When I first started blogging about the Bakken, I said if you "had" one well, you would eventually have four, probably eight, possibly twelve, and maybe even many more.

Sunday, November 13, 2022

The CLR Charolais Federal Wells Have Been Updated -- These Are Monster Wells, Multiple Formations -- November 13, 2022

Things We Will Be Talking About This Week -- November 13, 2022

Gasoline: in north Texas, Murphy Oil, down to $2.89 / gallon. My wife is thrilled.

- average in Los Angeles County, CA: $5.51 / gallon

WTI: Sunday night futures open up slightly but now trading over $89.

- up 23 cents; up 0.26%; trading at $89.19

Personal note:

- one of the better things for me about the blog: it gets me excited about the future of Texas and the future of the US (and oil and investing)

- best example in the past six hours: Texas relocation and Alliance

The story of the week: crypto. And this story has legs. This is a "run on the banks" without FDIC insurance. There are three components:

- crypto before the FTX crash;

- the FTX crash; and,

- crypto after the FTX crash.

- books will be written about the FTX crash, but the bigger story will be the week that follows. This week, November 14, 2022 -- November 18, 2022.

- I haven't watched CNBC in months, maybe close to a year without watching CNBC, but I am really interested to see how the four panelists on Melissa's "Fast Money" show will spin this story.

- A year ago, their banter on crypto covered the continuum, but, in general, they were cautiously bullish on crypto. Those panelists probably "made it safe" for a lot of naive small mom-and-pop retail investors to get into crypto.

Twitter: this will also be the week that Twitter turns the corner. In a good way.

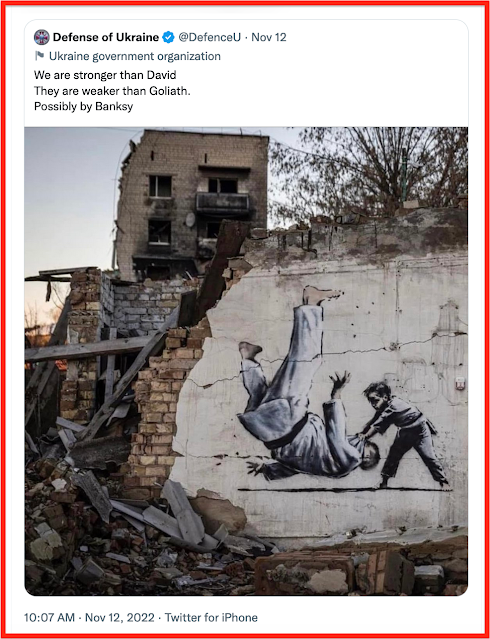

Ukraine.

Oil: now that the world's two biggest producers have made their policies clear:

- US: "no more drilling"

- OPEC: "Saudi first"

- speaking of which: what's the status of "NOPEC"?

Oil:

- they say shale production is peaking;

- SPR releases have to come to an end, sooner or later;

- "Saudi first"

- "no more drilling"

- Iran could still target Saudi oil infrastructure

- China opens up, sooner or later;

- world population hits 8 billion people on November 15, 2022

- Russian sanctions become much more severe December 5, 2022

- even without sanctions, Russia

- has lost huge manpower base

- has lost all (?) western oil field services

- has lost all (?) western technology for drilling

- reminder: Russia didn't even have the expertise to repair one Nord Stream turbine

COP27: the 1.5°C climate target is dead.

- Biden arrives. For an 80-year-old man, he sure gets around.

The Dallas Cowboys.

GE -- November 13, 2022

This is not an investment site. No recommendations. Usual disclaimers apply.

For investors with a 30-year horizon:

- EVs are going to be an albatross around the necks of auto manufacturers for decades;

- best scenario: EV industry survives, but investors make "no" money

- worst scenario: EV industry goes the way of crypto

- renewable energy:

- lots of "ink," but at best, a niche sector

- healthcare: toughest sector for investors?

- aviation is going to be huge -- but it will take another five years to work through the pilot shortage

- with a 30-year horizon, five years will go by quickly;

- more importantly, opens up a great opportunity for those airlines (passenger and cargo) that navigate the shortage the best.

- but the real money: the infrastructure -- planes, engines, digital -- not operations.

On the way to looking up something else, I got distracted by this, after seeing the Barron's article (see below).

GE "demerging":

On November 9, 2021, the company announced it would demerge into three investment-grade public companies.

On July 18, 2022, GE unveiled the brand names of the companies it will create through its planned separation: GE Aerospace, GE HealthCare and GE Vernova.

The new companies will be focused on aerospace, healthcare, and energy (renewable energy, power, and digital).

The first spin-off of GE HealthCare is planned for the first week of January 2023, to be followed by the spin-off of GE's portfolio of energy businesses which plan to become GE Vernova in 2024.

Following these transactions, GE will be an aviation-focused company, renaming itself as GE Aerospace, and will be the legal successor of the original GE.

GE "ad campaign":

- ad campaign, the next era of GE: three business divisions: healthcare; aerospace, and energy.

Getting the most press?

News:

- will spin off its healthcare division

- will re-structure it's energy business

- renewable energy is costing GE money

- but you have to read deeply and in-between the lines to get an idea of how bad it really is

3Q22 CALPERS, link here.

Ticker, one year:

One way to play this:

- accumulate GE today through the end of the year

- take the GE healthcare spin-off and put it back into GE (aviation and energy)

- accumulate the "new" GE throughout 2023, and then,

- take the GE Energy spin-off and put it into GE Aviation

Again, this is not an investment site; no recommendation; usual disclaimers apply.

Winter -- November 13, 2022

This is a photograph taken with an iPhone, not a Nikon, and not a painting. Perhaps one of the best winter scenes I have ever seen.

Flathead Lake, Mission View, November, 2022. Photo by Jan Oksol Greenwald.

**************************

Meanwhile

*****************************

Twitter

They will all come back.

Unless they want to cede the advertising platform to their adversaries, their competitors, to Donald Trump. LOL.

In Passing -- November 13, 2022

Another shoe to drop? Link here.

Another one goes down: AAX. Link here. But it is safe? It's the safest.

I found crypto so uninteresting, that "crypto" was not even noted on the "theme" pages from 2019 and 2021.

Charlie Munger and Warren Buffett nailed it.

Jamie Morgan, flip-flopped.

**********************

More

Bankruptcy: well, duh. Over at CNBC.

CNBC's "Fast Money" panelists: back in 2021, all four panelists were investing in crypto, to the best of my recollection. It would be nice to hear this week, from them how they have done but I doubt they will tell I haven't watched CNBC in months. Maybe I'll watch tomorrow.

Speechless: bitten by a shark.

Losers: Tom Brady, Steph Curry, Kevin O'Leary. This was at Barron's.

Big name auditors: in Forbes.

*********************

Still Biking

Brazilian Jiu-Jitsu -- November 13, 2022

Sophia has a number of after-school activities to include martial arts, dance, and gymnastics.

By a wide margin, Sophia enjoys Brazilian jiu-jitsu the most.

Because of Sophia, I now have a much better understanding of the martial arts.

This popped up in my social media news feed yesterday -- I recognized it immediately as BJJ. Wow, awesome.

************************

Vaccinations

Before I forget, I need to update my vaccination status. This is the most up-to-date I've been since retiring from the USAF, over fifteen years ago.

- Covid-19: fully vaccinated; two primary and two boosters. Next booster next spring / early summer if approved. President Biden has extended the Covid-19 government concern for another ninety days, or something to that effect.

- Shingles: first of two-injection series.

- Seasonal flu: first time I've had the season flu vaccine since leaving the service in 2007.

- Remaining:

- pneumococcal

- tetanus; it's been well over ten years.

*********************

The Book Page

For movie buffs, highly recommended:

- Cinema Speculation, Quentin Tarantino, published November 1, 2022.

Texas Relocation And A Digression -- November 13, 2022

Texas re-locations are tracked here (when I remember).

I've heard the announcement over the PA system many, many times when I've flown from DFW to PDX (north Texas to Portlland, OR) but I have never really paid attention and I never knew "it" was really a thing.

But it really is.

Every time I fly Alaska Airlines, the flight attendants remind the airline is part of the "oneworld alliance." Whatever that is.

Well, here it is and it's real.

And it's really big, and it just moved its headquarters from NYC to Fort Worth, TX.

Which brings us, of course, to the blog's tag, Texas_relocation. The original tag focused on California companies moving to Texas but the tag has now expanded to include New York.

And, now, there's a "Texas relocation" website.

Since we last visited that site, Obagi Cosmeceuticals has announced to relocate their headquarters froom California to The Woodlands.

The Woodlands is a special-purpose district and census-designated place (CDP) in the U.S. state of Texas in the Houston–The Woodlands–Sugar Land metropolitan statistical area.

The Woodlands is located 28 miles north of Houston along Interstate 45. The Woodlands is primarily located in Montgomery County, with portions extending into Harris County. The Woodlands is governed by The Woodlands Township, an organization that provides municipal services and is administered by an elected board of directors.

As of the 2020 U.S. Census, the township had a population of 114,436 people.

In 2021, The Howard Hughes Corporation estimated the population of The Woodlands was 119,000.

Though it began as an exurban development and a bedroom community, it has also attracted corporations and has several corporate campuses, most notably Occidental Petroleum Corporation, Chevron Phillips Chemical, Huntsman Corporation, Woodforest National Bank, Baker Hughes, McKesson Specialty Health, and Halliburton.

The community won a Special Award for Excellence in 1994 from the Urban Land Institute and in 2021 & 2022 was rated the #1 "Best City to Live in America" by Niche.

Obagi Cosmeceuticals, link here. And its website.

Samsung. A much, much bigger story, but slightly older, and perhaps discussed earlier on the blog (I've long forgotten), from a year ago, November 24, 2021:

Taylor, Texas, is in the Austin, Texas, area, about 29 miles northeast of Austin.

Samsung Electronics Co., Ltd., a world leader in advanced semiconductor technology, today announced that it would build a new semiconductor manufacturing facility in Taylor, Texas.

The estimated $17 billion investment in the United States will help boost production of advanced logic semiconductor solutions that power next-generation innovations and technologies. The new facility will manufacture products based on advanced process technologies for application in areas such as mobile, 5G, high-performance computing (HPC) and artificial intelligence (AI).

Samsung remains committed to supporting customers globally by making advanced semiconductor fabrication more accessible and meeting surging demand for leading-edge products.

To put the $17 billion in perspective, let's take another look at another large investment, this time in Phoenix, Arizona: TSMC.

- TSMC: to build another fabrication plant in Arizona alongside the $12 billion factory it has already committed to in Phoenix. Link here.

ATI: a reminder that Allegheny Technologies, renamed ATI recently moved to Dallas:

ATI Inc. (previously Allegheny Technologies Incorporated) is an American producer of specialty materials, the company is headquartered in Dallas, Texas.

ATI produces titanium and titanium alloys, nickel-based alloys and superalloys, grain-oriented electrical steel, stainless and specialty steels, zirconium, hafnium, and niobium, tungsten materials, forgings and castings.

ATI's key markets are aerospace and defense particularly commercial jet engines (over 50% of sales), oil & gas, chemical process industry, electrical energy, and medical.

The company's plants in Western Pennsylvania include facilities in Harrison Township (Allegheny Ludlum's Brackenridge Works), Vandergrift, and Washington. The company also has plants in: Illinois; Indiana; Ohio; Kentucky; California; South Carolina; Oregon; Alabama; Texas; Connecticut; Massachusetts; North Carolina; Wisconsin; New York; Shanghai, China; and several facilities in Europe.

Its titanium sponge plants are located in Albany, Oregon and Rowley, Utah. In total, ATI was said to have capacity for 40 million tons per annum.

Texas re-locations are tracked here (when I remember).

*************************

Speaking of DFW

From the link:

The DFW to Auckland flight is one of only a handful of U.S. flights to New Zealand, and it is the only U.S. flight to New Zealand for the oneworld alliance.

This route connects customers to The City of Sails, located on the North Island of New Zealand, which is the country’s largest city and is host to major sporting events, festivals, high-end shopping, concerts, and world-class food and wine.

This new service connects New Zealand customers to over 200 destinations and builds on the strength of oneworld’s alliance and how it helps make DFW the second most connected airport in the world.

Flight duration: 15 hours.

********************************

DFW: Not The Only Airport In The Metro Area

Love Field: SWA. Downtown Dallas. Passenger.

But this is "a" best-kept secret: Fort Worth Alliance Airport. Link here.

Right now, the "population" center of the DFW metroplex is north of Dallas: Plano, McKinney, Frisco -- some of the fastest growing cities in the US and some of the "richest" cities in the US, home of many, many Fortune 500 companies.

Texas DOT projects/predicts and is planning for the DFW metroplex "population center will move west and by 2050, that center will be north of Ft Worth, right over Westlake, Roanoke, Rhoame. And the airport located there? Fort Worth Alliance Airport .... the country’s first industrial airport, which began Hillwood’s flagship 27,000-acre AllianceTexas development.

DFW: 17,000 acres.

[The master-planned project] was named AllianceTexas because it was a true public-private partnership.

Froom Ross Perot, Jr, and the linked article:

Some 35 years ago, if you looked at a map of Dallas-Fort Worth, the last big piece in North Texas to be built out was the region northwest of DFW Airport. Like other developers, we started out buying land in North Dallas and up and down the Tollway. It was the classic Dallas play. Well, the land prices got too expensive. So, we moved over to north Fort Worth where the land was cheap. That’s where we started investing.

We had one piece of land—about 2,500 acres—and the FAA came to us and said they want to build another airport in North Texas. It was part of the DFW Master Plan, and they built four new airports in the region. We were the second of the four.

We were young. [AllianceTexas co-founder] Mike Berry and I were 26 or 27 years old at the time. What’s great about being young is that you don’t know what you don’t know. All of the established developers at the time told us it would take decades to build an airport.

So, in 1986 the idea was brought to us. We broke ground in the summer of 1988, and we were open by the fall of 1989.

We ended up developing a new generation of airport, called an industrial airport. At the time, the designation didn’t exist with the FAA. So, I went to see the Speaker of the House at the time, Jim Wright (D-Texas). He told me, ‘Don’t worry, Ross, we’ll have a new category in a couple of weeks.’ He wrote it into the budget. And that’s how it got done.

By the way: in the very same area -- GE locomotives for Burlington Northern (now, part of Warren Buffett's empire) --

GE Transportation is a division of Wabtec.

It was known as GE Rail and owned by General Electric until sold to Wabtec on February 25, 2019.

The organization manufactures equipment for the railroad, marine, mining, drilling and energy generation industries.

The company was founded in 1907. It is headquartered in Pittsburgh, Pennsylvania, while its main manufacturing facility is located in Erie, Pennsylvania.

Locomotives are assembled at the Erie plant, while engine manufacturing takes place in Grove City, Pennsylvania.

In May 2011, the company announced plans to build a second locomotive factory in Fort Worth, Texas, which opened in January 2013.

I'm sort of expecting Wabtec to move to Texas some day.

*****************************

First, It Was DQ -- Now, Buc-ee's

No Frack Spreads Available For CLR? Enerplus With Another Big Well -- Initial Production For Wells Coming Off Confidential List This Next Week -- November 13 ,2022

The wells:

- 38786, conf, Medicine Hole 8-27H, Jim Creek, no production data,

- 37954, conf, CLR, Brangus Federal 5-11H1, Elm Tree, no production data,

- 38787, conf, CLR, Medicine Hole 9-27H1, Jim Creek, no production data,

- 37955, conf, CLR, Brangus FIU 4-11H, Elm Tree, no production data,

- 38803, conf, Hunt, King 156-90-5-34H 4, Ross, no production data,

- 37956, conf, CLR, Brangus FIU 3-11H2, Elm Tree, no production data,

- 38788, conf, CLR, Medicine Hole 10-27H, Jim Creek, no production data,

- 37957, conf, CLR, Brangus FIU 2-11H, Elm Tree, no production data,

- 38789, conf, CLR, Medicine Hole 11-27H1, Jim Creek, no production data,

- 37958, conf, CLR, Charolais South Federal 16-10HSL1, Elm Point, no production data,

- 38818, conf, CLR, Bonneville 10-23H1, Rattlesnake Point, no production data,

- 38521, conf, Whiting, Kannianen 11-5-2HU, Sanish,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 9-2022 | 3669 | 2848 |

| 8-2022 | 7055 | 7062 |

| 7-2022 | 15917 | 11775 |

| 6-2022 | 16736 | 11952 |

- 37429, conf, Hess, EN-Madisyn-LE-154-94-0705H-5, Alkali Creek,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 9-2022 | 16194 | 34685 |

| 8-2022 | 17160 | 34440 |

| 7-2022 | 29984 | 50797 |

| 6-2022 | 33384 | 61876 |

| 5-2022 | 30732 | 44709 |

- 35716, conf, Enerplus, FB Leviathan 151-94-27A-34-12T, Antelope,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 9-2022 | 30010 | 62872 |

| 8-2022 | 42383 | 75221 |

| 7-2022 | 39802 | 62285 |

| 6-2022 | 53200 | 80429 |

| 5-2022 | 18013 | 25041 |

- 37430, conf, Hess, EN-Madisyn-LE-154-94-0705H-6, Alkali Creek,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 9-2022 | 16153 | 42609 |

| 8-2022 | 19656 | 47246 |

| 7-2022 | 26388 | 50983 |

| 6-2022 | 31489 | 80808 |

| 5-2022 | 33643 | 51987 |

- 38792, conf, Ovintiv, White Butte 146-98-34-27-1H, Ranch Coulee,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 9-2022 | 24598 | 15314 |

| 8-2022 | 0 | 9 |

- 35489, conf, Enerplus, FB Leviathan 151-94-27A-34-14T2, Antelope,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 9-2022 | 36589 | 62135 |

| 8-2022 | 10992 | 17610 |

| 7-2022 | 24892 | 35391 |

| 6-2022 | 10727 | 12635 |

| 5-2022 | 3666 | 3836 |

38381, conf, Oasis, Swenson Federal 5197 43-35 3B, Siverston,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 9-2022 | 34332 | 60390 |

| 8-2022 | 31784 | 53001 |

| 7-2022 | 32143 | 50964 |

| 6-2022 | 31264 | 48075 |

| 5-2022 | 23814 | 28228 |

- 38271, conf, Whiting, Platt 44-18-2H, Sanish,

| Date | Oil Runs | MCF Sold |

|---|---|---|

| 9-2022 | 3297 | 4427 |

| 8-2022 | 15165 | 13628 |

| 7-2022 | 19676 | 16042 |

| 6-2022 | 20828 | 16654 |

Wells Coming Off The Confidential List This Next Week -- Big Week For CLR: Brangus, Charolais, Medicine Hole, Bonneville -- November 13, 2022

Wednesday, November 23, 2022: 40 for the month, 77 for the quarter, 622 for the year.

38786, conf, Medicine Hole 8-27H,

37954, conf, CLR, Brangus Federal 5-11H1,

Tuesday, November 22, 2022: 38 for the month, 75 for the quarter, 620 for the year.

38787, conf, CLR, Medicine Hole 9-27H1,

37955, conf, CLR, Brangus FIU 4-11H,

Monday, November 21, 2022: 36 for the month, 73 for the quarter, 618 for the year.

38803, conf, Hunt, King 156-90-5-34H 4,

37956, conf, CLR, Brangus FIU 3-11H2,

Sunday, November 20, 2022: 34 for the month, 71 for the quarter, 616 for the year.

38876, conf, CLR, Nebula SWD,

38788, conf, CLR, Medicine Hole 10-27H,

37957, conf, CLR, Brangus FIU 2-11H,

Saturday, November 19, 2022: 32 for the month, 69 for the quarter, 614 for the year.

38789, conf, CLR, Medicine Hole 11-27H1,

37958, conf, CLR, Charolais South Federal 16-10HSL1,

Friday, November 18, 2022: 30 for the month, 67 for the quarter, 612 for the year.

None.

Thursday, November 17, 2022: 30 for the month, 67 for the quarter, 612 for the year.

38818, conf, CLR, Bonneville 10-23H1,

38521, conf, Whiting, Kannianen 11-5-2HU,

37429, conf, Hess, EN-Madisyn-LE-154-94-0705H-5,

35716, conf, Enerplus, FB Leviathan 151-94-27A-34-12T,

Wednesday, November 16, 2022: 26 for the month, 63 for the quarter, 608 for the year.

37430, conf, Hess, EN-Madisyn-LE-154-94-0705H-6,

38792, conf, Ovintiv, White Butte 146-98-34-27-1H,

Tuesday, November 15, 2022: 24 for the month, 61 for the quarter, 606 for the year.

None.

Monday, November 14, 2022: 24 for the month, 61 for the quarter, 606 for the year.

35489, conf, Enerplus, FB Leviathan 151-94-27A-34-14T2,

Sunday, November 13, 2022: 23 for the month, 60 for the quarter, 605 for the year.

38381, conf, Oasis, Swenson Federal 5197 43-35 3B,

Saturday, November 12, 2022: 22 for the month, 59 for the quarter, 604 for the year.

38271, conf, Whiting, Platt 44-18-2H,