Locator: 48447B.

WTI: $57.15.

New wells:

Thursday, April 10, 2025: 37 for the month, 37 for the quarter, 244 for the year,

- 40761, conf, Hunt Oil, Kandiyohi 159-90-6-18H-3,

- 40698, conf, Hess, EN-Kiesel-153-94-918H-8,

- 40902, conf, CLR, Entzel 3-14H,

- 40153, conf, Hess, EN-Eneebreton-157-94-1003H-3,

- 40152, conf, Hess, EN-Engebretson-157-94-1003H-2,

- 39039, conf, Grayson Mill, Orville 4-9 3H,

RBN Energy: US-China trade war has potential to devastate propane, ethane markets. Archived.

China was slated to enact a 34% reciprocal tariff on all imports of U.S. goods on April 10, now that has escalated to 84%. Unlike its February retaliatory tariffs of 10%-15% on U.S. oil and LNG, this time NGLs and all energy products are included — with propane and ethane squarely in the crosshairs. The Trump administration added another 50% to its tariffs on China, and China has maintained that it will fight to the end. China's latest retaliation of 84% tariff on Chinese imports of U.S. goods has the potential to destroy the propane and ethane markets. In today’s RBN blog, we look at the potential impact of China’s reciprocal tariffs.

Like all of President Trump’s tariff wars, this front has been subject to rapid escalation. On February 1, he signed Executive Order 14195, imposing a 10% tariff on all Chinese imports, which took effect on February 4. That same day, China imposed a wide range of retaliatory tariffs against the U.S., including a 15% tariff on LNG and a 10% tariff on oil. At that point, there was no action on other energy products, so propane and ethane, along with other NGLs, were effectively exempt. But that was not the end of it. On March 4, the president increased the tariffs by another 10%. In retaliation, China announced a 15% tariff on U.S. goods. Then, as part of the “Liberation Day” proclamations of April 2, the U.S. tariff on Chinese goods was increased by another 34%, making the total tariff rate 54%. China followed with a retaliatory 34% tariff on all goods imported from the U.S., including oil, LNG, and all energy products.

The situation escalated on April 8, when President Trump formalized a further increase of 50% on imports of Chinese goods to the U.S., to go into effect April 9 if China did not rescind its most recent increase, pushing the total tariff rate to 104%. China has vowed not to back down. No additional tariffs had been announced at the time of posting the first version of this blog, but this morning (Wednesday) China raised its tariffs on U.S. goods to 84%, matching President Trump.

China imports very little crude oil from the U.S., and those volumes can easily be rerouted so that other countries replace U.S. barrels. China does not import much LNG or other energy products from the U.S. However, liquified petroleum gas, or LPG (propane and butane), plays a much larger role, ranking as the second-highest U.S. export to China by value.

As a result, the tariffs have the potential to be a major disruptive force in global NGL markets. The U.S. sends about 20% of its propane exports to China. Most of that is used in the production of propylene via propane dehydrogenation (PDH). A 34% tariff on U.S. propane would devastate PDH economics, likely forcing China to drastically cut imports of U.S. propane. That, in turn, would place serious downward pressure on U.S. propane prices. China would try to replace as much U.S. supply as possible, but doing so would require uneconomic cargo rerouting — only possible if U.S. propane prices drop significantly at the point of origin to remain competitive.

The outlook for ethane is even more dire — at least for China. Chinese petrochemical crackers that use ethane as a feedstock rely exclusively on U.S. volumes. If tariffs make U.S. ethane uneconomical, these facilities will face two choices: absorb the cost or shut down. If shutdowns occur, the U.S. won’t be able to export those ethane volumes and will have to reject the surplus molecules into the natural gas stream. Almost 50% of U.S. ethane exports go to China, all used in ethylene production. The U.S. is China’s only possible source of ethane imports as it is the only country exporting ethane in large carriers.

With that background out of the way, let’s look a little closer at the impacts on LPG and ethane.

LPG – Propane and Butane

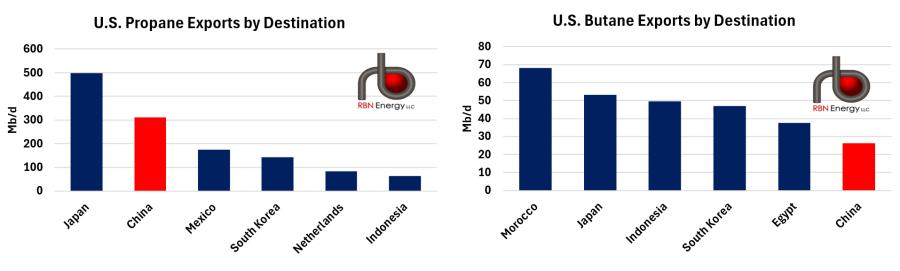

China was the second-largest importer of U.S. propane in 2024 at 311 Mb/d (red bar in left graph in Figure 1 below). The amount of butane in 2024 was much smaller at 26 Mb/d, or 5% of total U.S. exports, making China the sixth-largest importer of U.S. butane (red bar in right graph). Total U.S. exports of LPG to China were 337 Mb/d.

Figure 1. U.S. Propane and Butane Exports by Destination. Source: EIA