Locator: 48489B.

Victor Davis Hanson: link here. Must-watch.

Southern surge, 12 million, done intentionally. I've maintained the same thing for quite some time. Comments on Trump's "SOTU" speech. Longest on record. Much of it was long due to interruptions; Al Green escorted out. ActBlue -- a Democratic Party PAC. Comment: best thing the Democratic Party ever did for the nation: allow 12 million into the US in one huge initiative. "Long term process .... it could take up to a year." LOL. That's the US -- a "long term process" means it could take up to a year. The Chinese: a "long term process"? Thirty years. Maybe longer. Canadian GDP per capita is lower than Mississippi -- the state with the lowest GDP per capita.

Quickies:

- beer: Texas brewery: top brand selling six-packs for $5.99 through March 23; limit four packs;

- I'll be stopping by later today to "thank them" for their effort to fight inflation, one six-pack at a time

- tallow: memo to self, google mcdonalds fries seitch tallow to oil

- RFK, Jr: endorses Steak 'n Shake

- coal: it's coming back; link here.

- natural gas: drill, baby, drill -- link here.

- Ukraine: tea leaves suggest ceasefire within the month; Macron gets involved

- Saudi cash crunch: back to the future; link here. But much, much more. Stand-alone post coming later.

- Oracle: raises dividend 25%; tell me again the world is coming apart, and we're heading into a recession;

- tariffs, Canada: tea leaves suggest even Canadian tariffs are waning; the art of the deal

- Panama: the art of the deal; Trump bypassing California to get natural gas to China. Link here.

- Big Pharma, renewable energy: senators, RFK, Jr.,: the hypocrisy! I'm shocked, shocked, I say. Link here.

- Brigham - Haynesville: link here.

- FEMA.

- Woke-ism, DEI, BLM: dead.

- equity market: prepare for a short squeeze

- personal investing: as mentioned last week, I continue to invest in equities at fastest pace ever. See disclaimer.

Shake ' Steak: good for them! Note who isn't reporting this story --

McDonald's: let's see how its CEO reacts -- this will speak volumes about MCD's CEO --

*******************************

Back to the Bakken

WTI: $66.68.

New wells:

- Wednesday, March 12, 2025: 33 for the month, 149 for the quarter, 149 for the year,

- 41104, conf, Medora Minerals, LLC, Davis Creek 2-28H,

- 40780, conf, Oasis, Barnes Federal 5202 43-11 4B,

- Tuesday, March 11, 2025: 31 for the month, 147 for the quarter, 147 for the year,

- 40446, conf, Grayson Mill, Alfred South 20-22-5H,

- 39951, conf, Hess, EN-Wefald-156-24-2413H-4,

RBN Energy: its offshore wind plans thwarted, New England wonders what to do next. Archived. Simply put: New England bet on the wrong horse.

New England is determined to shift toward a greener electric grid, but the region’s plan to slash its current reliance on natural gas (and backup fuel oil — and sometimes coal) by ramping up offshore wind and solar (and backup batteries) has hit a seemingly immovable object. President Trump, a staunch opponent of offshore wind, on Day 1 of his second administration ordered a halt to new leases and permits and directed his Interior Secretary to review existing permits. As we’ll discuss in today’s RBN blog, those moves have left New England power planners scratching their heads, and may even resurrect the possibility of expanding natural gas pipeline capacity into the region.

New England’s energy path the past few decades has been as twisty-turny as a gravel road through the Green Mountains of deepest, darkest Vermont. First the rallying cry was “No nukes!” — from the early 1990s through the late 2010s, six of the region’s eight nuclear plants were shut down. Then it was “No fossil fuels!” Sign-wielding protesters in the proudly progressive region blocked most — but not all — energy-industry efforts to enable more natural gas to be piped in from the nearby Marcellus Shale to fuel new gas-fired power plants (and allow older, dirtier coal- and oil-fired units to be retired). “More renewables!” has been a long-standing call to action too. Scores of new solar farms and a handful of wind farms (almost all of them onshore) have been developed, and plans made for a slew of large, offshore wind farms that many thought would make New England a sort of “Denmark-in-the-States.”

New England’s energy reality today is an electric grid that functions very well most of the time, primarily dependent on a mix of gas-fired power, nukes, solar, wind and hydroelectricity (some within the region and some imported from Quebec), solar and onshore wind — plus a heavy dose of energy efficiency that reflects the region’s deeply ingrained frugality. But for at least a few days each winter — and sometimes a couple of weeks — grid operators at ISO New England (ISO-NE) are on tenterhooks when the temperatures turn frigid, the snow piles up, the winds howl and most of the natural gas flowing into the region is used for space heating, leaving many gas-fired power plants with only a fraction of the gas they would need to run flat-out. That’s led to the now-widespread stockpiling of backup fuel oil (at dual-fuel plants) or LNG (at gas-only plants) that operators can turn to when pipeline gas is in short supply.

No fewer than six questions need to be answered:

- How has New England’s power-generation mix evolved over the past 25 years?

- What is the region’s generation mix today?

- What goals have the states set for decarbonizing the power sector?

- What is the plan for meeting those goals?

- How will President Trump’s adamant stance against offshore wind — and for fossil fuels and deregulation — impact that plan?

- How will grid operators maintain system reliability under this new reality?

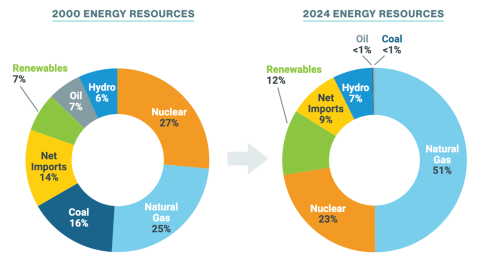

We’ll cut to the chase on each of these. As shown in Figure 1 below, gas-fired plants (light-blue slices) generated 25% of New England’s power needs in 2000 and just over half (51%) in 2024 as a slew of coal-fired (dark-blue slices) and oil-fired (gray slices) generation was either retired or relegated to emergency-only use. Also, several nuclear plants — including Vermont Yankee (in 2013) and Pilgrim (in Massachusetts, in 2019) — were permanently removed from service, leaving only Millstone (in Connecticut) and Seabrook (in New Hampshire) running, and trimming nuclear’s contribution to regional generation (orange slices) to 23%.

New England’s Power Generation Mix, 2000 vs. 2024

Figure 1. New England’s Power Generation Mix, 2000 vs. 2024. Source: ISO New England

**********************************

Disclaimer

Brief

Reminder

Briefly:

- I am

inappropriately exuberant about the Bakken and I am often well out front

of my headlights. I am often appropriately accused of hyperbole when it

comes to the Bakken.

- I am inappropriately exuberant about the US economy and the US market.

- I am also inappropriately exuberant about all things Apple.

- See disclaimer. This is not an investment site.

- Disclaimer:

this is not an investment site. Do not make any investment, financial,

job, career, travel, or relationship decisions based on what you read

here or think you may have read here. All my posts are done quickly:

there will be content and typographical errors. If something appears wrong, it probably is. Feel free to fact check everything.

- If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

- Reminder: I am inappropriately exuberant about the Bakken, US economy, and the US market.

- I am also inappropriately exuberant about all things Apple.

- And now, Nvidia, also. I am also inappropriately exuberant about all things Nvidia. Nvidia is a metonym for AI and/or the sixth industrial revolution.

- I've now added Broadcom to the disclaimer. I am also inappropriately exuberant about all things Broadcom.

- Longer version here.