Locator: 48541B.

Gabbard confirmation! Wow, that was fast. Reported at 12:18 p.m. CT, February 12, 2025. Yesterday, it was reported the vote would be held this evening. The RFK, Jr., nomination moves forward. Only Mitch McConnell broke ranks with the GOP. JD Vance not even in town to provide the tie-breaking vote if needed. That's how sure John Thune was about the vote.

Cbevron to slash employee count! Wow.

Doing less with less. Link here. I don't think I've heard of a 20%-cut -- ever. Something tells me the Hess deal isn't going to close. Could be wrong. Chevron has 45,600 employees. Does this give Chevron an opening to leave California completely? Maybe the Hess deal is working out perfectly and Chevron no longer needs California. LOL!

*************************************

Back to the Bakken

WTI: $72.03.

New wells:

- Thursday, February 13, 2025: 22 for the month, 67 for the quarter, 67 for the year,

- 40843, conf, CLR, Catron 3-26H,

- 40398, conf, Grayson Mill, Alfred North 17-15 3H,

- 39842, conf, CLR, Harms West Federal 7-32H1,

- Wednesday, February 12, 2025: 19 for the month, 65 for the quarter, 65 for the year,

- 40852, conf, CLR, Taney 3-23H,

- 39956, conf, Hess, EN-Heinle-LE-156-94-2536H-1,

- 39952, conf, Hess, EN-Heinle-156-94-2536H-5,

- 39843, conf, CLR, Harms West Federal 8-32H,

RBN Energy: Guyana may have a head start, but Suriname making strides with its offshore blocks. Archived.

Suriname has been a very minor crude oil producer over the past few decades, with minimal output from its onshore reserves. But with more than a dozen offshore blocks already awarded for development and production set to spike in the coming years, the small South American nation looks primed to follow in the footsteps of its next-door neighbor, Guyana, which is amid an oil-production boom. In today’s RBN blog, we’ll look at the status of Suriname’s offshore developments, the major players involved, and what we know about the crude grades to be produced there.

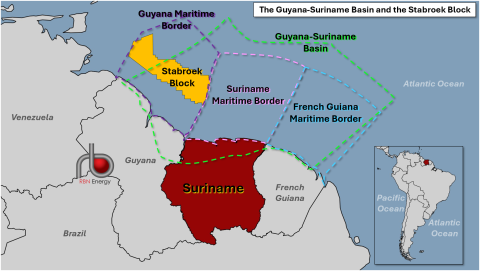

In the first blog in this mini-series, Wouldn’t It Be Nice, we highlighted how Guyana has been a rising star (see Break My Stride and My Guy) in the global crude market, even if it’s only a recent entrant. The offshore Stabroek block (gold-shaded area in Figure 1 below) is churning out more than 650 Mb/d of oil from three projects in the reserve-rich Guyana-Suriname Basin (area within dashed-green line), with the possibility that production in Guyana’s territorial waters (area within dashed-purple line) could double by the end of 2027. But Guyana isn’t the only country planning to develop the basin’s reserves.

Figure 1. The Guyana-Suriname Basin and the Stabroek Block. Source: RBN

Note: Map does not reflect disputed onshore border areasThe Guyana-Suriname Basin stretches across three countries on the Atlantic coast of South America: Guyana, Suriname and French Guiana. Suriname has been extracting crude oil from the onshore portion of the basin since the 1980s but the former Dutch colony wants to raise its profile as a petroleum supplier, mirroring its neighbor’s success. According to Suriname’s state-owned Staatsolie, authorities struck oil in 1965 but commercial oil production only began 17 years later, in 1982. Flows of the country’s Saramacca grade started at 200 b/d and now stand at about 20 Mb/d.

Offshore E&P activity in Suriname perked up after ExxonMobil made a significant find in 2015 in Guyana’s portion of the Guyana-Suriname Basin. Five years later, joint-venture partners TotalEnergies and APA Corp. (owner of Apache Corp.) made an extensive deepwater discovery in Suriname’s territorial waters (area within dashed-pink line of Figure 1). That same year (2020), Staatsolie created a subsidiary, Staatsolie Hydrocarbon Institute (SHI), to steer coastal E&P activities like setting up policies and procedures for acreage development, negotiating with oil and gas companies to unearth deposits, evaluating resource potential, and getting independent evaluations of hydrocarbon potential.