Locator: 45467TX.

Locator: 45467PIPELINE.

Locator: 45467ENB.

I used to track Enbridge pipelines here, but not so much any more.

- in many respects, many investors look at pipelines as utilities which don't interest me much any more; been there; done that; just enjoy the dividends;

- in many respects, pipelines have become the protest du jour for today's faux environmentalists:

- and, of course, a derivative of that, pipelines have become political issues, which is always something that bores me when it comes to energy and business.

- judges can't seem to get enough of them on their dockets; and, instead of just throwing out the cases to begin with, they find ways to extend the cases well beyond their "Best By Date."

Enbridge Ingleside Energy Center

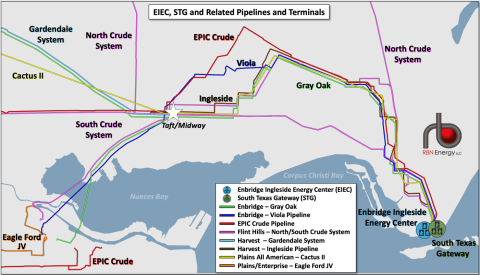

We took a deep-dive look at Enbridge’s October 2021 acquisition of what until then was known as the Moda Ingleside Energy Center in You Send Me. In that blog, we noted that the terminal (now called EIEC; circular blue icon in Figure 2) had 15.6 MMbbl of crude oil storage capacity (it’s currently building another ~2 MMbbl) as well as extraordinary pipeline interconnectivity, including direct links to Cactus II (yellow line), EPIC Crude (red line) and Gray Oak (green line), which charge some of the lowest rates of any Permian-to-Gulf Coast pipelines and allow for neat batches of crude to be sent straight from West Texas to dedicated tanks at the terminal, thereby maintaining crude quality. (Calgary, AB-based Enbridge holds a 68.5% ownership interest in Gray Oak and a 30% stake in Cactus II; it also operates Gray Oak.) EIEC also is connected via its own Viola Pipeline (acquired as part of the Moda deal; purple line) to Plains All American and Enterprise’s Eagle Ford JV Pipeline (orange line), which transports crude from the original Cactus I pipeline’s Gardendale terminus to Corpus Christi’s Inner Harbor area. Further, Harvest Midstream’s 600-Mb/d Harvest Ingleside pipeline (brown line) links Harvest’s Midway terminal (near Enbridge’s Taft terminal; white star) to EIEC.

EIEC’s ability to send out an average of about 900 Mb/d in the first seven months of this year (and as much as ~1 MMb/d — the terminal’s send-out pace in April 2023) doesn’t just depend on those pipeline connections. Its success is also tied to the terminal’s ability to load up to 1.6 MMbbl onto a 2-MMbbl VLCC and to fully load a 1-MMbbl Suezmax — feats enabled by EIEC’s tankage, pumps and direct access to the newly deepened Corpus Christi Ship Channel. (VLCCs, Very Large Crude Carriers, are the transporters of choice for many shippers moving crude oil to Asia and Europe because of the lower per-barrel cost, and filling four-fifths of a VLCC at the dock provides additional savings by slashing the cost of reverse lightering.)

Figure 2. EIEC, STG and Related Pipelines and Terminals. Source: RBN