Locator: 46461JOBS.

CNBC talk, not me:

- huge jobs jump — higher than expected.

- wage increase — higher than expected.

- numbers good for the economy, good for union movement (?); not good for equities.

- what a great country!

- 36th month of labor growth.

- 5th longest on record.

- unemployment rate unchanged at 3.7%.

- no indication for any Fed cut any time soon.

- narrative starting to change.

- From “how high” to “how long.”

- S&P might end the year no higher than it entered. Stock pickers’ market.

- 1H24 is going to be rough. Likely to be a very slow 1Q24.

Unemployment: Table A-15.

Barron’s: jobs report — two words — hot, unexpected; link here.

The U.S. added 216,000 jobs in December, a strong showing that surpassed many forecasts and underscored that the labor market remains resilient.

The end of 2023 continued a recent trend of surprises on the upside. Employment rose even faster than in November, when a revised 173,000 jobs were added following the resolution of strikes by auto workers and the Hollywood actors’ union. Economists surveyed by FactSet anticipated that the U.S. would add 160,000 jobs in December..

Stocks immediately fell in response to the news, which appeared to make it less likely that the Federal Reserve will cut interest rates as soon as investors had expected.

*******************************

Autos

Ford: annual sales increase lower than the overall industry's growth. Link here.

EVs: Ford loses EV bragging rights to GM: link here. Best summary to date.

For the full year, Ford shipped almost 2 million vehicles in the U.S., up about 7% compared with 2022. BEV sales came in at about 73,000 units, up 17%. Hybrid (fake EVs) sales amounted to almost 134,000 units in 2023, up 25% from 2022.

Despite Ford’s sales growth, General Motors still edged its rival out for the title of second-largest EV maker in the U.S., behind Tesla. Ford had held the No. 2 spot in 2022. GM shipped 75,585 BEVs in 2023.

Tesla U.S. numbers aren’t available yet, but its lead is immense. It probably sold roughly 600,000 BEVs in the U.S. in 2023.

EVs, the Chevy Corvette EV: link here.

The Z06? Chevrolet still makes the Z06.

The Z06 is an incredibly special

car. It was our Performance Car of the Year just last year, and

rightfully so. GM reverse engineered the Ferrari 458 Speciale, one of

the greatest cars in history, and succeeded. You want that. You need

that. And it’s only about $6,000 extra, spec-for-spec.

As much as the author raves about the E-Ray, his bottom line?

Would I personally choose the hybrid variant of the Corvette?

Not as long as the Z06 is around, I wouldn’t. That car -- the Z06 -- is simply too

special, the cost difference is incremental, and I don’t have much rain

or snow to contend with. But the E-Ray is the look into our Corvette

future for sure, so choose wisely, and be thankful the choice still

exists.

Personal investing:

- remain fully invested, hold no cash;

- horizon: 30-year rolling;

- bucket list of tickers: 5-year performance

- move RMDs to 529s

- energy dividends will be a very bright spot

- opportunity to build positions in tech

- 2024 to be a watershed year for EVs and entire renewable energy story

- Apple: hope springs eternal. AAPL needs some really good news.

*****************************

Back to the Bakken

WTI: $72.96. Nice.

Monday, January 8, 2024: 6 for the month; 6 for the quarter, 6 for the year

39929, conf, Neptune Operating, Jacobson 17-8-5 3H,

Sunday, January 7, 2024: 5 for the month; 5 for the quarter, 5 for the year

39930, conf, Neptune Operating, Jacobson 17-8-5 2H,

Saturday, January 6, 2024: 4 for the month; 4 for the quarter, 4 for the year

39025, conf, Hess, GO-Golden Valley-157-96-2833H-2,

39024, conf, Hess, GO-Golden Valley-157-96-2833H-3,

Friday, January 5, 2024: 2 for the month; 2 for the quarter, 2 for the year

None.

Thursday, January 4, 2024: 2 for the month; 2 for the quarter, 2 for the year

None.

RBN ENERGY: Trinity constructing first greenfield gas storage project in many years.

We’ve been saying for a while now that the natural gas storage market may be on the verge of a comeback. At the same time, we’ve cautioned that the world has changed since the heyday of gas storage in the mid-to-late 2000s, and that while market participants are clamoring for storage solutions and storage values are rising, what’s driving storage values today is vastly different than what drove the last big capacity build-out (which resulted in a major storage overbuild).

As a result, only a handful of storage projects meeting special needs in particular places are likely to reach a final investment decision (FID). In today’s RBN blog, we discuss one such project: a greenfield storage facility under construction at two depleted dry-gas reservoirs 90 miles southeast of Dallas.

In our Squeezebox blog series a few months ago, we took an in-depth look at the changing role and value of natural gas storage over the past several decades — before and after the deregulation and unbundling of the gas market in the early 1990s, then (in the mid-to-late 2000s) the advent of market-based storage rates and plans for LNG imports, and (through the mid-to-late 2010s) the Shale Era’s gas-supply abundance, which (combined with the storage overbuild) led to declining storage values and a virtual halt in the development of new storage capacity. That brings us to what we see as a potential revival of the storage market — and why we think it will look different than storage market cycles in the past. For one thing, today’s demand for storage is being driven largely by extrinsic economics, not intrinsic values.

More:

Here’s the bottom line: Storage is no longer valued for the capacity alone but is increasingly valued for its role in providing volume assurance and the opportunities created by high deliverability. However, that doesn’t necessarily mean storage values will be high enough to support the large-scale build-out of new facilities. Instead, the development of new storage capacity is likely to be very targeted — it will happen only where it clearly makes economic sense.

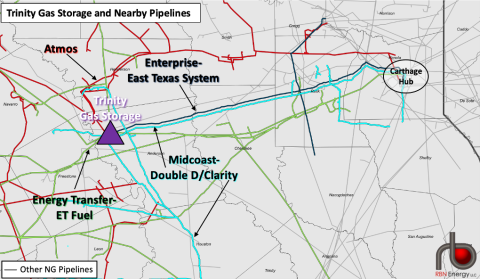

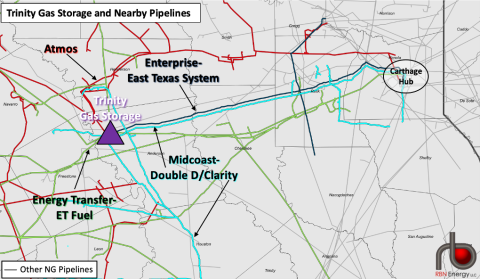

Figure 1. Trinity Gas Storage and Nearby Pipelines. Source: RBN

All of which brings us to the focus of today’s blog: Trinity Gas Storage’s greenfield gas storage project. Located in Bethel, TX — and adjacent to system storage for nearby Atmos Energy and Energy Transfer pipelines — the Trinity project is utilizing two largely depleted gas reservoirs as a “warehouse” in which customers will inject/withdraw natural gas. The facility’s Phase I, slated for commercial startup in Q2 2024, will provide about 24 Bcf of capacity and marketed deliverability of at least 0.46 Bcf — it also will be able to deliver up to 0.75 Bcf on a day when demand for stored gas is unusually high. (Deliverability is the volume of gas that can be withdrawn from storage in a 24-hour period.) A second phase of up to 26 Bcf of capacity and marketed deliverability numbers close to those in Phase I is in an advanced stage of development, with Trinity launching its marketing for Phase II this month and anticipating commissioning as soon as Q2 2025.

Before we dive into the details of the project — and the rationale for it — we should note that Trinity's executive team has extensive experience in depleted-reservoir gas storage projects, having been involved in (among other things) the greenfield development of the 18.5-Bcf Caledonia Energy Partners project in northeastern Mississippi in the late 1990s and early 2000s and the management and operation of the 36-Bcf NorTex storage facility (formerly known as Falcon Gas Storage) west of Dallas/Fort Worth.

Phase I of the Trinity project in East Texas, which achieved a positive FID in September 2023 and has secured $190 million in financing, involves the conversion of part of a nearly depleted reservoir that has been producing dry natural gas since the early days of the Eisenhower administration. (For our younger readers, that was 70-plus years ago.) Work on the Texas Railroad Commission-approved project is underway and is slated for completion and initial operation in Q3 2024.

Bethel, Texas, is two hours southeast of our little hovel in Euless, Texas. Who-hoo.