Locator: 48420B.

Budget: had Mike Johnson / John Thune signaled huge personal income tax cuts / corporate tax cuts, that would have offset the tariff talk; blaming Trump/Musk for what Americans have been demanding for years (cut the deficit / the debt) -- wrong target. The problem? Congress.

- has Congress even passed any meaningful legislation yet this year?

- GOP has control of both houses and still not getting anything done

- letting judges determine US foreign policy

- not allowing new mothers six weeks to vote from home (US House) has shut down Congress indefinitely

- this suggests to me, GOP not serious; not daring, not willing to support Trump.

Hunch: big story Monday -- one of two big headlines -- or possibly both:

- Trump: spends the weekend golfing;

- Mideast: Iran's nuclear sites implode overnight -- neither US nor Israel comment

Trade wars: this is where we start -- link here -- reported this morning, right on cue, thank you, Ms Liz Ann Sonders, Schwab, link here:

Headlines, same subject:

Comment: US exports surged in anticipation of tariffs! This will be interesting to see how much Europe, Chinese like American products. If things go Trump's way, it's going to corroborate his thesis, as my dad would say, "in spades."

Mexico: Ford, Stellantis both shut their factories in Mexico yesterday (details need to be fact-checked) but fortunately the southern border has been closed; had the southern border not been closed, the headlines this morning would be record illegal crossings surge as Mexico recession pushes workers into America.

Overheard: Obama, "he did it, he really did it. Audacious."

Tariffs: if every country in the world raises tariffs -- everything balances out, doesn't it? What's the difference if every country has 0% tariffs or every country has 50% tariffs? Think about that.

But what really happens: individuals -- i.e., taxpayers -- pay those tariffs, and money generated by tariffs goes directly to the government that mandates tariffs. So, the playing field is even if every country imposes equal tariffs and the money goes directly to the country. Governments have simply raised money to fund their operations. Or pay off debt (wink, wink).

The next question: if tariffs are moot (all countries have 0% tariffs or if all countries ave 50% tariffs) from which country will consumers buy consumer products? Probably from the countries that produce them. One is not going to buy automobiles from Sri Lanka, for example. So, now we get to the crux of the matter: again, from which country will consumers buy consumer products? Yes, the answer is: it depends.

Which countries will participate the most in the sixth industrial revolution. Does China need US products more than the US needs Chinese products? It depends. It may be an incredibly challenge for Wall Street in the near term, but in the long term, the gap between the US and China widens considerably. Russia remains irrelevant (when it comes to consumer goods) and EU comes ever more irrelevant (in everything, not just consumer goods, but also energy and AI).

Europe's push to increase military spending as Trump pulls back: too little too late; and so far, it's just rhetoric.

Fate of Ukraine: now on Macron's shoulders. Quick: name the Germany chancellor. Name the British prime minister. I cannot. And I can't even remember Macron's first name. Most folks can name the president of the United States and six of his lieutenants, the leader of Israel, and the president of Russia.

#1 question this morning: what's going on with TikTok? Let's check x. Nada. Crickets.

- NY Times: no deal yet, but "the contours of one are starting to take shape."

- These are the same guys who earlier this week said "after a slow start, high-speed rail might finally arrive in America" and then revealed that one can drive Boston-to-NYC three minutes faster than the fastest Amtrak train in American (Acela - top speed 150 mph; averages 66 mph Beantown-to-the Big Apple).

- Likely: President Trump will need to extend TikTok waiver for another 15 days;

Iran: on edge.

Biden: another death that shouldn't have happened -- killer had been arrested by ICE; papers signed for deportation; nothing happened under Biden administration -- not only senseless but also criminal on several levels --

******************************

Back to the Bakken

WTI: Trump wanted less expensive oil and he's succeeding -- Saudi's reaction?

- WTI at $62.62 this morning, after dropping 6.47%; dropping $4.33 / bbl. If prices at the pump reflect that drop this weekend, American drivers will be cheering as the 2025 driving season begins.

- everyone predicted tariffs to push inflation higher; but with energy costs plummeting, one wonders.

- it will be interesting to see if US oil production drops back below 13 million bopd

- this really, really messes up the renewable energy equation; 99% of renewable energy manufacturing is thought by many to be China-based (solar panels) or EU-based (wind turbines); if oil is this cheap, it hardly makes sense to spend money on solar panels and wind turbines with huge tariffs

Active rigs: 33.

Five new permits, #41769 - #41773, inclusive, from daily report, dated April 3, 2025:

- Operator: Hess

- Field: Big Butte

- Comments:

- Hess has permits for two EN-Schroeder wells, NWNE 14-157-94; permits for two Patrick Joseph wells, NWNE 14-157-94; and a permit for a EN-Will Trust well, NENW 27-157-94;

- the EN-Schroeder wells to be sited 492 / 525 FNL and 2128 FEL; the Patrick oseph wels, to be sited 426 / 459 FNL and 2128 FEL; and the EN-Will Trust well to be sited 680 FNL and 2082 FWL.

Thirteen permits renewed:

- Grayson Mill &7): Clear Creek Federal, Westberg; Tufto (2), Cow Creek; Peter Coffee (2), Moccasin Creek; and Skaar (2), South Tobacco Garden.

- BR (6): Carlsbad (2), Carlzama, Mazama (3), Twin Valley;

New wells:

- Sunday, April 6, 2025: 26 for the month, 26 for the quarter, 223 for the year,

- 41013, conf, CLR, Alfsvaag FIU 6-31H,

- 40922, conf, CLR, Rutledge 2-11HSL,

- 40373, conf, Slawson, Kahuna 2-6-7H,

- 39809, conf, Kraken, Turbodiesel 19-30-31 1H,

- Saturday, April 5, 2025: 22 for the month, 22 for the quarter, 219 for the year,

- 40372, conf, Slawson, Kahuna 3-6-7H,

- 41034, conf, BR, Cleetwood 7B,

- 39810, conf, Krakken, Turbodiesel 19-30-31-3H,

- Friday, April 4, 2025: 19 for the month, 19 for the quarter, 216 for the year,

- 41064, conf, BR, Tilton 2B,

- 40944, conf, Murex, LA-Alexander Andres 23-36H MB,

- 40497, conf, CLR, Marshall 2-24HSL,

- 40304, conf, Hunt Oil, Trulson 156-90-11-14H-2,

- 39811, conf, Kraken, Apollo 18-7-6-1H,

RBN Energy: US, Canadian energy markets remain key allies despite trade tensions.

The North American energy landscape has undergone significant shifts in

production, infrastructure and pricing for crude oil, natural gas and

NGLs over the past few years and developments within Canada have

strengthened its role in the global energy trade, creating opportunities

and reshaping supply chains. Yet, the market is constantly changing and

today geopolitics and the potential impact of tariffs weigh heavily on

the relationship between Canada and the U.S., North America’s two

producing heavyweights. That shifting landscape is the subject of

today’s RBN blog and a topic we’ll be discussing at our upcoming School of Energy Canada, set for August 26-27 in Calgary. Fair warning, this blog includes an unabashed advertorial for the conference.

The

U.S. and Canada have long been considered to have one of the most

successful bilateral trading relationships in the world, even if those

bonds are being tested like never before. Americans and Canadians are

inextricably linked in a number of ways, from less-serious endeavors

like sports and entertainment to more important topics like commerce and

energy policy. And you can see the similarities in the hard-working

people in the energy capitals of the two nations, Calgary and Houston.

Of course, both cities have epic rodeo seasons. And, aside from the fact

that our northern neighbors can easily handle cold weather at a level

that would (and often does) simply shut down the Bayou City, we’re cut

from the same kind of cloth — good-natured and business-minded.

Despite that camaraderie, trade relations between the two countries’

governments are frayed and tensions unresolved, so it’s more important

than ever to understand the essential connections between the two

neighbors, even if current circumstances remain difficult. The strongest

energy-related links are around crude oil, the main focus for Day 1 of

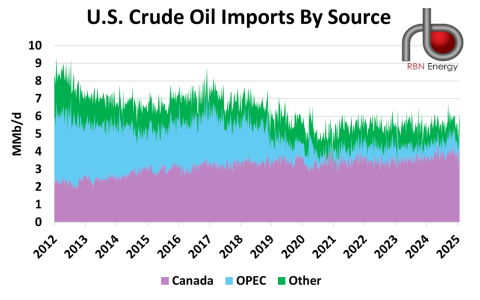

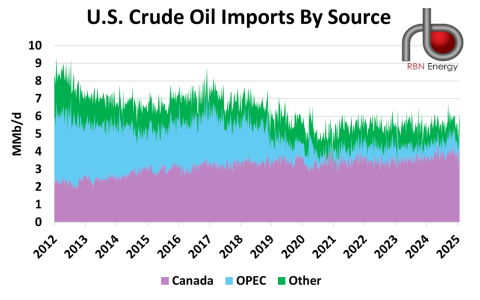

our upcoming conference. Canada (purple layer in Figure 1 below)

supplied 3.8 MMb/d to the U.S. in 2024, or about two-thirds of total

U.S. imports, with imports from OPEC countries (blue layer) and non-OPEC

countries (green layer) in distant second and third place at 1 MMb/d

and 740 Mb/d, respectively. Most of those Canadian imports flowed to

U.S. refineries in PADD 2 (Midwest), many of which are configured

specifically to process large volumes of heavy Canadian crude (see Heart of the Country).

Figure 1. U.S. Crude Oil Imports by Source. Source: RBN