Locator: 47985B.

Wednesday, May 29, 2024

Updating The WPX Omaha Woman Wells, Phaelens Butte

Locator: 47984WPX.

The wells of interest:

- 36864, drl/A-->F/A, WPX, Omaha Woman 24-13-12HD, Phaelens Butte/Squaw Creek, t10/20; cum 65K in 29 days; cum 305K 5/21; cum 500K 3/24; still F;

- 36820, drl/A-->F/A, WPX, Omaha Woman 24-13-12HC, Phaelens Butte/Squaw Creek, t10/20; cum 82K over 28 days; cum 354K 5/21; cum 563K 3/24; still F;

The maps:

The wells:

- to the south, running north, three section, extended long laterals:

- 36819, AL/A, WPX, Omaha Woman 24-13-12HY, Phaelens Butte, t9/20; cum 503K 3/24;

- 36820, drl/A-->F/A, WPX, Omaha Woman 24-13-12HC, Phaelens Butte/Squaw Creek, t10/20; cum 82K over 28 days; cum 354K 5/21; cum 563K 3/24; still F;

- 36864, drl/A-->F/A, WPX, Omaha Woman 24-13-12HD, Phaelens Butte/Squaw Creek, t10/20; cum 65K in 29 days; cum 305K 5/21; cum 500K 3/24; still F;

- 36821, F/A, WPX, Omaha Woman 24-13-12HZ, Phaelens Butte/Squaw Creek, t10/20; cum 564K 3/24; still F;

- 37309, F/A, WPX, Omaha Woman 24-13-12HIL, Phaelens Butte/Squaw Creek, t10/20; cum 726K 3/24; still F;

- to the north, running south, three sections, extended long laterals:

- 37328, AL/A, WPX, Nokota 24-13-12HQ, Phaelens Butte, t10/20; cum 406K 3/23;

- 37133, AL/A, WPX, Nokota 24-13-12HA, Phaelens Butte, t10/20; cum 491K 3/23;

- 37134, F/A, WPX, Nokota 24-13-12HB, Phaelens Butte, t10/20; cum 652K 3/23; still F;

- 37135, F/A, WPX, Nokota 24-13-12HX, Phaelens Butte, t10/20; cum 531K 3/23; still F;

Initial production:

- 37135:

| BAKKEN | 8-2021 | 31 | 19457 | 19439 | 22837 | 58196 | 58033 | 0 |

| BAKKEN | 7-2021 | 31 | 12801 | 12826 | 15195 | 24056 | 23936 | 0 |

| BAKKEN | 6-2021 | 30 | 22794 | 22662 | 25459 | 44288 | 33908 | 7784 |

| BAKKEN | 5-2021 | 20 | 15993 | 16142 | 17837 | 31075 | 25709 | 3555 |

| BAKKEN | 4-2021 | 30 | 27115 | 27005 | 28704 | 42463 | 39409 | 0 |

| BAKKEN | 3-2021 | 31 | 26596 | 26665 | 27747 | 36543 | 28096 | 5442 |

| BAKKEN | 2-2021 | 28 | 27175 | 27077 | 29275 | 37338 | 26647 | 7646 |

| BAKKEN | 1-2021 | 29 | 32158 | 32156 | 34355 | 44186 | 28486 | 12111 |

| BAKKEN | 12-2020 | 31 | 45703 | 45616 | 46583 | 62797 | 40034 | 17710 |

| BAKKEN | 11-2020 | 30 | 68773 | 69001 | 74085 | 94493 | 41935 | 45043 |

| BAKKEN | 10-2020 | 13 | 59212 | 58831 | 48316 | 81357 | 36455 | 38501 |

- 37134:

| BAKKEN | 7-2021 | 31 | 13182 | 13185 | 11789 | 36622 | 36496 | 0 |

| BAKKEN | 6-2021 | 30 | 22109 | 22136 | 17568 | 52375 | 41828 | 8032 |

| BAKKEN | 5-2021 | 31 | 26142 | 26211 | 20108 | 61929 | 44087 | 14883 |

| BAKKEN | 4-2021 | 30 | 31921 | 31893 | 22168 | 53189 | 49621 | 0 |

| BAKKEN | 3-2021 | 31 | 41412 | 41373 | 26830 | 54582 | 49894 | 97 |

| BAKKEN | 2-2021 | 24 | 30537 | 30454 | 20670 | 40248 | 32166 | 4696 |

| BAKKEN | 1-2021 | 29 | 39777 | 39846 | 31805 | 52426 | 35692 | 12333 |

| BAKKEN | 12-2020 | 31 | 70137 | 69948 | 48429 | 92442 | 65453 | 19322 |

| BAKKEN | 11-2020 | 30 | 80474 | 80740 | 58188 | 106063 | 60245 | 37051 |

| BAKKEN | 10-2020 | 13 | 69136 | 68691 | 47438 | 91121 | 44375 | 39282 |

- 37309:

| BAKKEN | 8-2021 | 31 | 25592 | 25488 | 13000 | 48424 | 48271 | 0 |

| BAKKEN | 7-2021 | 31 | 26513 | 26656 | 13715 | 43951 | 43800 | 0 |

| BAKKEN | 6-2021 | 30 | 28170 | 28212 | 14095 | 43402 | 40253 | 0 |

| BAKKEN | 5-2021 | 31 | 40140 | 40139 | 18482 | 62692 | 58248 | 0 |

| BAKKEN | 4-2021 | 27 | 30185 | 30130 | 16221 | 39151 | 35013 | 779 |

| BAKKEN | 3-2021 | 31 | 42472 | 42547 | 20947 | 55085 | 49187 | 1198 |

| BAKKEN | 2-2021 | 17 | 18536 | 18498 | 10589 | 24354 | 22290 | 0 |

| BAKKEN | 1-2021 | 31 | 41052 | 40866 | 22277 | 53243 | 48635 | 62 |

| BAKKEN | 12-2020 | 31 | 48713 | 48725 | 26894 | 59283 | 42942 | 10973 |

| BAKKEN | 11-2020 | 30 | 34954 | 34911 | 20172 | 42539 | 32280 | 6368 |

| BAKKEN | 10-2020 | 31 | 48585 | 48702 | 22651 | 39600 | 34247 | 0 |

| BAKKEN | 9-2020 | 20 | 46676 | 46414 | 27852 | 56805 | 19326 | 32393 |

| BAKKEN | 8-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

- 36820:

| BAKKEN | 5-2021 | 21 | 10590 | 10774 | 9727 | 20757 | 10602 | 8922 |

| BAKKEN | 4-2021 | 30 | 24721 | 24706 | 17932 | 36463 | 26336 | 7326 |

| BAKKEN | 3-2021 | 31 | 30057 | 30136 | 20112 | 44335 | 22865 | 18099 |

| BAKKEN | 2-2021 | 28 | 37650 | 37403 | 26118 | 55532 | 31215 | 20152 |

| BAKKEN | 1-2021 | 27 | 34886 | 34888 | 24518 | 51455 | 26865 | 20731 |

| BAKKEN | 12-2020 | 31 | 59662 | 59668 | 39381 | 73265 | 44955 | 21771 |

| BAKKEN | 11-2020 | 30 | 73776 | 73960 | 55275 | 90596 | 50894 | 31658 |

| BAKKEN | 10-2020 | 28 | 82318 | 81951 | 58511 | 62518 | 53575 | 0 |

| BAKKEN | 9-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 8-2020 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

COP - MRO Deal -- Announced May, 2024

Three New Permits; Six Permits Renewed -- May 29, 2024

Locator: 47982B.

McDonald's: the company's problem now? Perception. The word is out. McDonald's is very expensive.

Even if McDonald's were to cut prices -- and the restaurant chain will have a month-long $5-meal campaign -- it will take a long time for customers to "accept" that McDonald's is still an affordable fast-food restaurant.

Often, so much is about perception. For me, now, when I need a quick snack at home, it's a peanut butter and jelly sandwich, probably costing all of 20 cents. I assume others are doing the same.

The $5-meal promotion may be McDonald's Mulvaney moment. We'll see.

***********************

Back to the Bakken

API: reports significant draw of oil inventories. We will see if EIA confirms tomorrow;

- a draw of 6.6 million bbls for the week ending May 17, 2024;

WTI: $79.23.

Active rigs: 34.

Three new permits, #40790 - #40792, inclusive:

- Operator: Phoenix Operating

- Field: Skabo (Divide County)

- Comments:

- Phoenix Operating has permits for three Jacobson wells, NENW 19-160-98,

- to be sited 310 FNL, and 2182, 2272, and 2242 FWL.

Six permits renewed:

- CLR: Patent Gate oil field permits for Berlain (sic) (2), Olympia (2), and Charleston (2).

The Book Page -- May 29, 2024

Locator: 47981BOOKS.

The Book Page

In This Economy? How Money and Markets Really Work, Kyla Scanlon, c. 2024.

Kyla was the individual who coined the word, vibecession.

A fun book to read; experienced investors can read this book in one setting. I doubt many in my audience would find this book useful.

Target audience: the first or second year, probably the first year, college student majoring in finance, business, etc, and/or the same college student interested in starting to invest, or at least to better understand the daily equity and bond markets.

I'm glad I bought it but I wouldn't recommend it except for college students with business or investing interests.

***************************

Never Quit Reading -- Like A Box Full Of Chocolates

Today, while reading a biography of Charlie Chaplin, c. 2023, I came across this:

So, I pulled out my copy of this:

And what a wonderful surprise! The James' family house was featured in a two-page spread in the book:

Many decades ago I had the pleasure of spending a lot of time in the Carmel area. To think I could have purchased a small bungalow along the coast for a "song," as they say.

The BR Boxer Wells In Pershing Oil Field -- May 29, 2024

Locator: 47982B OXER.

The BR Boxer wells:

- 39211, conf, BR, Boxer 4C MBH-ULW, Pershing, no production data,

- 37940, conf, BR, Boxer 4B TFH, Pershing, no production data,

- 37939, conf, BR, Boxer 4A MBH, Pershing, no production data,

- 37936, loc/A, BR, Boxer 3C TFH, Pershing, t4/24; cum 4K first 30 days;

- 37935, loc/A, BR, Boxer 3B MBH, Pershing, t4/24; cum 27K first 30 days;

- 37934, loc/A, BR, Boxer 3A TFH, Pershing, npd,

- 37928, loc/A, BR, Boxer 2B MBH, Pershing, minimal production data,

- 37926, loc/drl, BR, Boxer 2C TFH, Pershing, npd,

- 37924, loc/A, BR, Boxer 2A TFH, Pershing, t4/24; cum 10K first 30 days;

- 17393, 600, BR, Boxer 21-6H, Pershing, t3/10; cum 314K 4/24;

Original Post

- 37934, 4,632, BR, Boxer 3A TFH, Pershing, no production data, frack data not scanned in at NDIC; if the 4,632 IP is accurate, that's a huge IP for a BR well.

The parent well:

- 17393, 600, BR, Boxer 21-6H, t3/10; cum 309K 8/23; off line as of 9/23; back on line, cum 314K 4/24;

| Pool | Date | Days | BBLS Oil | Runs | BBLS Water | MCF Prod | MCF Sold | Vent/Flare |

|---|---|---|---|---|---|---|---|---|

| BAKKEN | 4-2024 | 28 | 4682 | 4664 | 0 | 0 | 0 | 0 |

| BAKKEN | 3-2024 | 17 | 580 | 640 | 2189 | 994 | 679 | 102 |

| BAKKEN | 2-2024 | 1 | 73 | 252 | 199 | 76 | 23 | 52 |

| BAKKEN | 1-2024 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 12-2023 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| BAKKEN | 11-2023 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| BAKKEN | 10-2023 | 18 | 922 | 514 | 343 | 1848 | 1206 | 416 |

| BAKKEN | 9-2023 | 7 | 280 | 702 | 139 | 1023 | 920 | 15 |

| BAKKEN | 8-2023 | 23 | 1358 | 1160 | 767 | 3414 | 2859 | 267 |

| BAKKEN | 7-2023 | 19 | 597 | 973 | 217 | 1546 | 1151 | 157 |

| BAKKEN | 6-2023 | 20 | 875 | 726 | 152 | 2766 | 2484 | 31 |

| BAKKEN | 5-2023 | 31 | 1713 | 1608 | 362 | 4886 | 4420 | 78 |

| BAKKEN | 4-2023 | 30 | 1036 | 1150 | 279 | 2234 | 1799 | 59 |

| BAKKEN | 3-2023 | 31 | 1308 | 1216 | 279 | 3110 | 2660 | 62 |

The map:

- 37929, loc/drl, BR, Parrish 3A TFH, Pershing, producing 4/24; 10K first 30 days;

- 37926, loc/drl, BR, Boxer 2C TFH, Pershing, npd,

- 37931, loc/drl, BR, Parrish 3B MBH, Pershing, producing, 4/24; 27K first 30 days;

- 37940, conf, BR, Boxer 4B TFH, Pershing, no production data,

The BR Boxer wells:

- 39211, conf, BR, Boxer 4C MBH-ULW, Pershing, no production data,

- 37940, conf, BR, Boxer 4B TFH, Pershing, no production data,

- 37939, conf, BR, Boxer 4A MBH, Pershing, no production data,

- 37936, loc/A, BR, Boxer 3C TFH, Pershing, t4/24; cum 4K first 30 days;

- 37935, loc/A, BR, Boxer 3B MBH, Pershing, t4/24; cum 27K first 30 days;

- 37934, loc/A, BR, Boxer 3A TFH, Pershing, npd,

- 37928, loc/A, BR, Boxer 2B MBH, Pershing, minimal production data,

- 37926, loc/drl, BR, Boxer 2C TFH, Pershing, npd,

- 37924, loc/A, BR, Boxer 2A TFH, Pershing, t4/24; cum 10K first 30 days;

- 17393, 600, BR, Boxer 21-6H, Pershing, t3/10; cum 314K 4/24;

Israel Says War With Hamas Will Last Through End Of The Year -- Seven More Months -- May 29, 2024

Locator: 47981GEOPOLITCS.

Other news:

PGA: criminal charges against Scottie Scheffler have been dismissed.

The Market -- On A Day With Huge Buying Opportunities -- Note The Timing -- Sell In May, Go Away? May 29, 2024

Locator: 47980INV.

Personal investing:

- added to my WMT position today by rule. No recommendation. See disclaimer.

- first contribution to Sophia's "529" yesterday; new money contribution

- see below: ABBV --> AVGO

**************************

AAPL

On a down day for the market, AAPL is doing surprising well, and seems to be growing "stronger" as the day progresses. See my disclaimer re: AAPL / Apple, Inc.

If Apple can "sell" their M4 as a GPU-AI chip -- this could get interesting.

***************************

Personal Investing

No recommendations. See disclaimers.

Over the years I 've built up a huge position in ABBV; ABBV has paid a nice dividend allowing investments in other areas, but now the position is large enough to consider tax-loss harvesting, and buying AVGO.

Cramer would suggest: don't sell entire ABBV position; perhaps one-fourth, one-half and with the proceeds buy AVGO.

Dividend:

- ABBV: 4%

- AVGO: 1.5%

Google and AVGO: link here.

******************************

US Economy

Recession? LOL.

Stressed consumer? LOL.

- Dick's sporting goods soars! Link here.

- I don't consider Dick's a low cost retailer

- but wow, it has the best selection

- it's really geared for the high-end buyer but a lot of lower-middle class completely unaware

- considering our Walmart is almost next door, I'm surprised how well Dick's must be doing, even locally

- biggest competitor? Yeah, Walmart

Abercrombie up almost 20% today after posting strongest quarter ever! "Hottest retailer around" -- Sara Eisen

- I always consider A&F a niche retailer: hip 20-somethings who liked to bare their bodies; press the edge of the envelope

- huge pivot over last several years

- Abercrombie and Hollister

- another great interview by Carl Q and Sara Eisen

- noted that weddings were no longer single-day events;

- weddings now run three to five days

- women (perhaps men) need multiple outfits for the three to five day gala events

- my hunch: a lot of one-day events are now becoming multi-day events

- I surprised my wife some years ago (two decades ago?) when I expanded her one-day birthday celebration to a full week celebration -- much the way our wedding / wedding celebration was staged over several days across two far-flung states

- back to ANF: huge lessons learned during Covid-19: stay lean

- CEO is obviously very, very thrilled; one of the better CEO interviews I've seen in a long time

- Hollister, almost half of total company

- ANF brings a lot of traffic to malls; but sticks close to right size, right location

Chewy: also huge; stressed consumer?

- personal observation: we live in a dog-friendly, medium-end apartment complex

- Chewy deliveries one of the biggest things I see in the complex on a daily basis

- why lug home pet food (generally bulky, heavy) when it can be ordered / delivered from Amazon / Chewy.com

***************************

COP - MRO

In the Bakken:

- COP is a big player, but through its subsidiary, BR, is a relatively important operator in the Bakken

- MRO probably has some of the best wells in the Bakken, but more importantly seems to be the leader in re-fracking the Bakken, particularly in the Bailey oil field

- the real surprise? How big Chord Energy has become in such a short period of time

- Chord Energy may have overtaken Continental Resources (formerly known as CLR)

- I don't know if folks remember but at one time just last year it was rumored that Devon would buy Enerplus --

- market caps

- DVN: $30 billion

- CHRD: $7.5 billion

- ERF: $4 billion

- to increase base dividend to 78 cents in 4Q24

- breakeven in the Permian: $30

- (78-58)/58 = 34% increase

- dividend history:

******************************

Other

A bridge too far? If the CVX - HES deal falls through, could CVX pivot quickly to acquire DVN in light of the COP-MRO announcement. Everyone suggests the COP-MRO deal is the need for COP to increase its shale oil exposure

- market cap:

- HES: $16 billion

- DVN: $30 billion

AAPL:

- in the old days when APPL's target was around $200, I bought more APPL when it went to $160;

- now, with target still at $200, but some targets as high as $275, could the new buying opportunity for AAPL be at $190?

- possibly;

- by rule, I can't invest in more AAPL unless AAPL drops below $175

- interestingly, on a "down-day" for the US markets, AAPL doing very, very well -- this is very, very unusual and something to watch

Disclaimer Briefly

Reminder:

I am inappropriately exuberant about the US economy and the US market, I

am also inappropriately exuberant about all things Apple.

See disclaimer. This is not an investment site.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

All my posts are done quickly: there will be content and typographical errors. If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

Reminder:

I am inappropriately exuberant about the US economy and the US market, I

am also inappropriately exuberant about all things Apple.

PersInv -- May 29, 2024

Locator: 47979PERSINV.

Tag: intergenerational wealth transfer.

Updates

July 16, 2024: one beneficiary can be a beneficiary of multiple "529" plans -- the total beneficiary limit is the sum of all "529" plans, but only one 529 plan in each state. Thus, Sophia could have a "529" in Kansas for $475,000 plus a "529" in California for an additional $500,000. Link here.

July 16, 2024: with regard to the "529," Schwab defaults to the Kansas state "529," managed by American Century Investments, a very-well respected investment firm. Coincidentally, and purely through serendipity, I chose American Century for one of my IRAs over 30 years ago, and it's still going strong.

Kansas state treasurer, 529, website;

From Schwab regarding the rules of the Kansas state "529":

Original Post

Before we get started. If you want to understand how the US Congress "works," I can think of no example better than the "529." The "529" and the "amended 529" were designed specifically with the members of the US House in mind. Whether the timing of the "amended 529" had anything to do with RMDs and the 10-year depletion rule is in the eye of the beholder. I feel the timing of the "amended 529" was related to the glaring disadvantages of the traditional IRA.

Remember, the "owner" of the "529" can be changed at any time with a single signature.

Now, back to personal investing.

I track personal investing here, a series just for the extended family.

The goal is to move my financial assets from my "accounts" and "my control" to the five grandchildren.

And we're making progress.

Yesterday, I opened up a "529" for Sophia and made the first contribution. For all practical purposes, there is no limit on contributions to a "529." Don't take that out of context.

Those are the limits for each "529." There is not limit to the number of "529s" one can establish.

"529s"? Some call them "educational savings funds." I call them "baby Roth IRAs."

This is the path, and it's a short path:

- for those able to do this, establish a "529" for each grandchild at the time of their birth

- appoint a family member to manage the overall "529" family plan on a yearly basis (maybe more on that later)

- contribution allocation changes

- change contributions based on need and Roth IRA limits

- change owners / beneficiaries based on need, limits

- at around age 20 for each beneficiary, establish a Roth IRA and begin transferring unneeded "529" education funds into the Roth IRA (or an already-established Roth IRA)

Comments:

- $35,000 doesn't sound like much, but it's a kick-start for establishing a retirement fund

- it's been my experience that the hardest thing about investing for retirement is getting started

- it would take a lot of work but there is not limit to the number of "529s" in which a beneficiary is named; there is a maximum lifetime contribution but ... the IRS may disagree -- something to discuss with others ...

So, where does that money come from?

- dividends from existing personal accounts;

- RMDs;

- mailbox money, including tax refunds;

- capital gains: whittling down personal investment accounts

Net result: those sources all have combined effect of transferring our investments to the grandchildren. For example:

- in the near term, add no more to our own investments; set limits on personal wealth and gradually drop those maximums

- e.g., if we have an investment account with $10,000 and it goes to $10,100 this year, we move $100 to the grandchildren

- starting the next year, (2025) we start transferring that principal ($10,000) to the grandchildren, perhaps 10% annually, as an example

Transition year: this year is our year of transition as we put the plan into effect; "emotionally" it will be difficult but handing this "control" off to the granddaughters will be very, very rewarding.

**************************

Next

Five grandchildren. The youngest two already have "529s" established (established at age three).

A "529" for Sophia added yesterday. First contribution made.

Two grandchildren left to go. The oldest graduates from college this year (one autumn semester left) but five years from now has plans to go to law school.

The fifth starts college this next fall, and has a full scholarship. But graduate school some ten years from now? Watch closely, and if no graduate school in the offing, convert the "529" to a Roth IRA in (2024 +15) 2039.

*****************************

Next After Next

It surprised me but it turns out the two oldest grandchildren have W-2 income despite one being in college and the other in high school (just graduated a few days ago).

Having learned that, I've asked them to open a Roth IRA this calendar year, and max out their allowable contributions into the new Roth IRAs and we will match them for their living expenses. This year and annually thereafter.

Disclaimer Briefly

Reminder:

I am inappropriately exuberant about the US economy and the US market, I

am also inappropriately exuberant about all things Apple.

See disclaimer. This is not an investment site.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

All my posts are done quickly: there will be content and typographical errors. If anything on any of my posts is important to you, go to the source. If/when I find typographical / content errors, I will correct them.

Reminder: I am inappropriately exuberant about the US economy and the US market, I am also inappropriately exuberant about all things Apple.

Enough for now.

Tioga Right Up There With The Other Leading Global Oil Powerhouses -- Ya Gotta Love The Bakken -- May 29, 2024

Locator: 47978B.

RBN Energy: Pembina inks ethane supply deal with Dow's Alberta ethane cracker expansion. Archived.

From that article, the following pertains to the Bakken:

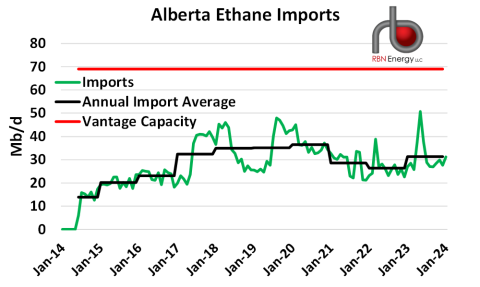

Pembina has said another important avenue for enhancing ethane supplies could involve increased utilization of its wholly owned Vantage Pipeline (blue lines in Figure 1) that imports ethane from a gathering point in Tioga, ND, in the heart of the Bakken, along with very small amounts that come from an ethane-extraction plant in Saskatchewan. Vantage’s capacity is pegged at 69 Mb/d (red line in Figure 4 below) and the AER’s data puts January 2024 and full-year 2023 ethane imports at 31 Mb/d (right end of green line and black line, respectively), although flows have reached as high as 51 Mb/d. With 2023 imports averaging 31 Mb/d, less than half of the pipeline’s capacity is typically being utilized and suggests that up to 38 Mb/d of additional supply could be sent to the Dow site via Vantage, or to supply Nova’s Joffre site, with a portion of existing Joffre-bound ethane supplies being diverted to Dow.

Figure 4. Alberta Ethane Imports. Source: AER

There is certainly some potential for more ethane to come from the Bakken. Back in August, ONEOK sanctioned a 100-Mb/d expansion of its existing 300-Mb/d Elk Creek NGLs Pipeline that will increase NGLs takeaway for Bakken gas producers and ship these volumes southeast to a market hub in Bushton, KS. ONEOK also owns a 30-Mb/d pipeline (the Tioga Lateral) that connects to Elk Creek and ties back to the Tioga connection with Pembina’s Vantage Pipeline. Although no specific expansion of this lateral has been announced, this could be an easy bolt-on for ONEOK, especially with the assurance that more ethane demand is soon to be on tap in Alberta. Our point here is that, with steadily rising amounts of associated gas production in the Bakken (i.e., gas that is rich in NGLs), producers will benefit from more NGLs takeaway capacity, and the Tioga connection to Vantage could form part of that solution, as well as Pembina’s in terms of tapping into more ethane imports.

Dicks, Abercrombie, COP, TSA -- Sure Doesn't Look Like Recession, Stagflation -- Except For Commercial Real Estate Depression Could Lead To Regional Bank Failures -- May 29, 2024

Locator: 47977B.

Today:

- TSA: record screening

- COP-MRO: $17 - $21 billion all stock deal

- Hess shareholders approve CVX-Hess deal

- Dicks: setting records

- Abercrombie: setting records; best quarter all-time

Jamie Dimon: continuing to misuse the definition of "stagflation."

- unless he's suggesting the worst of the worst, he seems to be using "stagflation" as a meme for "sticky inflation"

- stagflation: "serious" inflation; "serious" unemployment; and, "no growth"

- we currently have "sticky inflation" but it's still contributing to a "Goldilocks" economy

- biggest problem: not understanding "reason" for "sticky inflation" and how "inflation" is defined, measured

Texas heat:

- for all the media-induced anxiety, the grid is doing very, very well;

- expensive yes, but that's what folks wanted (they just didn't know because they didn't read); but the grid holds

****************************

Back to the Bakken

WTI: $80.24.

Friday, May 31, 2024: 43 for the month; 107 for the quarter, 306 for the year

None.

Thursday, May 30, 2024: 43 for the month; 107 for the quarter, 306 for the year

39655, conf, Hess, GO-Bergstrom-156-98-2734H-3,

40184, conf, CLR, Sloan 5-8H,

39383, conf, BR, Devils Backbone 3A UTFH,

39326, conf, Hunt, Alexandria 161-100-22-15H3,

RBN Energy: Pembina inks ethane supply deal with Dow's Alberta ethane cracker expansion. Archived.

With an announcement in late 2023 by Dow Chemical that it would be undertaking an enormous expansion of its ethylene production site in Fort Saskatchewan, AB, it was immediately clear that Alberta’s ethane supplies would need to increase by a significant 110 Mb/d. As we’ll discuss in today’s RBN blog, a deal was signed in February between Dow and Pembina Pipeline Corp. that calls for the midstreamer to provide up to 50 Mb/d of additional ethane supplies and, according to executives at Pembina’s investor day earlier this month, will require the company to invest between C$300 million (US$220 million) and C$500 million (US$367 million) to build out its existing NGL/ethane infrastructure.

Alberta, Canada’s energy-producing powerhouse, is also home to a large and sophisticated petrochemical industry. Since the 1970s, the industry has relied on an abundance of ethane, which like other NGL “purity products” is extracted from the raw (or unprocessed) gas that also contains a mix of methane (the primary component of natural gas) along with other liquids such as propane, butane and condensate (with that last one usually referred to as natural gasoline in the U.S.). The extraction of some portion of these purity NGL products from the raw gas stream is necessary to meet specifications for transportation in pipelines and for use by downstream consumers. Ethane typically accounts for the largest portion of the liquids that can be extracted from the raw gas and can be sent to nearby petrochemical plants for use as a feedstock for more complex chemical molecules such as ethylene. Ethylene forms the basis for the manufacture of everyday plastics such as bottles, grocery bags, food packaging and many other products.