The wells:

- Sunday, January 12, 2025: 19 for the month, 19 for the quarter, 19 for the year,

- 40588, conf, Neptune Operating LLC, Simpson LW 5-8 5H,

- 40295, conf, BR, Kellogg Ranch 2B TFH,

- Saturday, January 11, 2025: 17 for the month, 17 for the quarter, 17 for the year,

- 40083, conf, Hess, EN-Halvorson-157-9-3229H-6,

- 40565, conf, Neptune Operating LLC, Simpson 5-8 6H,

- Friday, January 10, 2025: 15 for the month, 15 for the quarter, 15 for the year,

- 40084, conf, Hess, EN-Halvorson-157-93-3229H-5,

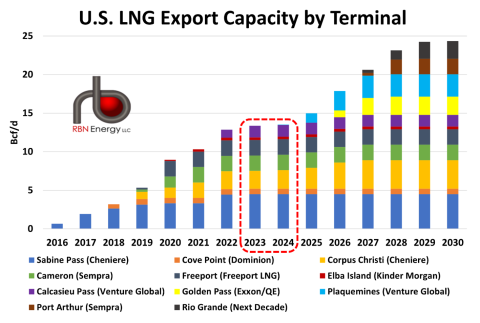

Russia’s invasion of Ukraine and Europe’s subsequent pivot away from Russian natural gas caused a huge resurgence in interest in U.S. LNG. That led to nearly 60 MMtpa (7.9 Bcf/d) of new U.S. LNG capacity reaching a final investment decision (FID) in 2022-23. But regulatory delays at the Federal Energy Regulatory Commission (FERC), the Biden administration’s pause on non-free-trade-agreement (non-FTA) export licenses, and legal challenges to the FERC approval process have essentially halted LNG development in the U.S. There are several LNG projects with enough commercial momentum to move forward that are stuck in regulatory or legal limbo, but even projects that have reached FID are not safe from legal challenges. In today’s RBN blog, we conclude our series on LNG delays by looking at recent court rulings and other regulatory issues and their impact on U.S. LNG development.In Part 1 of this mini-series we talked about how LNG construction delays caused 2024 to be the first year that U.S. LNG feedgas demand did not see meaningful year-on-year growth since U.S. exports began in 2016 (see dashed red box in Figure 1 below). Major construction delays at Golden Pass LNG (yellow bar segments) and the bankruptcy of the terminal’s engineering, procurement and construction (EPC) partner, Zachry Holdings, in the spring of 2024 delayed its startup by at least a year. Minor delays at Venture Global’s Plaquemines LNG (light-blue bar segments) pushed back the final stages of commissioning and startup at the terminal, although “first LNG” — the term of art for the first output from a plant — was achieved on December 14 and the terminal exported its first commissioning cargo on December 26. Flows at the terminal will ramp up this year as additional units come online.

Figure 1. U.S. LNG Export Capacity by Terminal. Source: RBN

Feedgas growth from near-term U.S. LNG projects may have been pushed back, but it’s still coming, with at least 1 Bcf/d of demand— and potentially more than 2.5 Bcf/d — expected by the end of the year, depending on the exact ramp schedule for the commissioning terminals. By the end of 2026, feedgas demand could approach 19 Bcf/d with Corpus Christi Stage III online, Plaquemines LNG Phase 1 online and Phase 2 commissioning, and Golden Pass ramping online. While construction issues can cause timing delays at the terminals, the three near-term projects appear to be secure in their path forward, but things become more uncertain further out. Regulatory and court challenges have made it increasingly difficult for new projects to take FID and, given that court challenges actually happen after projects are approved —sometimes even after FID — it’s a very unsettled world right now.