Locator: 45627AAPL.

Tuesday, September 12, 2023

Will We See $89 Tomorrow? Three New Permits; Two Permits Renewed; Two DUCs Reported As Completed -- September 12, 2023

Locator: 45625B.

McDonald's: about time. They should have done this years ago -- great decision on so many levels. McDonald's to remove self-serve soda machines. Smart, smart, smart.

Undocumented visitors: if NYC can't handle a thousand visitors from Texas, how in the world is Texas "handling" tens of thousands from Mexico on a daily basis? I see a lot of stories about the plights of NYC and San Francisco when it comes to undocumented visitors, but seldom an article on Texas and this issue.

Twitter: search Aaron Rodgers.

***************************

Back to the Bakken

- CVX: up almost 2% today; up over $3 / share

- COP: up 2.2%;

- PSX: up almost 2%

- MPC: up 1.75%

- KMI: up 2.8%

- Operators: Grayson Mill (2); BR

- Fields: Briar Creek (McKenzie County); Elidah (McKenzie)

- Comments:

- BR has a permit for a Nordeng well, lot 1, section 5-151-97;

- to be sited 419 FNL an 1247 FEL;

- Grayson Mill has permits for two Hopes wells, lot 4, section 30-152-104;

- one to be sited 860 FSL and 300 FWL and the other 890 FSL and 301 FWL

- 33973, Enerplus, a Titanium permit; Moccasin Creek, Dunn County;

- 33974, Enerplus, a Silver permit; Moccasin Creek, Dunn County;

- 39614, 1,420, Kraken, Gladys 29-20-17 4H,

- 39615, 1,301, Kraken, Gladys LE 29-20-17 1H,

Within Your Reach -- Investing -- September 12, 2023

Locator: 45624TECH.

Personalized direct investing. Custom indexing.

Links embedded in screenshot:

It was particularly noteworthy to see the "Fisher" ad. The Fisher ad says their fees are "transparent." Perhaps, but you have to provide personal information. Minimum investment: $500,000.

Schwab: fee -- 40 basis points and $100,000 minimum investment. The fee drops to 35 basis points at a high level of investment.

Schwab says Fidelity also offers the investment opportunity. I was unable to find specifics, but I did not look very hard. At the website, wealth management eligibility, generally $250,000 with fees of 50 to 150 basis points. My hunch: Fidelity will match Schwab's Personalized Indexing. This may be Fidelity's "personalized direct investing." But perhaps not, I don't know. If not, Schwab (and mostly likely Fisher) have added a most interesting feature.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

All my posts are done quickly:

there will be content and typographical errors. If anything on any of

my posts is important to you, go to the source. If/when I find

typographical / content errors, I will correct them.

The evolution of personalized investing:

- mutual funds: my dad's generation

- ETFs: my generation

- personalized direct investing: my daughter's / grandchildren's generation

IIRC Schwab introduced personalized direct investing in October, 2021. This has been available to high-dollars clients ($10 million in investment assets) and had very high fees. Schwab makes this investment tool / feature with a minimum of $100,000 and a fee of 40 basis points (0.4% = 0.004 as the multiplier).

Again, I also make simple arithmetic errors.

Schwab, apparently brought this investment vehicle to market, after polling its customers to find the #1 feature their clients wanted, or the #1 complaint they had about individual investing or the #1 thing about which investors were most concerned. My hunch: readers can guess the answer.

I may come back to this but mom-and-pop investors may want

to explore this investment tool previously available only to the very

wealthy.

Disclaimer: this is not an investment site. Do not make any investment, financial, job, career, travel, or relationship decisions based on what you read here or think you may have read here.

All my posts are done quickly:

there will be content and typographical errors. If anything on any of

my posts is important to you, go to the source. If/when I find

typographical / content errors, I will correct them.

************************

The Periodical Page

I subscribe to a fair number of periodicals. Many arrive each week and often I find myself paging through them and never reading them. I have most difficulty reading the Claremont Review of Books (conservative) and The New Yorker (liberal).

But I have a new resolution: I must read and take notes -- yes, take notes -- on at least one article from one periodical (print edition) every day.

I just finished a most delightful essay on baseball in the summer, 2023, issue of Claremont.

*************************

Apple

I just saw the Apple autumn presentation on the new Apple Watch, series 9; and, the new iPhone 15. The presentations, since the Steve Jobs' era, have become too slick -- a one-hour television commercial. They've lost the spontaneity and excitement that Steve Jobs used to bring to these semi-annual presentations. I'm glad I watched it from start to finish but had I missed the presentation, I would not have "missed" anything of substance.

TSM To Invest Up To $100 Million In ARM IPO -- September 12, 2023

Locator: 45624TECH.

**************************

The Book Page

It took awhile but I finally slogged my way through Alison Weir's Mary, Queen of Scots.

Highly recommend for those interested in the full story of the murder of Lord Darnley, her third husband.

Five-Years Of Investing -- September 12, 2023

Locator: 45622INV.

Net worth, link.

One wonders if net worth includes what one would need to have in the "bank" to cover social security benefits and government-backed pensions. And, then, of course, Medicare and Tricare. I figure many seniors would need upwards of $4 million "in the bank" to match social security benefits and government pensions.

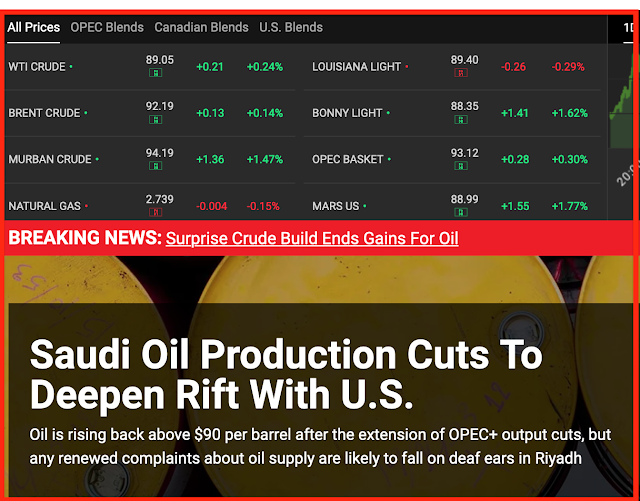

WTI: $88 -- Oil Stocks? Yawn -- September 12, 2023

Locator: 45621B.

WTI: $88.

Wednesday, September 13, 2023: 83 for the month; 285 for the quarter, 530 for the year

39641, conf, CLR, Gordon Federal 24-8HSL1,

39624, conf, Creescent Point, CPEUSC Ruby 4 20-17-158N-100W-MBH,

36574, conf, Hess, EN-Kiesel-155-94-1918H-5,

Tuesday, September 12, 2023: 80 for the month; 282 for the quarter, 527for the year

39625, conf, Crescent Point, CPEUUSC Matilda May 5 29-32-158N-100W-MBH,

38900, conf, Whiting, Snowshoe Federal 31-30-4H,

37926, conf, BR, Boxer 2C TFH,

RBN Energy: storage values are making a comeback; but will a capacity build-out follow?

After being relegated to the back burner during the shale boom, the natural gas storage market is showing signs of a comeback. Market participants are clamoring for storage solutions, storage values are rising, and storage deals and expansions are bubbling up. However, that won’t necessarily lead to a widespread build-out of new storage capacity like the one that transpired in the pre-shale storage heyday of the mid-to-late 2000s. That’s because the world has changed, and what’s driving storage values today is vastly different than what drove the last big capacity build-out. In today’s RBN blog, we look at the emerging developments in the storage market, what’s driving them, and the implications for Lower 48 storage capacity.