June 29, 2025

Locator: 48620APPLE.

Updates

June 30, 2025: AAPL pops on rumor that Apple is considering partnership of some sort with Perplexity and/or OpenAI. Rumors suggests both will "insert" into Siri. Would be blow to Google. Would also make the anti-monopoly case against Google/Apple moot.

Original Post

Reminder: two things --

- right now, much / most of the tech industry is cutting down on employees as AI upsets the apple cart (no pun intended)

- Apple appears to be headed in a different direction with regard to growing the company

- whatever area Apple moves into, it must be seen as "best-in-class"

- this all suggests a huge announcement from Apple before the end of this year

The story:

- Apple: new office space could bring in another 2,000 people

- Apple: this past week, it is being reported that Apple spent more than $500 million buying more office space in the Bay Area. Link here. I can think of only one reason Apple would need that much more office space. This is going to be incredibly interesting. Link here.

Apple (AAPL) cash on hand, link here:

Compare the $50 billion in cash that AAPL has with the $350 billion that Warren Buffett / BRK has:

BRK has nothing to do with this story, but I had to have some way to put Apple's $50 billion cash in perspective.

*******************************************

Disclaimer

Brief

Reminder

Briefly:

- I am

inappropriately exuberant about the Bakken and I am often well out front

of my headlights. I am often appropriately accused of hyperbole when it

comes to the Bakken.

- I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- See disclaimer. This is not an investment site.

- Disclaimer:

this is not an investment site. Do not make any investment, financial,

job, career, travel, or relationship decisions based on what you read

here or think you may have read here. All my posts are done quickly:

there will be content and typographical errors. If something appears wrong, it probably is. Feel free to fact check everything.

- If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

- Reminder: I am inappropriately exuberant about the Bakken, US economy, and the US market.

- I am also inappropriately exuberant about all things Apple.

- And now, Nvidia, also. I am also inappropriately exuberant about all things Nvidia. Nvidia is a metonym for AI and/or the sixth industrial revolution.

- I've now added Broadcom to the disclaimer. I am also inappropriately exuberant about all things Broadcom.

- I've now added Oracle to the disclaimer. I am also inappropriately exuberant about all things Oracle.

- Longer version here.

Tech: Clearing Off The Desktop -- June 29, 2025

Locator: 48619TECH.

Clearing off the desktop:

- OpenAI to use Google's TPU chips to power ChatGPT; first time is has used non-Nvidia chips in a meaing way. Link here. Later, apparently this was not accurate. Link here.

- Beth reports on Micron's huge beat. Link here.

- Apple: this past week, it is being reported that Apple spent more than $500 million buying more office space in the Bay Area. Link here. I can think of only one reason Apple would need that much more office space. This is going to be incredibly interesting. Link here.

*******************************************

Disclaimer

Brief

Reminder

Briefly:

- I am

inappropriately exuberant about the Bakken and I am often well out front

of my headlights. I am often appropriately accused of hyperbole when it

comes to the Bakken.

- I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- See disclaimer. This is not an investment site.

- Disclaimer:

this is not an investment site. Do not make any investment, financial,

job, career, travel, or relationship decisions based on what you read

here or think you may have read here. All my posts are done quickly:

there will be content and typographical errors. If something appears wrong, it probably is. Feel free to fact check everything.

- If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

- Reminder: I am inappropriately exuberant about the Bakken, US economy, and the US market.

- I am also inappropriately exuberant about all things Apple.

- And now, Nvidia, also. I am also inappropriately exuberant about all things Nvidia. Nvidia is a metonym for AI and/or the sixth industrial revolution.

- I've now added Broadcom to the disclaimer. I am also inappropriately exuberant about all things Broadcom.

- I've now added Oracle to the disclaimer. I am also inappropriately exuberant about all things Oracle.

- Longer version here.

Reading For The Weekend -- June 29, 2025

Legacy Fund -- June 29, 2025

North Dakota to expand in-state Legacy Fund investments, link here.

North Dakota plans to invest up to $150 million of Legacy Fund money in-state into land, infrastructure, agriculture and natural resources as part of a new agreement with investment firm GCM Grosvenor.

The Legacy Fund is a trust fund for the state made from oil tax revenue.

The fund, which as of March was valued at nearly $12 billion, is meant to create a source of reliable income for North Dakota even after the state’s energy industry tapers off.

The Legislature made a commitment during the 2021 session to invest more Legacy Fund dollars in-state, with the goal of making money for North Dakota while also stimulating its economy.

The state has set a goal of investing $600 million into North Dakota equity. The partnership with GCM Grosvenor to invest $150 million is part of that. The money is expected to go largely to private infrastructure, including for the energy and technology industries, according to the state Retirement and Investment Office, which administers the Legacy Fund.

That $600 million represents about 5% of the current value of the Legacy Fund.

Legacy Fund link here.

Mastermind Of October 7 Terror Attack Killed By IDF -- June 29, 2025

Locator: 48616ISRAEL.

In box below, note that The NYT is not found. I just did a word search at TNYT, Issa Al-Issa, and several articles popped up but the most recent was dated January 12, 2025, and I couldn't find a reference to the IDF having killed him over the weekend. I'll check again tomorrow if I remember.

But I did find this article, link here:

Who knew? Donuts?

Across the United States, Eid al-Fitr runs on Dunkin’ — or Krispy Kreme or a local bakery, depending on where your mosque caters from. As congregants mingle with friends and family, nearby tables heave with dozens of boxes of chocolate-frosted, glazed or jelly-stuffed pastries.

Initial Production For Wells Coming Off Confidential List This Next Week -- June 29, 2025

Locator: 48615WELLS.

The wells:

- 40888, conf, Grayson Mill, Bice 18-17F XS 2H, Haystack Butte,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 4-2025 | 21377 | 73600 |

| 3-2025 | 31478 | 77554 |

| 2-2025 | 40011 | 67403 |

| 1-2025 | 49170 | 61972 |

- 40865, conf, Grayson Mill, Martin 32-36 4H, Rosebud,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 4-2025 | 22185 | 19196 |

| 3-2025 | 30191 | 27327 |

| 2-2025 | 16058 | 12012 |

| 1-2025 | 25960 | 14054 |

- 40549, conf, Hunt Oil, Clearwater 157-90-24-25H-5, Clear Water,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 4-2025 | 16385 | 5838 |

| 3-2025 | 19407 | 5417 |

| 2-2025 | 8480 | 2644 |

| 1-2025 | 6672 | 1160 |

- 40548, conf, Hunt Oil, Clearwater 157-90-24-25H-4, Clear Water,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 4-2025 | 16590 | 7755 |

| 3-2025 | 19952 | 6192 |

| 2-2025 | 19822 | 7000 |

| 1-2025 | 12249 | 2580 |

- 41248, conf, CLR, Thornson FIU 13-28H1, Alkali Creek, npd,

- 39547, conf, Hunt Oil, Redmond 157-89-19-30H 5, Clear Water,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 4-2025 | 18145 | 6065 |

| 3-2025 | 22371 | 5114 |

| 2-2025 | 19036 | 3857 |

| 1-2025 | 9041 | 1747 |

- 39546, conf, Hunt Oil, Redmond 157-89-19-30H 4, Clear Water,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 4-2025 | 15814 | 6000 |

| 3-2025 | 19280 | 5102 |

| 2-2025 | 15437 | 4966 |

| 1-2025 | 5063 | 947 |

- 39545, conf, Hunt Oil, Redmond 157-89-19-30H 3, Clear Water,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 4-2025 | 8909 | 3138 |

| 3-2025 | 13315 | 3628 |

| 2-2025 | 14059 | 3840 |

| 1-2025 | 3661 | 26 |

- 40886, conf, Grayson Mill Bice 18-17 10TFH, Haystack Butte,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 4-2025 | 23311 | 37854 |

| 3-2025 | 25980 | 36269 |

| 2-2025 | 15018 | 25230 |

| 1-2025 | 20072 | 33251 |

- 41249, conf, CLR, Thronson Federal 10-28H, Alkali Creek, npd,

- 40898, conf, Hess, EN-McKenna_LE-157-93-3328H-1, Big Butte,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 4-2025 | 10417 | 19243 |

| 3-2025 | 13774 | 17546 |

| 2-2025 | 10785 | 10180 |

| 1-2025 | 7418 | 4942 |

- 40848, conf, Grayson Mill, Bice 18-17 6TFH, Haystack Butte,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 4-2025 | 23302 | 46494 |

| 3-2025 | 23973 | 36681 |

| 2-2025 | 20705 | 33721 |

| 1-2025 | 29031 | 39230 |

- 40887, conf, Grayson Mill, Bice 18-17F XS 1TFH, Hatystack Butte,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 4-2025 | 20072 | 59531 |

| 3-2025 | 28863 | 65825 |

| 2-2025 | 11649 | 22934 |

| 1-2025 | 32502 | 51192 |

- 41250, conf, CLR, Thronson FIU 11-28H2, Alkali Creek, npd,

- 41251, conf, CLR, Thronson FIU 12-28HSL, Alkali Creek, npd,

- 40796, conf, Grayson Mill, Bice 18-17 9H, Haystack Butte,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 4-2025 | 21410 | 59859 |

| 3-2025 | 29361 | 52587 |

| 2-2025 | 11273 | 19633 |

| 1-2025 | 33012 | 51332 |

| 12-2024 | 432 | 0 |

Wells Coming Off Confidential List This Next Week -- June 29, 2029

Locator: 48614WELLS.

The wells:

Wednesday, July 9, 2025: 16 for the month, 16 for the quarter, 446 for the year,

None.

Tuesday, July 8, 2025: 16 for the month, 16 for the quarter, 446 for the year,

40888, conf, Grayson Mill, Bice 18-17F XS 2H,

Monday, July 7, 2025: 15 for the month, 15 for the quarter, 445 for the year,

40865, conf, Grayson Mill, Martin 32-36 4H,

40549, conf, Hunt Oil, Clearwater 157-90-24-25H-5

40548, conf, Hunt Oil, Clearwater 157-90-24-25H-4,

Sunday, July 6, 2025: 12 for the month, 12 for the quarter, 452 for the year,

41248, conf, CLR, Thornson FIU 13-28H1,

39547, conf, Hunt Oil, Redmond 157-89-19-30H 5,

39546, conf, Hunt Oil, Redmond 157-89-19-30H 4,

39545, conf, Hunt Oil, Redmond 157-89-19-30H 3,

Saturday, July 5, 2025: 8 for the month, 8 for the quarter, 448 for the year,

40886, conf, Grayson Mill Bice 18-17 10TFH,

Friday, July 4, 2025: 7 for the month,7 for the quarter, 447 for the year,

41249, conf, CLR, Thronson Federal 10-28H,

40898, conf, Hess, EN-McKenna_LE-157-93-3328H-1,

40848, conf, Grayson Mill, Bice 18-17 6TFH,

Thursday, July 3, 2025: 4 for the month, 4 for the quarter, 444 for the year,

40887, conf, Grayson Mill, Bice 18-17F XS 1TFH,

Wednesday, July 2, 2025: 3 for the month, 3 for the quarter, 440 for the year,

41250, conf, CLR, Thronson FIU 11-28H2,

41251, conf, CLR, Thronson FIU 12-28HSL,

40796, conf, Grayson Mill, Bice 18-17 9H,

Saturday, June 28, 2025

Making The Military Great Again -- June 28, 2025

Locator: 48613MILITARY.

USAF cancels the E-7 Wedgetail, citing survivability and cost concerns. Link here. This a/c was built on the Boeing 737, also marketed as the Boeing 737 AEW&C. Link here.

Last year, the Air Force and Boeing inked a $2.6 billion deal for the first two Wedgetail prototypes, the first of which was set to be delivered in FY28. The service intended to buy a total of 26 Wedgetails to replace aging E-3 AWACS aircraft. The Air Force has not yet published detailed budget information, but supporting documents indicate a request of $200 million in research and development funding to close out the E-7 program.

From the first linked article:

The official added that the Wedgetail, while a “perfectly great” platform, doesn’t match with the department’s current ambitions to have a sensing solution that would cover the entire globe instead of a more limited theater.

“If we want to go there, we have to do a large investment in space-based sensing, which also supports Golden Dome. It covers homeland defense, It covers the Indo-Pacific, which is our priority theater, and also services the globe,” the official stated. “So that investment [in Wedgetail] was pushed that way [to space-based sensors].

We are bullish on space, and we think that’s a capability that can be achieved actually faster than the E-7 will deliver at this point.”

Was it easy to kill the E-7? First question to ask, where was the E-7 being built? From AI:

The Boeing E-7 Wedgetail is not being "built" in a single location. It is a modified Boeing 737-700 airframe that undergoes modification and integration of its mission systems.

And here it is:

The primary modification and integration work for the Royal Air Force's E-7 Wedgetail fleet is being done in the UK, specifically at facilities at RAF Lossiemouth in Scotland. While the core 737 airframe is built elsewhere, the "Wedgetail" configuration is completed in the UK.

I doubt the US Congress had any trouble killing this project.

Memo to self: stop by Barnes and Noble and buy some new aviation magazines. LOL.

**************************

How Slow Was News Today?

National news, CBS Nightly News, tonight, Saturday night led off with a still photo of a tornado that caused no damage in Bismarck, ND. I kid you not; I can' make this stuff up.

Global Economy -- There Seems To Be A Pattern Here -- June 28, 2025

Locator: 48612EVS.

First, this morning we had the story of GM Cadillac Celestiq:

Earlier, we had this: the starting price for a new Range Rover is around $107,400. Range 300 miles.Prices can increase significantly depending on the trim level, wheelbase, and options chosen. For example, the Range Rover SV can start at $209,000 for a standard wheelbase and go up to $234,000 for a long wheelbase.

And now this: link here.

I'm not looking for these stories. They pop up on my various feeds and seem to be associated with the sixth industrial revolution, and stories about making America great again.

Then, "combine" these stories with the $50-million Bezos wedding and one starts to get another feeling.... the gilded age, the roaring 20's. Not the 1920s -- the great Jay Gatsby -- but the gay (and literally, in some cases, really "gay") 20s, but this time, the 2020s.

And million-dollar bonuses for software engineers.

A lot of folks are trying to slow down this train. At their peril. This train has already left the station.

By the way, the Lamborghini Revuelto has a new 6.5-liter V12 engine! Say what? Yes, and they have the nerve to call this an EV. LOL. Range? Infinite, unlike a true EV. It can stop anywhere it needs to, to fill up with gasoline.

*********************************

Meanwhile

Shares have dropped.

From the link:

China’s top automaker is scaling back production at several factories due to rising vehicle inventories and slower-than-expected sales growth.

The company has canceled night shifts and delayed adding new production lines, reducing output at at least four factories by about one-third.

“There were two reasons for the mentioned actions: saving costs and failing to meet targets."

In May 2025, BYD launched aggressive discounts across 22 of its models, slashing prices by as much as 53,000 yuan (USD 7,390) in an attempt to ease dealership backlogs.

However, inventories continued to rise despite the deep price cuts. A major dealer network in eastern China even suspended operations, partly due to unsold stock.

The problem with EVs for automobile manufacturers: margins.

But now it's even worse: even with prices being slashed on the least expensive EVs to begin with, not even these are selling any more --- at least not at levels necessary to make the company a going concern.

Does Warren Buffett / BRK still owns shares in BYD? Yes, from ChatGPT:

Berkshire’s original investment began in September 2008, when they purchased HK$230 million worth (~225 million shares), representing about 9.9% of BYD’s Hong Kong-listed shares.

Beginning in 2022, Berkshire quietly began trimming its position.

By mid‑2023, it had edged below 8%, and by July 2024, its stake had fallen to 4.94%.

A filing in June 2024 confirmed their holding was roughly 6.9%, down from around 7.0%, while the July disclosure reflected further reduction to under 5%