Locator: 48487B.

Note: my only interest in Ford is to follow the American EV story. Read disclaimer.

Ford:

Appears to be paying about $2.3 billion in regular dividends on an annual basis.

Net profit:

Near the close today:

- tariffs, link here.

- EV losses, link here.

- forecasts weaker profit, link here.

- biggest question: when will Ford (F) stop reporting EV sales / profits separately and simply wrap those numbers in overall figures

- many investors appreciate the transparency,

- even Apple (AAPL) doesn't break out figures for every product line;

- I've never understood why F chose this route

The data above is very old data -- almost a year old -- but then this:

EVs sold in 4Q25:

Higher math:

$5,500,000,000 / 30,000 = $183,333 / vehicle.

Analysts expected worse:

Tariffs: will make things significantly worse for Ford, according to CEO. It doesn't help that the upper Midwest seems to be ground zero for Trump protests.

From GM Inside News, February 16, 2025, link here:

From The Verge, link here:

I honestly don't know how automakers can continue going down this road.

************************

COP

Maintains dividend: 78 cents. If one's cost basis for COP is about $4 / share, then 78 cents x 4 = $3.12 / $4.00 or 78% annual payout.

Barchart: link here.

Baystreet: link here.

Reminder: COP acquired MRO this past year. This is a huge story. Often forgotten by investors.

Upside? Hope springs eternal.

Long term holding, and by long, I mean really, really long.

Only interest I have in COP is its dividend.

Analysts and "talking heads" are no different than you and me: unless one is a college student or PhD candidate writing a thesis on a specific company as an investment, there is simply way too much information available. In general, analysts and "talking heads" are making decisions based on headlines. Slightly more successful analysts and "talking heads" are actually reading the first few paragraphs of these stories. Highly successful analysts and "talking heads" are YOLO, FOMO, MOJO, and risk takers. Until they aren't.

****************************

Other Headlines

Equinor: huge pivot on wind is absolutely amazing. Link here.

Norway: huge misstep in energy. Beyond the pale! Link here. Oilprice is not the only one reporting this almost-unbelievable story.

*******************************

Back to the Bakken

The Enerplus (Chord Energy) honor pad: tracked elsewhere; this is a great place to start.

Pending:

- 40434, conf, Enerplus, Purpose 150-94-06A-18H, Spotted Horn, spud 1/24/24;

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 12-2024 | 22716 | 31112 |

| 11-2024 | 34735 | 47494 |

| 10-2024 | 30788 | 36511 |

| 9-2024 | 29402 | 35971 |

| 8-2024 | 3991 | 1663 |

- 40432, conf, Enerplus, Fearless 150-94-06A-18H-LL, Spotted Horn, spud 1/25/24;

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 12-2024 | 25788 | 34487 |

| 11-2024 | 29496 | 50279 |

| 10-2024 | 32331 | 52955 |

| 9-2024 | 41396 | 68751 |

| 8-2024 | 1001 | 1959 |

- 40436, drl/drl, Enerplus, Prowess 150-94-06B-18H, Spotted Horn, spud 1/22/24; npd,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 12-2024 | 31793 | 43165 |

| 11-2024 | 42322 | 55545 |

| 10-2024 | 38512 | 42233 |

| 9-2024 | 32548 | 44389 |

| 8-2024 | 4592 | 6077 |

- 40437, drl/drl, Enerplus, Icon 150-94-06B-18H, Spotted Horn, spud 1/21/24;

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 12-2024 | 34811 | 58039 |

| 11-2024 | 18962 | 27492 |

| 10-2024 | 41 | 1248 |

| 9-2024 | 2388 | 4121 |

| 8-2024 | 15698 | 24600 |

40438, conf, Enerplus, Strength 150-94-06B-18H, Spotted Horn, spud 1/19/24;

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 12-2024 | 17419 | 40463 |

| 11-2024 | 25749 | 46277 |

| 10-2024 | 14176 | 20984 |

| 9-2024 | 24287 | 37009 |

| 8-2024 | 21073 | 36906 |

- 40409, conf, Enerplus, Valiant 150-94-06B-LL, Spotted Horn, spud 1/18/24;

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 12-2024 | 8224 | 26410 |

| 11-2024 | 5995 | 24587 |

| 10-2024 | 8525 | 20849 |

| 9-2024 | 12407 | 27621 |

| 8-2024 | 4821 | 5818 |

Updated production:

- 40409, conf, Enerplus, Valiant 150-94-06B-LL, Spotted Horn, spud 1/18/24; see above,

- 23541, A/IA/1,545, Enerplus, Honor 150-94-06B-18H TF, Spotted Horn, Three Forks, 59 stages; 14 million lbs sand, 1280 acres, t6/14; cum 705K 12/20; three-section lateral; t6/14; cum 737K 11/21; cum 788K 8/23; back on line after being off line almost a full year; no jump in production; cum 792K 11/24;

- 40438, conf, Enerplus, Strength 150-94-06B-18H, Spotted Horn, spud 1/19/24; see above,

- 40437, conf, Enerplus, Icon 150-94-06B-18H, Spotted Horn, spud 1/21/24; see above,

- 23542, IA/1,007, Enerplus, Grace 150-94-06B-07H, Spotted Horn, t2/13; cum 371K 12/20;TD -20,753 feet, two section lateral; cum 389K 11/21; cum 426K 11/23; cum 426K 11/24; remains off line;

- 40436, conf, Enerplus, Prowess 150-94-06B-18H, Spotted Horn, spud 1/22/24; see above,

- 26608, A/IA/1,601, Enerplus, Courage 150-94-06A-18H, Spotted Horn, t6/14; cum 655K 12/20; TD - 25,023 feet, three section lateral; 42K extrapolates to 54K over 30 days; cum 675K 11/21; cum 716K 11/23; back on line after being off line almost a full year; no jump in production; cum 720K 11/24;

- 40432, conf, Enerplus, Fearless 150-94-06A-18H-LL, Spotted Horn, spud 1/25/24; see above,

- 40434, conf, Enerplus, Purpose 150-94-06A-18H, Spotted Horn, spud 1/24/24; see above.

- 26609, A/IA/1,703, Enerplus Resources, Pride 150-94-06A-18H TF, t10/14; cum 564K 12/20; TD = 25,431 feet, three section lateral; cum 590K 11/21; cum 661K 9/23; back on line after being off line almost a full year; no jump in production; cum 664K 11/24;

*******************************

Morning Report

WTI: $71.38.

New wells:

- Friday, February 7, 2025: 8 for the month, 54 for the quarter, 54 for the year,

- 40438, conf, Enerplus, Strength 150-94-06B-18H,

- Thursday, February 6, 2025: 7 for the month, 53 for the quarter, 53 for the year,

- 40456, conf, Hess, GO-Beck Living TR-156-98-2017H-4,

- 39390, conf, CLR, Goodson 2-21H,

RBN Energy: LLOG's Salamanca strategy offers a test case for refurbishing offshore platforms.

Offshore platforms facilitate Gulf of Mexico (GOM) production, but when their useful life is over they are typically decommissioned and dismantled to be sold as scrap or converted into an artificial reef. Not always, though. In certain cases, inactive rigs can be refurbished and used in new projects — a potentially inviting possibility, especially with GOM production expected to rise and drillers under pressure to keep costs down. In today’s RBN blog, we will examine the challenges (and potential benefits) of reusing an inactive platform and look at plans by LLOG Exploration to refurbish an existing facility for its upcoming Salamanca development, the first such project in a decade.

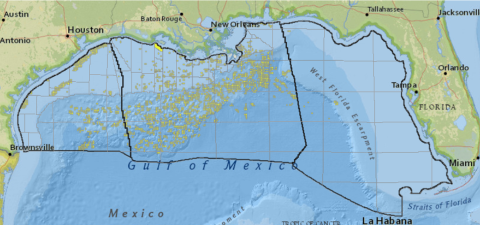

The majority of U.S. offshore E&P business occurs in the GOM, which generates about 14% of U.S. crude oil output. The federal government regulates most of that activity along the Outer Continental Shelf (OCS). Its oversight begins about 3.5 miles off the coast of Alabama, Louisiana and Mississippi; for Texas and Florida, its jurisdiction starts about 10 miles offshore (see black line hugging the coast in Figure 1 below). The Bureau of Ocean Energy Management (BOEM) and the Bureau of Safety and Environmental Enforcement (BSEE) are tasked with managing GOM activity, from overseeing lease sales to expanding production areas to issuing rules on what E&Ps must do with wells, platforms and associated infrastructure once their projects have run their course. (Note: Yellow dots in Figure 1 indicate active leases.)

Figure 1. Gulf of Mexico Offshore Production Areas. Source: Bureau of Ocean Energy Management

In Riders On The Storm, we noted that GOM drillers have nearly tripled the area’s oil output since the Energy Information Administration (EIA) started tracking data in the 1980s — production peaked at just under 2 MMb/d in 2019 and is expected to average 1.9 MMb/d in 2025, according to the EIA. There have been periods when offshore supply took a hit, like the Great Recession, the Macondo disaster and COVID-19, when weak markets challenged producers. However, the trendline shows supply is growing, with discoveries in progressively deeper waters more than offsetting receding supply in shallower coastal areas. As we have detailed in previous blogs, the deeper waters are primarily where there are still resources to discover; shallower areas are easier to develop but have limited potential after years of development activity. Deepwater production accounts for more than 90% of total GOM output. Also note that virtually all GOM production comes from areas not included in former President Biden’s decision to permanently ban new oil and gas drilling from 625 million acres of coastal waters — see Separate Ways (Worlds Apart) — an order that President Trump seeks to reverse.

**********************************

Disclaimer

Brief

Reminder

Briefly:

- I am

inappropriately exuberant about the Bakken and I am often well out front

of my headlights. I am often appropriately accused of hyperbole when it

comes to the Bakken.

- I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- See disclaimer. This is not an investment site.

- Disclaimer:

this is not an investment site. Do not make any investment, financial,

job, career, travel, or relationship decisions based on what you read

here or think you may have read here. All my posts are done quickly:

there will be content and typographical errors. If something appears wrong, it probably is. Feel free to fact check everything.

- If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

- Reminder: I am inappropriately exuberant about the Bakken, US economy, and the US market.

- I am also inappropriately exuberant about all things Apple.

- And now, Nvidia, also. I am also inappropriately exuberant about all things Nvidia. Nvidia is a metonym for AI and/or the sixth industrial revolution.

- I've now added Broadcom to the disclaimer. I am also inappropriately exuberant about all things Broadcom.

- Longer version here.