Locator: 47115B.

WTI: $80.75. Getting to look more and more like folks thinking low demand, possibly "recession." But, wow, that would be quite a reversal. Or, perhaps more likely, threat of a Fed rate increase to simply slow the economy.

Thursday, May 2, 2024: 4 for the month; 68 for the quarter, 267 for the year

40177, conf, Five States Operating, RH 1-16H,

39582, conf, Hess, CA-Anderson Smith-LW-155-96-2634H-1,

40120, conf, Slawson, Teapot Federal 6-15-14TFH,

39526, conf, Kraken, Alamo 3-34-27 3H,

RBN Energy: US gulf coast refiners face challenges to accessing heavier crude oil. Archived.

The prospect of decreased crude oil supplies from Mexico, the top international supplier to the U.S. Gulf Coast (USGC), is creating uncertainty among heavy crude-focused refineries. Mexico’s state-owned energy company, Petróleos Mexicanos (Pemex), instructed its trading unit to cancel up to 436 Mb/d of crude exports for April to supposedly focus on processing domestic oil at its new 340-Mb/d Dos Bocas refinery and/or its existing plants. While the refinery’s startup is likely not nearly as imminent as Pemex says, the cancellation of Mexican crude imports could be problematic for U.S. refiners with plants built to run heavy crude, a necessary ingredient to optimize operations and yields. Adding to the complexity of the situation is the upcoming startup of the Trans Mountain Pipeline expansion (TMX) and the recent reinstatement of U.S. sanctions on Venezuelan crude. In today’s RBN blog, we’ll examine the potential fallout resulting from Pemex’s decision at a time when heavy crudes elsewhere are also becoming less available.

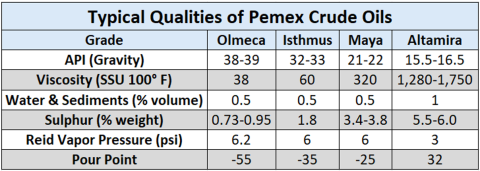

See Figure 1 below for more details around quality for these types of crude grades. (As we noted in The Weight, crude with a higher API gravity is lighter, or less dense, while oil with a lower API gravity is heavier, or denser.)

Figure 1. Typical Qualities of Pemex Crude Oils. Source: Pemex