Dallas is lucky it's not 0-3. It was a miracle that Dallas won last week. Had Dallas not scored that incredible last second touchdown last week, Dallas would be looking at a 0-3 beginning to the season. And I think everyone knows that. Last night, quarterback for Seattle Seahawks set an NFL TD record to defeat the Cowboys by a whopping 38 - 31. Yes, whopping. It should have been 45 - 24, but that's another story that won't be printed. But look at this:

Russell Wilson is performing at an incredible clip through three weeks -- historic, in fact.

Wilson's five passing touchdowns in Sunday's 38-31 win over the Dallas Cowboys gave him 14 on the year, breaking Patrick Mahomes' record of 13 set in 2018. It also made Wilson the first player in NFL history to throw for four or more touchdowns in each of his team's first three games.

NASCAR: incredible race last night. Kurt Busch, with win, is in the final eight.

Stanley Cup: Tampa Bay Lightning should clinch the championship series tonight; leads 3-2.

Americans and their pickup trucks, MarketWatch op-ed: Americans' love affair with pickup trucks might be derailing their retirement plans. Monthly payments trend toward $1,300. Link here.

Obviously written by a writer living in locked-down NYC; has never been west of the Mississippi; not even sure if he owns a car, much less ridden in a pickup truck. There's a reason 13 million new pickups were sold between 2013 and 2019. I'll bet a lot of them were "written off" in the first year of ownership by contractors, small business owners, especially roofing companies and landscaping companies in Texas.

Most under-reported energy story: the amount of natural being produced as "associated gas" from global oil fields. See below for yet another example. This has huge, unintended consequences.

Kuwait: crude oil burn hit record in July, 2020 -- ArgusMedia -- link here:

Kuwait burned a record amount of crude in its power and

water plants in July, as surging summer electricity demand coincided

with a drop in associated gas output resulting from the Opec+ production

restraint deal.

The Mideast Gulf state burned just under 184,000

b/d in July, which was around nine times higher than a year earlier.

Kuwaiti summers are brutally hot, and many

residents and citizens typically seek brief respite outside the region.

But that was impossible this year because of Covid-19-related restrictions of closing the country's airspace. As temperatures hit 52°C, Kuwait's peak load reached a record 14.96GW, up by 4 percent on July 2019.

Like many of its Mideast Gulf neighbours, Kuwait relies largely on

associated gas output for power generation and water desalination. It is

normally enough in the cooler winter months, and is usually topped up

in summer with LNG imported at a floating storage and regasification

unit.

But OPEC+ crude output cuts have reduced the amount of associated gas available. Argus

estimates that Kuwait produced 2.15mn b/d of crude in July, up by

100,000 b/d from 2.05mn b/d in June, but considerably lower than

Kuwait's self-reported 2019 average of nearly 2.68mn b/d. This meant

that Kuwait was only able to supply 1.32bn ft³/d of gas in July,

compared with nearly 1.6bn ft³/d in July 2019. [It would have been helpful to report the natural gas in boe rather than cubic feet. I've never understood why anyone would report a "gas" in terms of cubic feet.]

BP: shares hit 25-year low as company announces it will pivot to low-margin renewable energy. Link here.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

Devon saw the writing on the wall; took out an insurance policy. Could be the biggest story of 2021: New Mexico preps for a Biden presidency. By the way, this is one reason Devon bought WPX. Devon's portfolio overweight in federal land; worried about a federal ban on fracking. Link here:

With the U.S. oil industry reeling from the collapse in demand this

year, the New Mexico shale patch has emerged as the go-to spot for

drillers desperate to squeeze as much crude from the ground without

bleeding cash. There’s just one problem: Joe Biden wants to ban new

fracking there.

Just over the border with Texas, in a two-county stretch that forms

the far western edge of the Permian shale basin, there are more rigs

boring oil wells today than anywhere else in the nation. The rock here,

once overlooked by wildcatters obsessed with the much-bigger Texas side,

has quietly become the most profitable place to produce oil in America.

That’s attracting cash-strapped fracking outfits after the pandemic

pushed crude prices down to just $40 a barrel.

But there’s a different threat emerging for these drillers, one that

won’t affect their counterparts across the state line. The Permian in

New Mexico, unlike in Texas, lies largely on federal land. And Biden,

the Democratic candidate for president, has promised to ban new fracking

on federal land on “day one” if elected. That prospect has so unsettled

oil executives that they’re rushing to build a war chest of federal

permits to drill in the state. In the first nine months of the year,

permit applications for the region — from companies like Devon Energy

Corp. and Concho Resources Inc.

And more, from Bloomberg:

Devon Energy Corp. agreed to acquire WPX Energy Inc. in a $2.56 billion all-stock deal, creating one of the largest independent U.S. shale producers and answering investor calls for consolidation at a time of crisis for the sector.

The transaction, which includes a deal premium of about 2.6%, will see Devon shareholders own approximately 57 percent of the combined entity.

Shares of both Devon and WPX stock surged in pre-market trading, indicating shareholder enthusiasm for the deal.

The plunge in oil prices this year, which has left much of the shale industry unprofitable, has added to the impetus for mergers and acquisitions, particularly in the Permian, where scores of producers operate in close physical proximity.

U.S. shale investors are frustrated after years of poor returns and missed targets. Many have called for the sector to consolidate in order to slash costs, and some have advocated for low- to no-premium deals to get those deals across the finish line. Stock prices have been hammered, and companies with market values of less than $5 billion are losing relevance with public investors.

“The bar for investment is rising daily -- with most long-only clients we speak with now leaning towards a $10 billion minimum market cap for investment,” the analysts wrote in a note Monday.

“We believe the public markets would like to see the U.S. upstream sector drop down to 10-15 companies, most of which will likely consolidate through low premium stock-for-stock merger of equals.”

The combinnation of Devon and WPX will tie together two companies with sizable operations in the hottest part of the prolific Permian Basin, which straddles West Texas and southeastern New Mexico. [This, by the way, is the big story -- New Mexico.]

US cold wave to move natural gas prices? Hope springs eternal. We'll see. Consider the source. Link here.

Peak oil, what peak oil: now it's the Breidablikk oilfield. Equinor, COP, and Eni to invest $2 billion to develop this Norwegian oil field. Link here. Incredibly small field for this much press: 200 million bbls; production to begin 1H24.

It's official: Devon-WPX -- will be called Devon: and will become the biggest independent shale producer. Link here.

The merger will see the enlarged company retain the Devon name. It will

be led by Rick Muncrief, Tulsa-based WPX’s current chief executive

officer. Oklahoma City-based Devon also plans to initiate a so-called

fixed-plus variable dividend, which comprises quarterly payout of 11

cents a share and the distribution of up to 50% of the remaining free

cash flow. The takeover is expected to close in the first quarter of

next year.

OPEC basket,

link here: $41.93

****************************************

Back to the Bakken

Active rigs:

$40.69

| 9/28/2020 | 09/28/2019 | 09/28/2018 | 09/28/2017 | 09/28/2016 |

|---|

| Active Rigs | 11 | 57 | 66 | 58 | 32 |

Six wells coming off confidential list:

Monday, September 28, 2020: 145 for the month; 216 for the quarter, 662 for the year

- 36671, drl/A, Hess, TI-Ives-157-94-0601H-9, Tioga, t--; cum 91K over four months;

- 34662, SI/A, Whiting, Wold Federal 44-1-2H, Sand Creek, t--; cum 79K over 3 months;

Sunday, September 27, 2020: 143 for the month; 214 for the quarter, 660 for the year

- 36949, drl/A, Whiting, Arndt 11-24XH, Sanish,

Saturday, September 26, 2020: 142 for the month; 213 for the quarter, 659 for the year

- 37016, drl/IA, Hess, TI-Blestrud-158-94-3130H-1, Tioga, t--; cum 24K over 27 days;

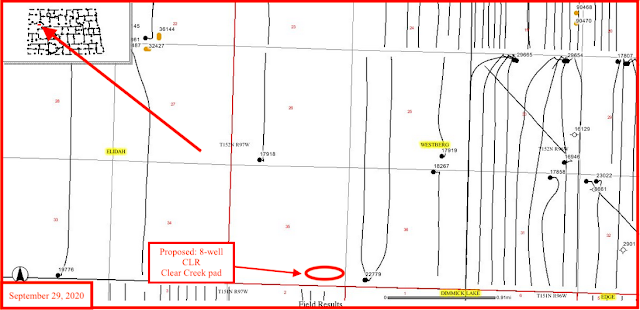

- 36313, loc/ NC, BR, State Dodge 1B MBH, Dimmick Lake,

- 34663, SI/A, Whiting, Wold Federal 44-1-2TFH, Sand Creek, t--; cum 86K over three months;

RBN Energy: Canadian natural gas production facing another year of decline.

Canadian gas production in 2019 turned lower for the first time in

half a dozen years as very weak benchmark Canadian gas prices led to a

sharp reduction in drilling and wellhead shut-ins. This year, higher

prices, more drilling, and greater pipeline egress capacity were

supposed to set the stage for a return of supply growth. Instead,

production volumes have slipped further due to reduced drilling activity

and, more recently, a spate of maintenance work. And even if there is

some improvement in the next few months, annual average production looks

to be on track for a second consecutive decline in 2020. But what about

next year? Today, we take a closer look at the recent supply trends and

whether there are any signs pointing to a production rebound in 2021.

Like producers in the Alberta oil sands, the natural gas sector in

Western Canada has faced its own share of problems in the past few

years: insufficient pipeline egress capacity, crippling disconnects and

discounts for the AECO price benchmark, and eroding market share for its

gas in the U.S. The April-to-October injection seasons of 2018 and 2019

saw all of these problems reach a fever pitch, with AECO prices

slipping to some of the lowest levels on record, including a few

instances of negative pricing, driven by the complexities of gas

supplies mismatched with the capacity of the pipeline system to deliver

those supplies.

This year was supposed to be different — and better. We outlined the

reasons why AECO prices and gas supplies were expected to be stronger in

2020 in a number of blogs earlier this year.