I don't know when I first saw it coming. Certainly it was by 2016. But OPEC is in deep doo-doo and the House of Saud is in extremis.

Data points:

- 3Q20:

- Saudi Aramco's net profit slightly less than $12 billion;

- net profit down almost 45% y/y;

- free cash flow: $12.4 billion

- forced to pay a dividend of almost $20 billion for the quarter

- first nine months of the calendar year:

- net profit down almost 50%;

- net profit down to $35 billion;

- average production: 9.2 million bpd;

- most interesting:

- the $75 billion dividend paid by Saudi Aramco will not be able to cover Saudi's budget deficit;

- the House of Saud won't be able to plug its deficit with the Aramco dividend as it did last year;

- tea leaves:

- Aramco's earnings could take a bigger hit before the year is out (exhibit A: OPEC basket today plunges below WTI);

- Aramco:

- its own budget commitments;

- must meet requirements to buy petrochemicals giant SABIC

- future? prices are too weak for OPEC to relax production cuts by another two million bopd next January

- could it get worse? Yup. A Biden presidency.

- the Biden wing supports Iran

- sanctions on Iran will be lifted on humanitarian grounds

- huge hit for Saudi Arabia when Iran gets back into the market

Aramco reported a net profit of $11.8 billion for the third quarter of 2020, down by 44.6 percent on the year as low oil prices continued to bite into its financial performance.

The company also said it had free cash flow of $12.4 billion at the end of the three-month period and declared a dividend of $18.75 billion for the quarter.

For the first nine months of the year, the hit from low oil prices and depressed demand was stronger. Net profit was down by close to 49 percent to $35.015 billion.

In oil production, the Saudi major reported an average daily of 9.2 million bpd for the first nine months of the year as it continued capping output in compliance with the OPEC+ agreement.

Earlier this year, Aramco declared an annual dividend of $75 billion. That amount, however, will not be sufficient to cover the Saudi budget deficit, Moody’s said in a report last month. Now, with oil prices still low and likely to go lower still if the surge in Covid-19 cases continues in Europe and the United States, Aramco’s earnings will take a bigger hit.

This means that the government in Riyadh will not be able to plug the budget hole with the Aramco dividend as it has done previously.

“The government is unlikely to be able to repeat the maneuver beyond 2021,” Moody’s said in the report. Aramco will have its own capital expenditure needs and its commitment to buy petrochemicals giant SABIC to look after, according to the ratings agency.

US crude oil imports from Saudi Arabia: huge plunge, not since the 1980s have we seen numbers this low.

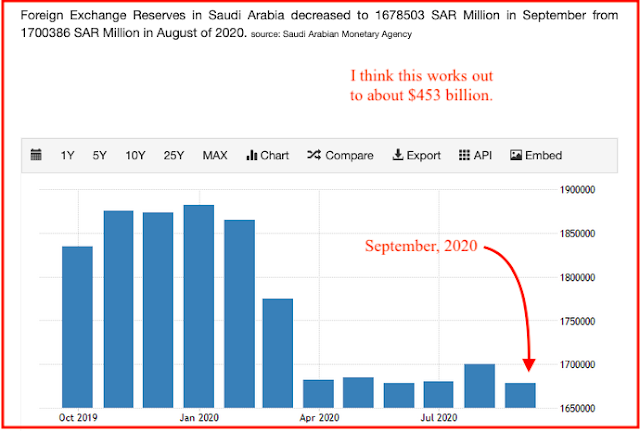

From the "milliondollarway" archives:

This might be good time to re-read this interesting story in Foreign Policy, May 5, 2020; still not behind a paywall; the writer of that article: Jason Bordoff, a former senior director on the staff of the US National Security Council and special assistant to President Barack Obama ... I first linked this article in September, 2020. It will be interesting to see how this plays out.