Locator: 48470B.

WTI: $68.13.

New wells;

- Sunday, March 9, 2025: 23 for the month, 139 for the quarter, 139 for the year,

- 40472, conf, Hess, GO-John-156-98-0508H-5,

- 26468, conf, Grayson Mill, Scott 150-99-13-24-5H,

- Saturday, March 8, 2025: 21 for the month, 137 for the quarter, 137 for the year,

- None.

- Friday, March 7, 2025: 21 for the month, 137 for the quarter, 137 for the year,

- 40496, conf, Hess, GO-Olson-157-98-2536H-4,

- 40370, conf, Enerplus, LK-Quilliam 147-97-14-23-8H,

- 40366, conf, Enerplus, LK-Erickson 147-97-11-2-5H-LL,

- 40363, conf, Enerplus, LK-Quilliam 147-97-14-23-5H-LL,

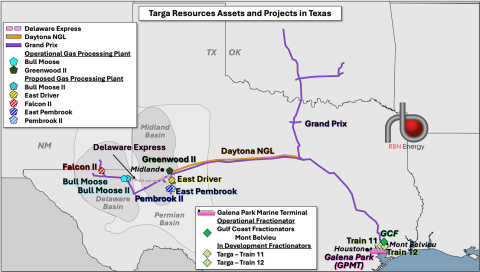

RBN Energy: Targa Resources, Phillips 66 detail plans for expanding Permian-to_Gulf infrastructure. Part 1 archived. Part 2 archived.

The handful of midstream companies that provide a full range of “wellhead-to-water” services between the Permian and the Gulf Coast are in growth mode, advancing a long list of gas processing plants, takeaway pipelines, fractionators and export terminal expansions. Last time we looked at what Enterprise Products Partners and Energy Transfer are up to. In today’s RBN blog, we shift our spotlight to what Targa Resources and Phillips 66 are planning, with Targa building a slew of projects and P66 growing primarily through organic opportunities that have arisen following recent bolt-on M&A.

As we said in Part 1, a small but gradually growing group of midstreamers have seen the benefits of owning and operating the infrastructure that processes, transports and, in many cases, exports the increasing volumes of crude oil, natural gas and NGLs emerging from wells in the Permian Basin. Companies that offer the full gamut of midstream services can reap a number of important benefits — chief among them, the ability to operate with extraordinary efficiency, collect fees from shippers each step of the way, and feed pipelines, fractionators, storage and export terminals along the network’s value chain.

In that blog, we also detailed plans by Enterprise to add another 900 MMcf/d of gas processing capacity in the Permian over the next year or so, as well as bring online its 600-Mb/d Bahia NGL pipeline from West Texas to Mont Belvieu (in Q3 2025) and yet another fractionator (also in Q3). Several projects that will boost the company’s NGL export capacity out of Beaumont and Houston are also planned. Energy Transfer has similarly ambitious plans: 875 MMcf/d of incremental Permian gas processing capacity, upgrades to its Lone Star and West Texas Gateway NGL pipelines, a new fractionator at Mont Belvieu, an expansion at its Nederland Terminal to handle more NGL exports, and — last but not least — the 400-mile, 1.5-Bcf/d (and maybe larger) Hugh Brinson gas pipeline from West Texas to south of the Dallas/Fort Worth area.

Figure 1. Targa Resources Assets and Projects in Texas. Source: RBN