Locator: 47978B.

RBN Energy: Pembina inks ethane supply deal with Dow's Alberta ethane cracker expansion. Archived.

From that article, the following pertains to the Bakken:

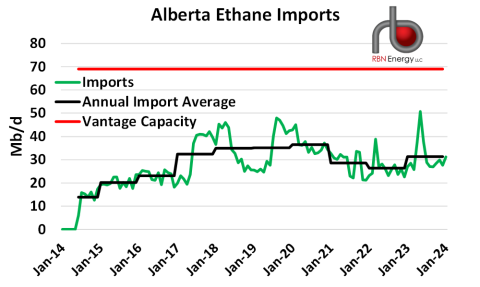

Pembina has said another important avenue for enhancing ethane supplies could involve increased utilization of its wholly owned Vantage Pipeline (blue lines in Figure 1) that imports ethane from a gathering point in Tioga, ND, in the heart of the Bakken, along with very small amounts that come from an ethane-extraction plant in Saskatchewan. Vantage’s capacity is pegged at 69 Mb/d (red line in Figure 4 below) and the AER’s data puts January 2024 and full-year 2023 ethane imports at 31 Mb/d (right end of green line and black line, respectively), although flows have reached as high as 51 Mb/d. With 2023 imports averaging 31 Mb/d, less than half of the pipeline’s capacity is typically being utilized and suggests that up to 38 Mb/d of additional supply could be sent to the Dow site via Vantage, or to supply Nova’s Joffre site, with a portion of existing Joffre-bound ethane supplies being diverted to Dow.

Figure 4. Alberta Ethane Imports. Source: AER

There is certainly some potential for more ethane to come from the Bakken. Back in August, ONEOK sanctioned a 100-Mb/d expansion of its existing 300-Mb/d Elk Creek NGLs Pipeline that will increase NGLs takeaway for Bakken gas producers and ship these volumes southeast to a market hub in Bushton, KS. ONEOK also owns a 30-Mb/d pipeline (the Tioga Lateral) that connects to Elk Creek and ties back to the Tioga connection with Pembina’s Vantage Pipeline. Although no specific expansion of this lateral has been announced, this could be an easy bolt-on for ONEOK, especially with the assurance that more ethane demand is soon to be on tap in Alberta. Our point here is that, with steadily rising amounts of associated gas production in the Bakken (i.e., gas that is rich in NGLs), producers will benefit from more NGLs takeaway capacity, and the Tioga connection to Vantage could form part of that solution, as well as Pembina’s in terms of tapping into more ethane imports.