What we'll be talking about today:

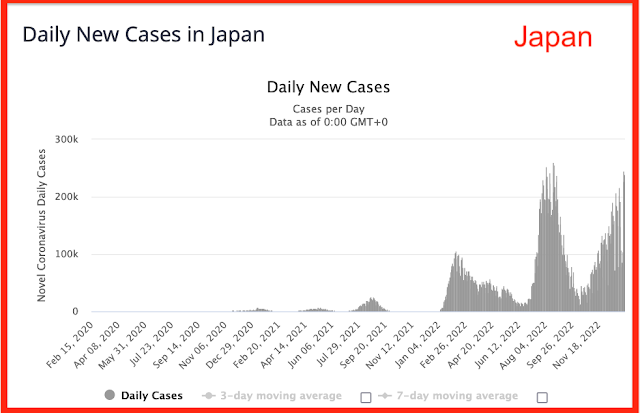

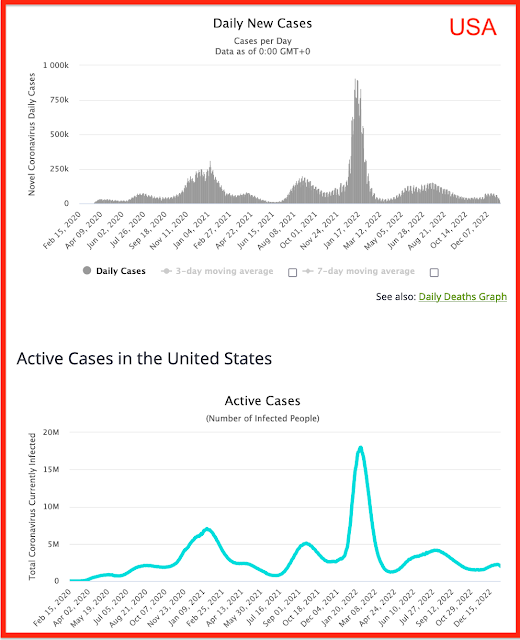

- Japan: Covid-19.

- China: re-opening.

- announces massive oil import quotas

- coal from Australia

- WTI / Brent surges

- Warren Buffett's commodity buying: historical

- Russian sanctions

- TSMC: Buffett again

- airline travel now greater than records set in 2019

- laser-focused on dividends: EPD raises "dividend"

- New England: powering up with most expensive energy on earth

*****************************

Back to the Bakken

The Far Side: the far side.

Active rigs: link here.

WTI: up 3%; up $2.22; trading at $75.99.

Natural gas: up 11%; up 40 cent; trading at $4.114

Monday, January 9, 2023:

37566, conf, Petro-Hunt, Johnson 158-94-14A-23-1HS,

Sunday, January 8, 2023:

38197, conf, Hess, EN-Rehak A-155-94-1423H-6,

36180, conf, BR, George 2B TFH,

Saturday, January 7, 2023:

38918, conf, Rampart Energy Company, Coteau 4,

36181, conf, BR, George 2A MBH,

RBN Energy: Tallgrass bid breathes new purpose into languishing Ruby Pipeline. Archived.

Tallgrass Energy last month snagged an early Christmas present: It

won a bid for Ruby Pipeline, the beleaguered Rockies-to-West Coast

natural gas system that has long been underutilized and cash-poor.

In

doing so, it beat out one of the largest midstream companies in North

America and a long-time co-owner of Ruby — Kinder Morgan.

Ruby may be a

languishing asset, but for Tallgrass it’s more like a crown jewel in its

quest to be the only transcontinental header system in the country that

would connect trapped Appalachian gas supply with premium West Coast

markets

Tallgrass’s Rockies Express (REX) pipeline is already moving

Marcellus/Utica molecules west to the Rockies — the opposite direction

than it was originally built for in the pre-Shale Era

The Ruby

acquisition, which has yet to close, would allow Tallgrass to extend its

reach farther west, directly into the premium West Coast markets. The

Ruby deal comes at a time when California’s aggressive decarbonization

goals are leading to gas shortages and exorbitant fuel premiums out

west, and there’s an immediate need to debottleneck routes to get gas

there. In today’s RBN blog, we begin a series delving into how Ruby fits

into the Western U.S. gas market and what the acquisition would mean

for Tallgrass.

We’ll start with the deal itself. On December 16, Tallgrass announced

that it had reached an agreement to buy the Ruby Pipeline out of

bankruptcy for $282.5 million.

Ruby Pipeline, a joint venture of Kinder

Morgan and Calgary-based Pembina, filed for Chapter 11 bankruptcy

protection on March 31 as the financially struggling pipeline was

approaching debt repayment obligations that it could not meet. Tallgrass

entered its bid in a court-ordered auction held on December 13, beating

out a bid of $276 million from Kinder Morgan’s EP Ruby LLC, which also

made the initial stalking-horse bid of $236 million.