Locator: 44569B.

Some love for Linda Lavin, link here:

LNG update: with Cheniere's 1.4 Bcf/d Corpus Christi III (#8) now on line, what's next:

- QatarEnergy/ExxonMobil’s 2.4-Bcf/d Golden Pass LNG (#9) in Sabine Pass, TX, which will start coming online in the first half of 2025;

- Sempra's 0.43 Bcf/d Energía Costa Azul (ECA) LNG Phase 1 in west Mexico, to start up in spring, 2026 (this is a delay, had been scheduled to go online summer of 2025);

- NextDecade Corp.’s 2.3-Bcf/d Rio Grande LNG (#10) in Brownsville, TX, starting up in 2027; and,

- Sempra and ConocoPhillips’s 2-Bcf/d Port Arthur LNG (#11), coming online in 2027-28.

*********************************

Back to the Bakken

WTI: $71.05.

Tuesday, December 31, 2024: 51 for the month; 154 for the quarter, 682 for the year

- None.

Monday, December 30, 2024: 51 for the month; 154 for the quarter, 682 for the year

- None.

Sunday, December 29, 2024: 51 for the month; 154 for the quarter, 682 for the year

- None.

Saturday, December 28, 2024: 51 for the month; 154 for the quarter, 682 for the year

- 40731, conf, Rockport Energy, Camden 10-3 3H,

- 39499, conf, Enerplus, Brown Bear 158-99-36-25-5H,

- 37664, conf, BR, Kellogg Ranch 1A TFH,

RBN Energy: Gray Oak stands out as the only Permian crude pipeline to greenlight an expansion. Archived.

As crude oil production in the Permian continues to grow and pipelines from West Texas to the Gulf Coast edge closer to full utilization, it’s becoming a challenge for producers and shippers alike. Amid this capacity crunch, one pipeline stands out as the only one with a detailed expansion plan: the 850-mile, 900-Mb/d Gray Oak Pipeline from West Texas to Corpus Christi and Sweeny, TX, which started up in late 2019 and became fully operational in early 2020. In today’s RBN blog — the latest in our series on Permian crude oil pipelines — we discuss Gray Oak Pipeline’s dynamic story, including its shifting ownership, strategic connectivity and expansion plans.

In Part 1 and Part 3 of this series, we looked at Longhorn Pipeline and BridgeTex Pipeline, respectively, and what ONEOK has accomplished with these systems since it acquired Magellan. In Part 2, we looked at EPIC’s Crude Pipeline to the Corpus Christi area, which has been operating at full capacity. Today, we’ll cover Gray Oak.

We’ll begin by noting that Gray Oak started up shortly before crude oil demand cratered as the pandemic hit. In response, Permian producers shut in a significant amount of production during the summer of 2020. Additionally, two other new Permian pipelines — also to Corpus Christi — started up during the second half of 2019: Plains All American’s Cactus II (585 Mb/d) and EPIC Crude (400 Mb/d, expanded in 2020 to 600 Mb/d), resulting in a glut of crude pipeline egress.

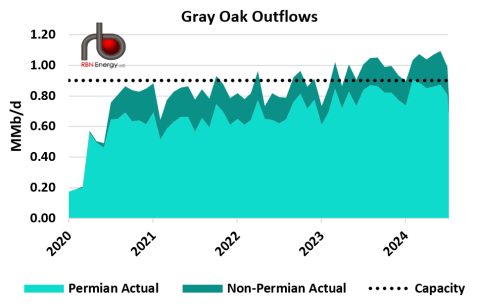

Despite these challenges, Gray Oak’s outflows quickly ramped up throughout 2020. As shown in Figure 1 below, Gray Oak has operated near its 900-Mb/d capacity (dotted horizontal black line) for some time now. Earlier this year, Gray Oak Pipeline LLC sanctioned a 120-Mb/d expansion following a successful open season. Contracted volume commitments of 80 Mb/d start in April 2025 and one year later another 40 Mb/d is committed to the pipe. Gray Oak could offer early service for new or existing shippers if capacity is desired sooner.

Figure 1. Gray Oak Outflows. Source: RBN Crude Oil Permian

The ownership journey of Gray Oak Pipeline is complicated, to say the least. When the project was in its planning stage, Phillips 66 (P66) held a 75% stake and refining company Andeavor owned the remaining 25%. In 2018, Marathon Petroleum acquired Andeavor for $23 billion, inheriting its 25% stake in Gray Oak (box #1 in Figure 2 below), along with a similar stake in the South Texas Gateway (STG) export terminal in Ingleside, across the bay from Corpus. (More on that later — spoiler alert: STG’s traded hands a couple of times since then.) We should note that Andeavor and its old Andeavor Logistics master limited partnership (MLP) had its own intricate corporate history with Marathon and its MPLX unit.

Much, much more at the link.

*********************************

Cheniere

December 30, 2024: Cheniere produces first LNG at Corpus Christi, stage III, link here.

April 16, 2024, flashback:

From RBN Energy, today: new JV's focus is moving Permian natural gas to LNG export terminals. Archived here.

Projects already approved / permitted by the US government ... expected to increase U.S. LNG export capacity to about 25 Bcf/d from the current 14 Bcf/d.

Of that 11 Bcf/d of incremental capacity, more than 8 Bcf/d will be sited along the Texas coast.

These projects include Cheniere Energy’s 1.4-Bcf/d Stage III at Corpus Christi LNG, which is scheduled to begin starting up late this year; QatarEnergy/ExxonMobil’s 2.4-Bcf/d Golden Pass LNG in Sabine Pass, TX, which will start coming online in the first half of 2025; NextDecade Corp.’s 2.3-Bcf/d Rio Grande LNG in Brownsville, starting up in 2027; and Sempra and ConocoPhillips’s 2-Bcf/d Port Arthur LNG, coming online in 2027-28.