Updates

Later, 1:21 p.m. CT: absolutely amazing. I suggested to a reader that the $6 / gallon gasoline pictured in the original post was from west Hollywood and that prices were probably higher out in the far east desert near the Arizona state line.

It's generally higher out there simply because of the distance to transport gasoline and very few stations with huge traffic on the interstate with gas stations out there few and far between.

Right on cue, a reader sent this picture of one of those very, very busy service stations I used to visit on my cross country trips. It appears they've pulled the gasoline pumps and will be installing EV charging stations any day now. This is on the Arizona side of the state line. California requires warning signs regarding risk of cancer (Proposition 65).

Oil/gasoline:

- Brent: $71.11 / bbl

- WTI: $68.59 / bbl

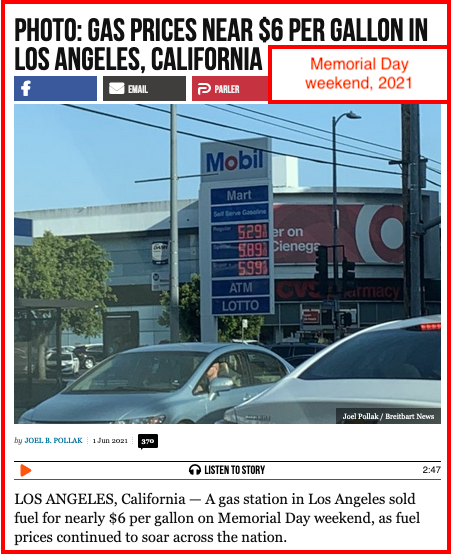

- Gasoline: $5.99 / gallon west Los Angeles

******************************************

Back to the Bakken

Active rigs:

| 6/1/2021 | 06/01/2020 | 06/01/2019 | 06/01/2018 | 06/01/2017 | |

|---|---|---|---|---|---|

| Active Rigs | 22 | 12 | 64 | 60 | 48 |

Wells coming off confidential list:

Monday, May 31, 2021: 38 for the month, 59 for the quarter, 140 for the year:

- None.

Sunday, May 30, 2021: 38 for the month, 59 for the quarter, 140 for the year:

- None.

- 36994, 2,433, MRO, Hull 41-28TFH, Chimney Butte, t12/20; cum 114K 3/21;

| Pool | Date | Days | BBLS Oil | Runs | BBLS Water | MCF Prod | MCF Sold | Vent/Flare |

|---|---|---|---|---|---|---|---|---|

| BAKKEN | 3-2021 | 31 | 18505 | 18604 | 19273 | 21960 | 20539 | 69 |

| BAKKEN | 2-2021 | 28 | 27982 | 27787 | 26725 | 26359 | 24394 | 0 |

| BAKKEN | 1-2021 | 31 | 33097 | 33109 | 38496 | 28771 | 26452 | 0 |

| BAKKEN | 12-2020 | 30 | 31852 | 31350 | 46717 | 27217 | 24982 | 0 |

RBN Energy: OPEC+ supply management faces tests as crude oil market recovers.

Much like the world at large, the crude oil market has been healing from the ravages of COVID-19. Overall, market conditions are far better than they were in April 2020, when global oil consumption, crushed by pandemic-related lockdowns, slumped to 80.4 MMb/d, a 17% decline from the start of last year and a 20% drop from April 2019. Demand has been rebounding in fits and starts for a full year now — recovering from downturns is what markets do. But this recovery has gotten a big assist: 10 members of the Organization of the Petroleum Exporting Countries (OPEC), acting in concert with 10 non-members, have restrained crude oil production in a program unprecedented in scale and duration. Now, oil prices are high enough to revive activity by some producers outside the so-called OPEC+ group. For at least the rest of this year, in fact, the market looks like a steel-cage match between crude supply subject to coordinated management and supply governed only by raw market signals. Today, we look at oil-market projections from three important agencies and estimate demand for oil not supplied by the OPEC+ exporters.