Updates

August 16, 2021: it's coming. See this post.

Original Post

Not-ready-for-prime-time.

This is a long, disjointed post, but for those paying attention, it may pay huge dividends.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

This is one of those posts that does not flow well from one "idea" to the next. But, trust me, it's a big deal if you can put this altogether.

First, re-read my not-ready-for-prime-time reply to a reader re: Denbury.

That was posted earlier today.

Then pure serendipity, The Williston Herald had an article on blue hydrogen. A reader sent me the article/link/story; I would have missed it. [Did my blog on Denbury have anything to do with the reader catching the Herald article and sending it my way? One wonders. But I digress.]

The dots connect. Wow! Do they connect! And how!

On January 28, 2021, RBN Energy had a blog about hydrogen, part 2. As usual, I posted the lede, but in this case, I also archived the entire blog. I thought it might be important some time down the road. I had no idea that "down the road" happened so fast.

Here was the lede that was posted on the blog.

RBN Energy: making sense of the hydrogen buzz, production edition, part 2. Archived.

Based on the response we received to our first-ever hydrogen blog last fall, it’s fair to say we didn’t waste this space on a fringe subject. To be honest, the level of interest in hydrogen far exceeded our expectations, and suggested that we might have even been a little bit late to the party — but fashionably so, if you ask us. In the weeks since then, we’ve spent a fair amount of time distilling the tremendous amount of news flow and reading material that was either sent our way or popped up in the daily news feeds.

You could go a lot of different directions with hydrogen and it’s still very easy, in our view, to get lost in the forest of green energy technology. So, as we are wont to do, we have stuck to our simple approach of tackling this fuel just like we do with hydrocarbons, and we are first turning our attention upstream. Today, we continue our series on hydrogen with a look at the top production methods for the fuel.

So, what is "blue hydrogen" about which The Williston Herald is talking?

From the RBN Energy blog regarding blue hydrogen, the stuff Mitsubishi was talking about in Bismarck this past week:

The existing hydrogen market is huge. It also emits significant amounts of carbon. That’s because, according to the International Energy Agency (IEA), around 75% of the hydrogen produced in the world is synthesized using natural gas, mostly through a process called steam methane reforming (SMR).

Note that another 20+% of global hydrogen is produced using coal, thanks mostly to China. In the U.S., about 95% of the hydrogen produced comes from natural gas, according to the Department of Energy (DOE).

Similar to the rest of the world, most of the natural gas is turned into hydrogen via SMR, although there are a few partial oxidation (POX) plants that make up a small sliver of the supply side of the market.

We won’t cover POX today, or another technology for producing hydrogen from natural gas called autothermal reforming (ATR), but the processes are not very different than SMR.

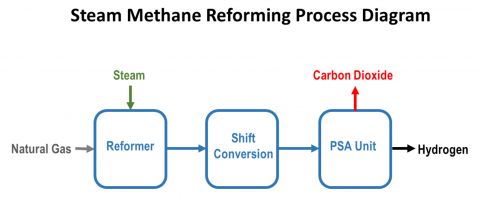

To that end, Figure 1 below shows a simplified process flow diagram for a typical SMR unit.

Figure 1. Simplified SMR Flow Diagram. Source: RBN

To create hydrogen via SMR, natural gas is first fed into a processing unit called a reformer. There it reacts with high-temperature steam and a catalyst, usually one that is nickel-based, to form hydrogen and carbon monoxide. The resulting gas mix is then fed to the shift conversion unit, where the carbon monoxide reacts with the steam to produce even more hydrogen, plus carbon dioxide (CO2). The hydrogen and carbon dioxide are then sent to a pressure swing adsorption (PSA) unit, where the CO2 is removed from the hydrogen.

Naturally, our Figure 1 is simplified, and there are a bunch of other pieces of equipment such as heat exchangers and dryers that we left off, but you get the general idea.

According to data published by the Argonne National Laboratory, the SMR process is about 70%-80% efficient. Using the low end of that range and an assumed $3 per million British thermal units (MMBtu) natural gas price, we estimate the natural gas costs of SMR equate to about $0.50 per kilogram (kg), a number supported by a recent IEA study.

The IEA also assumes another $0.17/kg in other variable costs for SMR, along with $0.34/kg to cover capital costs. That math brings SMR hydrogen production costs to just about $1/kg, assuming you do nothing to contain the produced carbon dioxide.

The IEA estimates that installing a carbon capture, utilization, and storage (CCUS) technology brings total costs up to $1.50/kg of hydrogen.

Even with the added cost of containing the CO2, SMR is cheap when compared to just about any other method of production. Also, while some SMR units feature CCUS, most do not. Remember from Part 1 of this series that hydrogen produced from natural gas via SMR is called “gray” hydrogen. If you combine CCUS with the SMR, your turn the hydrogen from gray to “blue”.

It's okay to ignore this next paragraph:

How much do SMR units produce each year? That’s a good question, and answering it isn’t as easy as you might like. To our knowledge, there is no requirement to report hydrogen production in the U.S., so there’s nothing in the way of historical data from the Energy Information Administration (EIA) like there is for most of the hydrocarbon world. The most recent information we could find from the DOE estimated U.S. hydrogen production at about 10 million metric tons per year (Mtpa). On a daily basis, that’s roughly 11 billion cubic feet per day (Bcf/d) of hydrogen containing approximately 3 million MMBtu. That translates to about 3 Bcf/d of natural gas equivalent energy. Further, if we assume almost all of that produced hydrogen was generated with natural gas-based SMR — the DOE estimates appear to exclude by-product hydrogen relinquished by refinery and chemical plant processing units — the amount of natural gas used to produce it would come out to roughly 4.3 Bcf/d. Note that math (4.3 Bcf/d of natural gas used to make the hydrogen energy equivalent of 3 Bcf/d) uses the low-end of our previously stated 70%-80% efficiency range.

But don't ignore this paragraph:

All of which is to say that gas demand from the hydrogen industry is already a huge component of the existing energy balance within the U.S., a fact not lost on most natural gas analysts. Note also that the DOE estimates about 25% of that hydrogen is consumed in the ammonia industry, with most of the rest in the refining and petrochemical sector.

For what it’s worth, we could find no production data for the “green” methods of producing hydrogen, which we discuss next.

So, blue hydrogen: Remember from Part 1 of this series that hydrogen produced from natural gas via SMR is called “gray” hydrogen. If you combine CCUS with the SMR, your turn the hydrogen from gray to “blue”.

Quick! Who combines CCUS with CO2 EOR? Full circle. We're back to Denbury.

Some folks suggest Denbury is about the only operator of note involved with CO2 EOR and CCUS.

I think I've said enough.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.