RBN Energy: What's with all the DUCs?

The latest Drilling Productivity Report from the EIA, released yesterday (February 13, 2017), shows that while the combined rig count in the seven major U.S. shale plays rose about 25% in the fourth quarter of 2016 versus the previous quarter, and the number of wells drilled was up 29%, well completions were up a paltry 1%, leading to an increase in the inventory of drilled-but-uncompleted wells (DUCs).

Completions accelerated a bit in January 2017, but DUCs still continued to rise. That certainly seems counterintuitive. With crude oil prices stable in the low $50’s over the past few months you might think that producers would be pulling DUCs out of inventory, and in fact there have been statements to that effect in several producer investor calls. This is not just an exercise in energy fundamentals numerology. If the DUC inventory is increasing, then production will not be ramping up as fast as the growing rig count would imply.

So, what's the status of DUCs now?But what if, as some early signs indicate, the historical relationships are out of whack and the DUC inventory isn’t growing but rather declining? In that case, forecast models could be understating the outlook for production growth, and the market could be in for a more rapid and steeper rebound in oil and gas production than many expect. In today’s blog, we delve into the DUC inventory data and its potential upside risk to production forecasts.

Understanding the DUC inventory trend is critical to forecasting production because it reflects the ability of producers to respond in relatively short order to market fundamentals such as price and demand without a single rig addition.

At any given time, there is always a substantial base inventory of DUCs in the market due to the normal delay between drilling and completion activities.

But increases or decreases in the DUC inventory can speed or slow the rate of production growth (or decline) in the short- or mid-term. When crude oil prices crashed in 2014 through early 2016, we saw an increase in DUCs as producers continued to drill, but deferred completing wells due to economics, contractual commitments and other factors. It was generally expected that as prices increased, many producers would start competing those previously drilled wells (i.e., taking DUCs out of inventory) to start generating cash from their drilling investment.

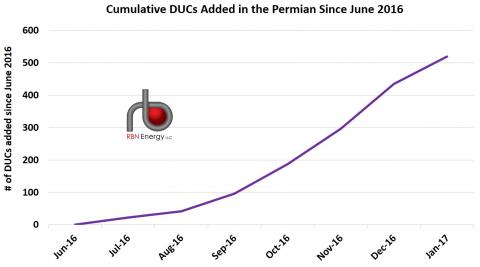

But as shown in Figure 1, (according to EIA’s DUC inventory and Drilling Productivity Report data) that was not the case, particularly in the most prolific of plays – the Permian.

Since June 2016, more than 500 DUCs have been added to inventory, far out of proportion to the increase in the total Permian rig count.

Figure 1; Source: EIA Drilling Productivity Report

Other data points:

- the growth in DUCs is accounted for almost entirely in the Permian

- of the 92 DUCs added last month, 84 were in the Permian

RBN Energy notes that official data is about two months old; the EIA has to "model" data based on historical relationships between rig counts to drilled and completed wells -- but those relationships are constantly in flux, says RBN Energy, "and even more so in the past few months as prices jumped and producer activity rapidly accelerated."RBN noted an interesting phenomenon in late 2016: an increase in delineation wells away from the "sweet spots." This obviously was happening more in the Permian, and not so muchin the Bakken.

RBN suggests that:

- while the EIA is projecting an increase in the number of DUCs,

- in fact, perhaps producers are working off their inventory of DUCs

Bottom line: US shale production is likely to see a significant jump in late 2017.

Perhaps OPEC realizes that also: the "cartel" has suggested that production cuts will have to be extended into 2H17.