Disclaimer: this is not an investment

site. Do not make any investment, financial, job, career, travel, or

relationship decisions based on what you read here or think you may have

read here.

All my posts are done quickly:

there will be content and typographical errors. If anything on any of

my posts is important to you, go to the source. If/when I find

typographical / content errors, I will correct them.

"New-money allocation: 30-year horizon.

- first and third week of every month

- dividend-paying

- allocation

- 40%: Buffett-like, blue chip, DE, CAT

- 25%: beaten down infrastructure (mostly semiconductors; copper)

- 20%: energy (mostly oil)

- 10%: mRNA (mostly Big Pharma)

- 5%: Daimler Truck Group

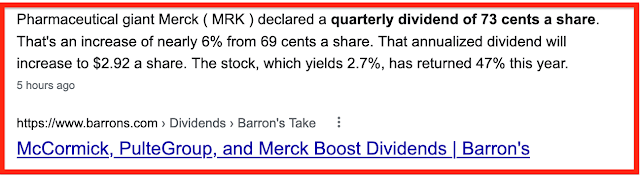

Both ENB and MRK announced dividend increases this past week.

Enbridge:

The leading midstream energy player projects earnings before interest, income taxes and depreciation for next year in the band of C$15.9 billion to C$16.5 billion. This reflects an improvement from C$15.0 billion to C$15.6 billion of adjusted EBITDA this year.

For next year, ENB projects distributable cash flow per share in the band of $5.25 to $5.65. This is also depicting the picture of improvement from this year’s DCF of $5.20 to $5.50.

Along with the financial guidance, Enbridge announced the increase of its annualized common share dividend to C$3.55 per share from C$3.44.

Merck:

****************************

TSM

Link here.

***********************

Read The Small Print; Very Interesting

Go woke, go broke

The announcement Tuesday, June 21, 2022, comes a decade after Kellogg’s $2.7 billion purchase of Pringles, which signaled the company’s shift to focusing on the global snacks business with people increasingly eating more often between meals.

Kellogg, along with rivals like Frito-Lay-owner PepsiCo and Oreo-cookie owner Mondelez

, have leaned into the trend by introducing more snacks and snapping up smaller brands.

On Monday, Mondelez said it is acquiring Clif Bar for $2.9 billion.

Cereal sales, by contrast, have stagnated in the U.S. as people eat on the go and reach for a greater variety of options in the morning.

Brands including Special K, Froot Loops and Rice Krispies had for decades been a foundation of Kellogg, but are no longer seen as key growth drivers for the company.

The pandemic briefly revived the cereal category as more consumers ate breakfast at home, but Kellogg expects flat revenue growth for its North American cereal business in the future.

Even before the deal was announced, we learn that Kellogg was considering selling its "plant-based business." Would this be "Beyon-Meat-like" companies/products? If so, this goes under the go woke, go broke category.

CEO Steve Cahillane said all three businesses have “significant” standalone potential, although the company is exploring alternatives including a potential sale for its plant-based business.

Note, December 3, 2022: