Locator: 46335B.

Busy, busy day. Where to begin? I'm on Pacific Time so I'm way behind everyone else.

Stories I'm following today:

- resurgence of shale -- at least two big stories;

- the Bakken: flashback; Jane's commentary;

- southern surge and labor shortage;

- investing:

- Buffett and GM; parted ways earlier this year;

- GS: raises price target on AMD

- AVGO today

- ORCL today

- CAT vs UNP today

- BRK today

**********************************

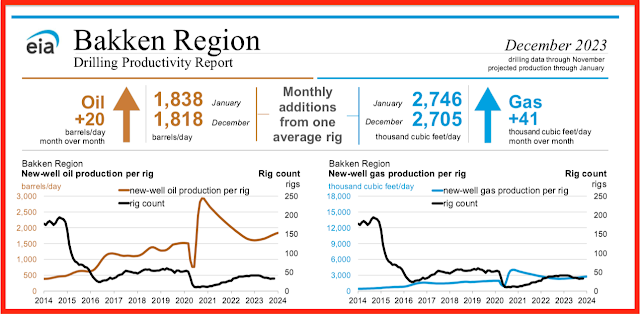

Back to the Bakken

WTI: $73.29.

Tuesday, December 19, 2023: 24 for the month; 173 for the quarter, 743 for the year

39697, conf, WPX, North John Elk 28-27HW,

38254, conf, Hess, EN-State B-155-93-0916H-7,

38114, conf, Formentera Operations, LFM1 22-34 161-93 BTF,

Monday, December 18, 2023: 21 for the month; 170 for the quarter, 740 for the year

None.

Sunday, December 17, 2023: 21 for the month; 170 for the quarter, 740 for the year

39696, conf, WPX, North John Elk 28-27HIL,

Saturday, December 16, 2023: 20 for the month; 169 for the quarter, 739 for the year

None.

RBN Energy: Kinder Morgan builds a south Texas network aimed at Mexico, LNG exports.

Kinder Morgan owns and operates natural gas pipelines across pretty much

every part of the U.S., from California to Massachusetts and North

Dakota to Florida. But if you look at a map of its gas pipeline assets,

you’ll notice a focus on lines in the Lone Star State that serve as

critical pathways for Permian- and Eagle Ford-sourced gas flowing to

Mexico, Texas’s Gulf Coast and a number of existing and planned LNG

export terminals.

Now, Kinder is poised to significantly expand its

pipeline network in that part of the world with the planned $1.8 billion

acquisition of NextEra Energy Partners’ STX Midstream unit, as we

discuss in today’s RBN blog.

****************************

Whatever Happened To Jane?

I wonder: whatever happened to Jane?