Locator: 48452B.

Reagan Airport: two American Airlines a/c clip wings on taxiway.

I guess it could have been worse; it could have been mid-air. The NBC reporter said it wouldn't have been a big deal had it not been at a Washington, DC-area airport. That may be true for NBC News but absolutely not true for Amerian Airlines. All pilots involved will be drug-tested, examined, debriefed and taken off flight status pending an in-depth investigation. At least that's what one would expect. Their jobs could be in jeopardy.

Tariffs: NBC News echoing the Chinese party line. So far, I've not heard anything from Chinese billionaires. If Trump holds tariffs at current level, China could move Christmas toys through the EU and then on to the US. My hunch: it won't work based on the way Trump will frame the tariffs.

Manipulating the market: mentioned on the blog yesterday; now The NYT reports the story for the first time.

******************************

Back to the Bakken

WTI: $59.98.

New wells:

- Friday, April 11, 2025: 39 for the month, 39 for the quarter, 246 for the year,

- 41166, conf, CLR, Arley 5-18H,

- 40699, conf, Hess, EN-Kiesel-155-94-1918H-9,

- Thursday, April 10, 2025: 37 for the month, 37 for the quarter, 244 for the year,

- 40761, conf, Hunt Oil, Kandiyohi 159-90-6-18H-3,

- 40698, conf, Hess, EN-Kiesel-153-94-918H-8,

RBN Energy: E&Ps maintain stable investment, shareholder returns ahead of uncertain 2025.

As the clock approached midnight on December 31, E&P managements and shareholders likely clinked champagne flutes to celebrate a remarkable four years of prosperity for an industry that had been nearly shattered by two decades of periodic financial crisis. Soaring post-pandemic commodity prices and gold-plated balance sheets provided generous cash flows, enabling substantial shareholder payouts that restored investor support, but after a period of relative stability the outlook for the E&Ps we follow is uncertain. In today’s RBN blog, we’ll review the cash-allocation strategies used by U.S. oil and gas producers in 2024 and examine the factors that could dramatically impact the sector’s performance in 2025.

Let’s take a brief look at recent history. WTI oil prices cratered to under $20/bbl in early 2020 and averaged just $39.16/bbl for the year. That nearly doubled to $68/bbl in 2021 and rose another 50% to $95/bbl in 2023. Cash flow from operations (CFOA or cash flow) for the publicly traded E&Ps we cover rose from $36 billion in 2020 to $76 billion in 2021 and a record $127 billion in 2022. That allowed producers to institute unprecedented dividends and share buybacks, which rose from a combined $15 billion in 2021 to $45 billion in 2022. The average oil price retreated to $77.58/bbl in 2023 but cash flows of $101 billion supported a still historically strong $31 billion in share buybacks and dividends. The average dividend yield for the E&P sector in 2023 was 3.8%, just above the 3.7% paid by the utility sector, which was second highest, and nearly three times the average 1.3% yield for the S&P 500.

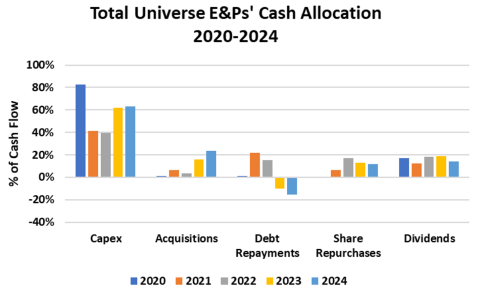

The average WTI oil price remained steady at $76.55/bbl in 2024. But the 37 E&Ps in our universe generated $105 billion in cash flow in 2024, 3% higher than in 2023, mainly due to acquisitions completed during the year. Total investment (including non-upstream capex) was $66.4 billion, 5% higher than 2023. This yielded a re-investment rate of 63% of CFOA in 2024 (blue bar in Capex grouping in Figure 1 below), just ahead of the 62% plowed back in 2023 (yellow bar). These two most recent years stand in stark contrast to 2021-22, when the reinvestment rate fell to circa 40% (orange and gray bars), and 2020, when 82% of CFOA (blue bar) was put back into oil and gas assets.

Figure 1. E&P Cash Allocation, 2020-24. Source: Oil & Gas Financial Analytics, LLC