Locator: 48409NG.

RBN Energy: are you kidding me! Is the Permian Basin already out of natural gas takeaway capacity? Archived.

After a record run of negative pricing last spring and summer, the Permian Basin collectively cheered as WhiteWater’s Matterhorn Express pipeline began flowing last October, bringing much-needed takeaway capacity to the area. Cash prices at the Waha Hub rebounded and the basin had a relatively uneventful winter, but prices began dropping in early March and have once again traded below zero for most of the past two weeks. This has taken the market somewhat by surprise, as many expected the impact of Matterhorn’s startup to last more than a few months. In today’s RBN blog, we’ll look at what’s driving the recent run of negative pricing in the Permian Basin and what it means until additional infrastructure comes online next year.

Permian gas supply has exploded, growing by 11.5 Bcf/d since the beginning of 2019. But as the prolific basin has expanded, it has outgrown the area’s natural gas infrastructure. Producers in the basin, unlike in most other supply areas, are willing to tolerate extremely low and even negative gas prices. Why? Because that’s not how they make money. The Permian is associated gas production, so as long as the oil price is favorable, the gas will keep coming, regardless of how low cash prices go. And it’s important to note that most of the big producers have firm capacity out of the Permian, so they are not exposed to negative prices. It’s mostly the smaller producers that feel the pain.

Before getting into the details, we need to point out that this analysis is based on RBN’s new Arrow Model product, which is now available for our subscription customers. The model (1) aggregates gas production, demand and net outflows or inflows for each market hub over time; (2) quantifies the degree to which gas is pushed/pulled between and among hubs, again over time; (3) anticipates gas flows on each corridor (and the need for incremental pipeline capacity); and (4) forecasts the basis differentials that underlie and support the aforementioned flows of gas. For more information, click here.

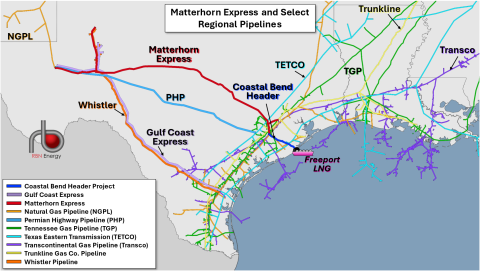

Now back to our analysis. Because of its location in West Texas and New Mexico, there is very little local demand within the Permian itself, so nearly all the gas produced must be piped elsewhere. Pipelines take the gas in four basic directions: west toward California, north to the Midcontinent, south to Mexico, and east toward the Gulf Coast and South Texas markets. Outflows east began with legacy capacity on a number of Texas intrastate pipelines, but this route has become increasingly popular due to exploding feedgas demand from LNG export terminals along the Gulf Coast. Since 2019, four new greenfield pipelines have come online to move gas out of the Waha area in this direction. Gulf Coast Express (lavender line in Figure 1 below) and Whistler Pipeline (dark-orange line) take a combined 4.5 Bcf/d to the Agua Dulce area, and Permian Highway Pipeline (PHP; medium-blue line) and the newest addition, Matterhorn Express (red line), target the Katy area near Houston. Permian Highway has a capacity of 2.5 Bcf/d thanks to a compression expansion on the pipeline in 2023. Matterhorn has or will have a capacity of 2.5 Bcf/d, but whether all of that capacity is online and available is one of the biggest questions lingering as the market grapples with this latest run of negative Waha prices.

Figure 1. Matterhorn Express and Select Regional Pipelines. Source: RBN