Locator: 48442RMDS.

This post is for my edification and to share with my extended family. It is not meant for others and should not be read by others.

Disclaimer: I often make typographical and content errors. I often misread and misunderstand news stories. News stories may be subject to error and may be confusing for some readers, including me. Do not make any financial decisions based on what you read here or think you may have read here.

I don't think there is anything new here.

I don't think the rules are confusing, necessarily, it's just "hard" so articulate them in language that can be "easily" understood.

Three questions (and their answers) might be confusing to some:

- what if I inherited an IRA before 2020: the new rules don't apply;

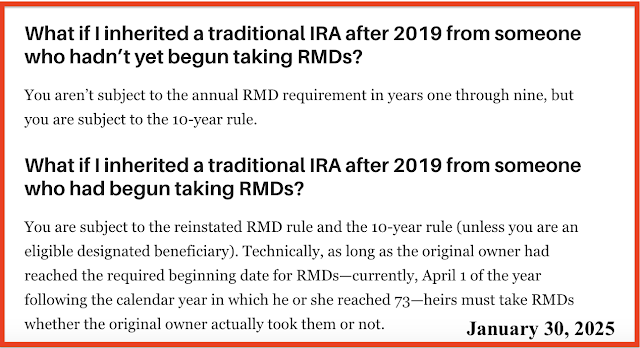

- what if I inherited a traditional IRA after 2019 from someone who had not yet started taking RMDs: annual withdrawals not required, but 10-year rule applies;

- what if I inherited a traditional IRA after 2019 from someone who had begun taking RMDs: annual RMDs are required using same rules as the original owner of the IRA, and the 10-year rule applies.

To help understand this, it makes sense to think about why Congress mandated these changes:

- with regard to a traditional IRA, Congress wanted these retirement accounts to be used as retirement accounts and not as never-ending vehicles for wealth accumulation.

These two paragraphs were NOT a bit confusing but I would be careful with two of the paragraphs --

As I understand it:

- for those who inherited a traditional IRA after 2019 from someone who had reached the age of requirement for taking RMDs --

- whether that individual had started taking RMDs or not -- beneficiaries are required to take annual RMDs per rules and are subject to the 10-year rule -- and again, that's how I interpret it and could be very wrong and/or could be misunderstood.

- RMDs for these folks is based on the age of the original owner of the traditional IRA

This is huge and I don't think folks are necessarily aware: inherited Roth IRAs are subject to the 10-year rule but not the annual RMD rule, years 1 - 9.