************************************

Weekly EIA Petroleum Report

- US crude oil in storage decreased by a fairly significant 4.6 million bbls from the previous week.

- US crude oil in storage now stands at 413.3 million bbls, about 8% below the five-year average.

- US crude oil imports average 6.1 million bbls per day, up by 185,000 bpd from previous week; the four-week average is 6.2 million bbls, 10.7% more than same four-week period last year.

- refiners are operating at a operational capacity lower than last week; now operating at 88.4% and yet gasoline inventories increased by a whopping 8.0 million bbls -- who saw this coming?

- gasoline inventories are 3% below the five-year average.

- distillates fuel increased by 2.5 million bbls; supplies now 15% below five-year average;

- propane decreased by 3.4 million bbls; now 6% below five-year average

- jet fuel supplied was up 27.7% compared with same period last year;

*******************************

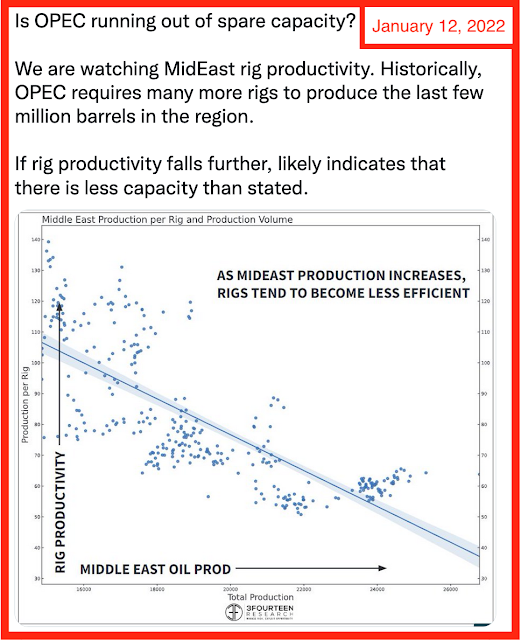

OPEC Spare Capacity? There Ain't None

Link here. Be sure to read the comments at this social link. A 2022 major theme.

****************************

Jim Cramer Flashback: I'm So Done With Fossil Fuels

Link here. Almost exactly two years ago -- January 21, 2020.

****************************

Michael Fitzsimmons Today: COP Closing In On 7-Year All-Time High

- A rising tide lifts all boats and ConocoPhillips has ridden the current wave of relatively oil prices to close-in on a potential new all-time closing high.

- Despite the biggest bull market of our lives, this would be the first all-time high for COP since June of 2014: more than 7 years ago.

- In addition to the relatively high price of oil, COP currently has multiple other very positive near-term catalysts working in its favor.

- One of those positive catalysts is the company's first variable dividend payout. That will occur this Friday, January 13th.

From the linked article:

It took ~7.5 years - during the biggest bull market of our lives - but ConocoPhillips (COP) is finally closing in on its previous all-time closing high of $85.73 set way back in June of 2014 (see graphic below). Of course much of this has to do with the on-going rally in the price of oil, but there are a few other positive catalysts in Conoco's favor as well: a recently announced variable dividend policy (the first being a $0.20/share distribution that will payout this Friday), recent strength in the price of Cenovus (CVE) stock (which COP still owns a very large stake in), and the fact that COP is on track to receive significant contingency payments from Cenovus because those payments are based on the currently high price of Western Canadian Select ("WCS") crude. I'll discuss all of these factors in the article below.

The dividend:

Note COP's variable dividend payments will be staggered relative to the ordinary dividend payout. The first VROC of $0.20 per share will be paid on Jan. 14, 2022 (this Friday) while the ordinary dividend is typically paid out around March 1. That sets up COP shareholders for the potential for 8 annual dividend payments per year.

Currently, COP's ordinary quarterly dividend is $0.46/share, which was only a 3-cent increase over the prior year (7%) despite the big rally in the price of crude and natural gas and - as I have repeatedly reported - COP's ability to generate massive free-cash-flow. The current ordinary dividend equates to $1.84/share annually for a 2.2% yield.

However, all things being equal COP should - at a bare minimum - easily be able to payout four VROC quarterly payments of at least $0.20/share. That would push the total estimated dividends for 2022 up to $2.64/share, or a 3.2% yield. Still nothing to crow about, but certainly better than the meager dividends COP shareholders have been receiving since the quarterly dividend was slashed from $0.74/share to $0.25/share back in 2015. Indeed, after 7 years, COP shareholders have yet to get back to that level of income.

Holy mackerel. There is so much at this article. This is quite interesting because the last time Fitzsimmons wrote about COP he was madder than heck that COP cut its dividend. But most of us knew what was going on; not sure how Mike missed it the last time.

**************************

EPD

Motley Fool link here.

Posted previously; another link: EPD enters the Permian in a huge fashion.

Enterprise Products announced its acquisition of Navitas Midstream Partners Monday for $3.25 billion, purchasing about 1,750 miles of pipelines and up to a billion cubic feet per day of natural gas processing capacity in the Midland sub-Basin on the eastern side of the Permian in Texas.

The added capacity included completion of the Leiker Plant, expected in early 2022, with an expected capacity of 240 million cubic feet per day.

In buying Navitas’ assets, Enterprise hoped to enter the prolific Permian Basin, one of the U.S.’ most active oil and gas fields. The Midland Basin, per an Enterprise news release, represents about 20 percent of U.S. onshore drilling.

Enterprise is already active in the Delaware Basin on the western side of the Permian, operating multiple facilities in southeast New Mexico and West Texas.