I have a ton of stories but not in the mood at the moment to post.

It's national donut day and I'm trying to figure out where to get my donut. Target is closest but lousy selection and most expensive. Albertson's is best but a three-minute bike ride. Do I really want to go that far for one donut?

On top of that, I have a full three-day weekend. The three granddaughters are in Houston for the weekend to watch Olivia play in the state's #1 soccer tournament. Actually, I don't know if it's the #1 tournament, but it's a biggie and this will be her first tournament with her new club team. Long story.

So, to get started, just a bit of "back to the Bakken" and then we'll see what happens next.

*************************

Back to the Bakken

WTI: $117.

Active rigs: 40 or thereabouts.

Friday, June 3, 2022: 4 for the month, 141 for the quarter, 301 for the year

- 37553, conf, Whiting, Lacey 13-10-2H, Sanish, initial production:

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 4-2022 | 18280 | 16042 |

| 3-2022 | 27120 | 22542 |

| 2-2022 | 26629 | 18346 |

| 1-2022 | 31269 | 21986 |

| 12-2021 | 13073 | 5739 |

RBN Energy: long-term deals propel new LNG development toward FID.

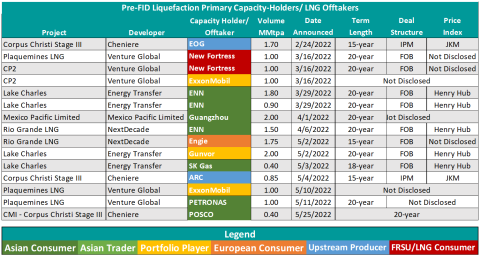

The momentum for North American LNG right now is incredible. With Europe’s efforts to wean itself off Russian natural gas supplies boosting long-term LNG demand in the continent and Asian demand expected to grow even further, there has been a strong push for new LNG projects in the U.S., Mexico and Canada, with enough commercial support and capital present to advance at least some of them to construction and operation. Venture Global on May 25 reached a final investment decision on Phase 1 of Plaquemines LNG, the first North American project to take FID since Energía Costa Azul LNG in 2020. But it’s unlikely to be the last. Cheniere’s Corpus Christi Stage III is likely to follow in the coming months and support is coalescing around a handful of other projects too. So far this year, more than 20 MMtpa of long-term, binding commitments tied to new North American LNG capacity have been signed, propelling a new wave of LNG projects towards FID. In today’s RBN blog, we take a look at the trends in the recent commercial commitments.

Surprisingly, perhaps, given all the talk about Europe’s gas crisis, the majority of the new SPAs announced in recent months — in volumes and number of deals — have been with Asian offtakers. Asia is still expected to be the primary growth market for new gas demand in the long-term and now, with trade-war tensions from the Trump administration seemingly over, Chinese buyers again are making deals for U.S. LNG. For example, Chinese utility ENN made deals with both NextDecade and Energy Transfer, the latter for its long-stalled Lake Charles project, which came back to life when the ENN SPAs were signed in March.

Figure 2. Pre-FID LNG Offtake Agreements Signed in 2022. Source: RBN LNG Voyager

Commercial momentum is showing no signs of slowing down — new SPAs are seemingly announced every week. European offtakers will likely come to the negotiating table again as more certainty builds around the continent’s long-term gas strategy. In the meantime, Asian offtakers are looking to shore up their own supplies, as demand growth in Asia is still expected to be a primary driver of the long-term need for more LNG export capacity.