Locator: 48428RBNVG.

RBN Energy: assessing Venture Global's assets in the wake of its $1.75 billion IPO. Archived.

Venture Global put U.S. LNG on center stage after going public on January 24. The company, now listed as VG on the New York Stock Exchange (NYSE), launched one of the largest initial public offerings (IPO) in U.S. energy history. The IPO shares were priced at $25 each, raising $1.75 billion but valuing the company at $60 billion, a significant drop from the company’s initial target of up to $110 billion. While Venture Global was able to capitalize on some truly fantastic timing, going public just as President Trump took office and lifted the export permit ban, the market remains cautious about LNG and the energy sector. While Trump will certainly smooth the path at least somewhat to new LNG buildout, lawsuits and regulatory hurdles won’t simply disappear overnight. In addition to the general regulatory uncertainty facing the industry, there is also the matter of Venture Global’s contentious relationship with its original customers: Shell, BP and others have brought arbitration cases against the company that have yet to be resolved. In today’s RBN blog, we take a closer look at Venture Global, its assets and what its IPO says about U.S. LNG.

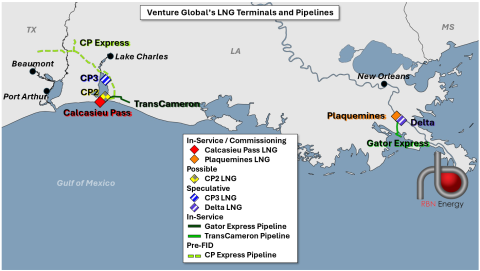

Venture Global is one of the largest players in U.S. LNG, with the 10-MMtpa (1.32 Bcf/d) Calcasieu Pass operational, although still technically commissioning (more on that shortly); the 20-MMtpa (2.65 Bcf/d) Plaquemines LNG under construction or commissioning now; CP2 in the late stages of development and nearing a final investment decision (FID); and two more speculative projects to pursue after CP2. Between Calcasieu Pass and Plaquemines, the company will own and operate 30 MMtpa (4 Bcf/d) by the end of 2027, leaving it second to only Cheniere Energy when it comes to U.S. LNG output (see King Creole for more on the big three players in U.S. LNG). And with more projects in the queue, Venture Global is obviously shooting for Cheniere’s crown. All of Venture Global’s LNG projects use midscale modular technology rather than traditional large-scale trains, promising investors shorter construction timelines and requiring less startup capital to build these smaller, factory-fabricated, but scalable units.

Figure 1. Venture Global’s LNG Terminals and Pipelines. Source: RBN

Venture Global took FID on its first U.S. LNG terminal, Calcasieu Pass (red diamond in Figure 1 above), in August 2019, although the project had been under construction since February of that year. The terminal has 18 mini trains, grouped into nine blocks, for a total nameplate capacity of 10 MMtpa (1.32 Bcf/d) and an expected peak capacity of 12.4 MMtpa (1.64 Bcf/d). Nameplate capacity is what is guaranteed by the design of the project by the engineering partners, but all LNG terminals have the ability to produce above that level.