Locator: 45583ECON.

Economy: it looks like the economy remains in great shape if one is listening to Jamie Dimon. JPM raised its dividend rate some weeks ago. Hardly suggests a dire decade. Link here. The problem is not "higher-for-longer," the problem is perspective.

Fossil fuel: quick look at headlines overnight suggests fossil fuels are back; renewable energy, global warming issues facing headwinds. Apparently some folks don’t like the idea of $7-gasoline.

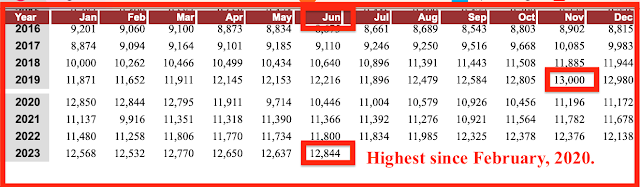

Higher-for-longer: young journalists don’t have sense of history; many apparently can’t read a graph.

UAW: stopping a new battery facility was the big story of the week.

History through oil-tinged glasses:

************************

Back to the Bakken

WTI: $89.06.

Wednesday, September 27, 2023: 116 for the month; 318 for the quarter, 563 for the year

39564, conf, Kraken, Blaine 33-28 3H,

38987, conf, Hess, RS-Harstad-LE-155-91-0433H-1,

Tuesday, September 26, 2023: 114 for the month; 316 for the quarter, 561 for the year

39595,

conf, Neptune Operating, Sigma Lee 14-23 3H,

39569,

conf, CLR, Eclipse SWD,

39563,

conf, Kraken, Blaine 33-28 2H,

RBN Energy: how much will the Midland-to-Houston WTI price spread widen as oil flows shift? Archived.

Over the past three-plus years, Corpus Christi has dominated the U.S.

crude oil export market, largely because of the availability of

straight-shot pipeline access from the Permian to two Corpus-area

terminals at Ingleside — Enbridge Ingleside Energy Center (EIEC) and

South Texas Gateway (STG) — that can partially load the huge 2-MMbbl

VLCCs (Very Large Crude Carriers).

But capacity on the pipes to Corpus

is now nearly maxed out and, with Permian production rising and exports

strong, an increasing share of West Texas crude output is instead being

sent to Houston on pipelines with capacity to spare.

The catch for

Permian shippers with capacity on Permian-to-Houston pipes is that the

Midland-to-MEH (Magellan East Houston) price differential for WTI has

been depressingly low —$0.22/bbl on average this year, compared to

almost $20/bbl for a few months in 2018 and averaging $5.50/bbl as

recently as 2019. However, the Midland-to-MEH WTI price spread looks to

be on the verge of a rebound of sorts, as we discuss in today’s RBN

blog.

A few months ago we said that exports are, well, calling the shots in the U.S. crude oil

market.

Lower 48 oil production now averages about 12.5 MMb/d — Alaska

adds another 400 Mb/d — the highest level in three and a half years and

only a tiny 1.5% away from where production peaked pre-COVID.

And

exports out of the Gulf Coast? They’ve averaged nearly 3.7 MMb/d so far

this year, a gain of about 500 Mb/d over 2022 (which was no slouch).

With

WTI prices now flirting with $90/bbl and OPEC+ keeping a lid on its

output, continued growth in both U.S. production — the vast majority of

it in the Permian — and export volumes are definitely in the cards.

It also seems likely that Corpus’s share of export volumes may have

topped out, at least for now.

Don’t get us wrong.

Corpus is still the

big dog. It handled 60% of Gulf Coast export volumes last year and has accounted for about the same proportion of exports so far in

2023. Shippers love the benefits that come from piping neat barrels of

Midland WTI to EIEC and STG at Ingleside, where the crude can be

directly loaded onto VLCCs that can be filled to capacity with only a

one-tanker reverse lighter just offshore. It’s hard to beat that

situation or those economics in Houston or even the Inner Harbor Corpus

terminals, and Ingleside’s magnet-like pull on Permian barrels has left

many of the pipes from West Texas to Houston running well below

capacity.

Is anyone paying attention?