Locator: 47015NATGAS.

From RBN Energy, today: new JV's focus is moving Permian natural gas to LNG export terminals. Archived here.

Projects already approved / permitted by the US government ... expected to increase U.S. LNG export capacity to about 25 Bcf/d from the current 14 Bcf/d.

Of that 11 Bcf/d of incremental capacity, more than 8 Bcf/d will be sited along the Texas coast. These projects include Cheniere Energy’s 1.4-Bcf/d Stage III at Corpus Christi LNG, which is scheduled to begin starting up late this year; QatarEnergy/ExxonMobil’s 2.4-Bcf/d Golden Pass LNG in Sabine Pass, TX, which will start coming online in the first half of 2025; NextDecade Corp.’s 2.3-Bcf/d Rio Grande LNG in Brownsville, starting up in 2027; and Sempra and ConocoPhillips’s 2-Bcf/d Port Arthur LNG, coming online in 2027-28.

While each of these liquefaction/LNG export facilities will receive feedgas ....

With the gas supply needs of these projects top of mind, WhiteWater/I Squared, MPLX and Enbridge on March 26 announced plans for a JV to develop, build, own and operate gas pipeline and storage assets connecting Permian supply to LNG export terminals and other Gulf Coast and south-of-the-border demand.

White Water / I Squared will hold a 50.6% stake in the JV to be formally created later in Q2 2024, while MPLX, a master limited partnership (MLP) formed by Marathon Petroleum, will own 30.4%, and Enbridge will own 19%.

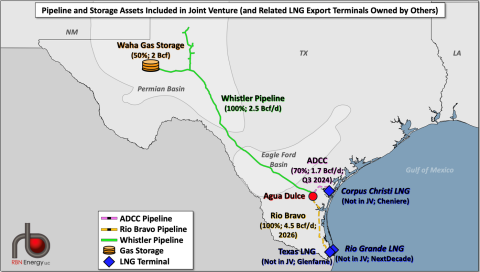

Figure 1. Gas Pipeline and Storage Assets Included in Joint Venture. Source: RBN

As shown in Figure 1 above, the JV will start out with four main assets:

- The 450-mile, 2.5-Bcf/d Whistler Pipeline (green line) from the Waha Hub in West Texas to the Agua Dulce Hub near Corpus Christi. It will connect to the Midland Basin.

- The planned 137-mile, 4.5-Bcf/d Rio Bravo Pipeline (dashed yellow line) from Agua Dulce to Rio Grande LNG.

- A 70% interest in the ADCC Pipeline (dashed pink line), a planned 40-mile, 1.7-Bcf/d pipeline from Agua Dulce to Corpus Christi LNG that is expected to come online in Q3 2024.

- A 50% stake in Waha Gas Storage (orange icon), a 2-Bcf/d underground salt-cavern facility near the Waha Hub in West Texas with extensive connections to inbound and outbound gas pipelines in the Permian.

We should note that upon the closing of the JV transaction, Enbridge will contribute its wholly owned Rio Bravo Pipeline project and $350 million in cash to the JV; Enbridge also will fund the first $150 million of the project’s post-closing capex and retain a 25% economic interest in the pipeline. WhiteWater, which over the past several years has become a top-tier midstream player in the Permian, will operate the JV’s pipeline and storage assets, including Rio Bravo.

The JV puts all three participants — WhiteWater, MPLX and Enbridge — at the center of one of the largest gas delivery opportunities of the next quarter century, namely, moving massive volumes of Permian-sourced gas to existing and planned LNG export terminals along the Texas coast that will, in turn, supply LNG to key international markets, especially Europe and Asia.

The JV also gives WhiteWater, MPLX and Enbridge more direct, Permian-to-LNG-terminal access; enables its partners to better manage gas flows ....

The JV also may find itself involved in an expansion of the Waha Gas Storage (WGS) facility ...

As we see it, the WhiteWater/I Squared /MPLX/Enbridge JV is in keeping with a growing trend — in the U.S. generally and the Permian especially — to build and/or assemble midstream networks that move crude oil, natural gas or NGLs through their entire value chains, from production areas to end-users...

The recently announced WhiteWater/I Squared/MPLX/Enbridge JV brings together three of the most accomplished midstreamers in Texas. Given everything that’s happening regarding Permian production and LNG export project development, it will be interesting to see what their new partnership does next. ... new Permian-to-Gulf-Coast capacity will be needed beyond the 2.5-Bcf/d Matterhorn Express Pipeline (slated to come online later this year), and it’s a good bet the incremental capacity will be pointed at LNG export terminals along the Texas coast.

Just one of the reasons I continue to add to my Enbridge holdings, a position I began decades ago and have never sold, just kept adding. It's been a pretty lousy investment in the big scheme of things, but my heirs will love it -- or at least I hope they love it.

I bought some more Enbridge today. Pays 8%. If the folks in Michigan, or Wisconsin, or wherever it and in Minnesota want to close down the Enbridge pipelines there, that's fine with me. The Permian will keep me happy.

Reminder:

I am inappropriately exuberant about the US economy and the US market, I

am also inappropriately exuberant about all things Apple.

See disclaimer. This is not an investment site.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

All my posts are done quickly: there will be content and typographical errors. If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

Again, all my posts are done quickly. There will be typographical and content errors in all my posts. If any of my posts are important to you, go to the source.

Reminder: I am inappropriately exuberant about the US economy and the US market, I am also inappropriately exuberant about all things Apple.

ENB now pays 8%. Because the price of shares have dropped so much. Years ago, I automatically reinvested all ENB dividends back into ENB. No more. I use the dividends to invest in other equities, but I occasionally add more ENB shares to my position.

****************************

Bat Cave

Every investor needs a Bat Cave.

Allows the investor a place to think without interruption.

And watch classic movies on TCM. Without interruption. So far today, three great movies. All black and white.

But having said that, I'm really, really excited about adding more ENB to my position today.