From the linked article:

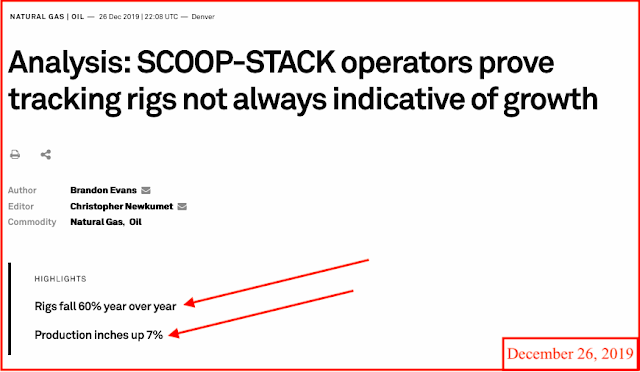

Continued production in Oklahoma's SCOOP-STACK demonstrates how tracking rig count to determine production swings has become an antiquated practice in some US shale plays.

For example, crude oil production in the SCOOP-STACK recently reached annual highs of 488,000 b/d even as rigs continued to plummet to new lows last seen in 2016.

While producers had more than 100 rigs deployed across the SCOOP-STACK in January, the number has since fallen to 44 rigs.

While tracking rigs used to be a key indication of where basin production would head in the near-term future, SCOOP-STACK operators have proven in 2019 this modeling concept does not always apply, as the region is expected to grow production 7% year over year, while rigs are down 60% year to date from the most recent drilling data by Enverus.

While well-level efficiencies are a key contributor toward understanding production gains or losses, the SCOOP-STACK happened to significantly draw from their built drilled-but-uncompleted (DUC) inventory for most of 2019, as heightened completion activity from January through May helped operators grow production.

Moving into 2020, Platts Analytics is forecasting the SCOOP-STACK to grow by 11,000 b/d, as operators such as Continental Resources and Encana can continue to utilize the same strategy developed in 2019.