Locator: 45800B.

NEWS

Tesla: link here. DOJ seeks documents on driving range (but look at the URL).

The company's spending is, however, expected to return to the $7

billion and $9 billion range in the next two years, a regulatory filing

showed.

Tesla was hesitating on its plans for a factory in Mexico

as it grapples with a turbulent economic outlook, CEO Elon Musk said in

an earnings call earlier this month.

Saudi perspective: Saudi Arabia's Mideast dream in tatters. Bloomberg. Hamas atrocities in Israel.

Apple: to lose everything it has on mainland China — Peter Zeihan. Link here.

Liz: Link here. Merry Christmas.

****************************

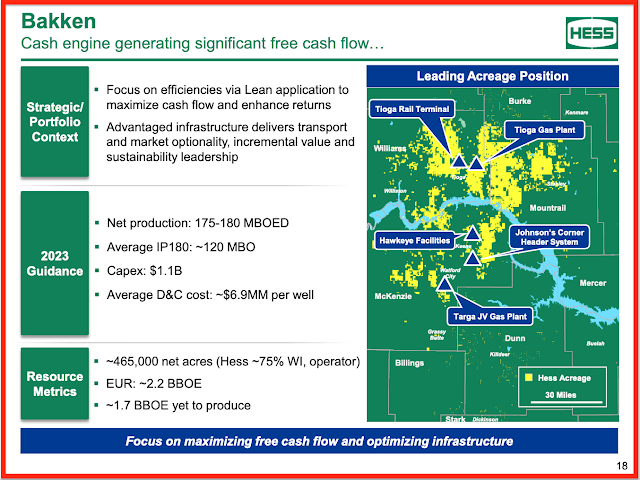

Back to the Bakken

WTI: $87.02. It appears the US has settled things down in the Mideast. Business back to normal.

Tuesday, October 24, 2023: 59 for the month; 59 for the quarter, 629 for the year

39678, conf, Crescent Point Energy, CPEUSC Getzlaf 3-25-36-158N-101W-MBH, Little Muddy,

38092, conf, Enerplus, Baleen 148-93-05A-06H, McGregory Buttes,

37449, conf, Hess, EN-Abrahamson-LE-155-93-3019H-1,

34221, conf, BR, Abercrombie 3-8-12 MBH, Elidah,

Monday, October 23, 2023: 55 for the month; 55 for the quarter, 625 for the year

39845, conf, Kraken, Wiseman 31-36-35-34 5H, Hebron,

39679, conf, Crescent Point Energy, CPEUSC Getzlaf 2-25-36-158N-101W-MBH,

39635, conf, SWD, Dakota Fluid Solutions

Sunday, October 22, 2023: 52 for the month; 52 for the quarter, 622 for the year

39680, conf, Crescent Point Energy, CPEUSC Farthing 5-30-31-158N-100W-MBH-LLW,

38276, conf, Hess, BB-Olson-150-95-009H-2, Blue Buttes,

Saturday, October 21, 2023: 50 for the month; 50 for the quarter, 620 for the year

39681,

conf, Crescent Point Energy, CPEUSC Clermont 5-19-18-158N-100W-MBH-LL,

RBN Energy: shifting natural gas and power market fundamentals driving storage values.

Storage has long been a critically important balancing mechanism in

the Lower 48 natural gas market. Now, after languishing for much of the

Shale Era, storage values are coming out of the doldrums. The key driver

behind this change is that, unlike in the old days, when the storage

market was driven primarily by the intrinsic value of capacity —

i.e., the need to sock away gas in the lower-demand summer months for

use in the peak winter months — the value of storage is being driven

almost exclusively by extrinsic economics — i.e., how flexible

and responsive capacity allows market participants to manage supply and

demand during short-term market swings. This flexibility and

responsiveness have become increasingly important criteria for ensuring

reliability as LNG export facilities and an increasingly

renewables-heavy power sector navigate frequent demand fluctuations day

to day, or even intraday, as well as during high-stakes, extreme weather

events like 2021’s Winter Storm Uri. In today’s RBN blog, we delve into

the fundamental shifts influencing today’s storage market.

In Part 1,

we began with a history of the various phases of the Lower 48 storage

market, including the gas storage heyday, when deregulation and a

scarcity mindset led to a big build-out of storage capacity in the late

2000s and early 2010s. That gave way to a Dark Age for storage in the

late 2010s when the near-perfection of shale drilling technology and an

era of supply abundance left the market with too much storage capacity

and depressed storage values. More recently, storage has been making a

comeback, but as we concluded in the earlier blog, things are different

this time around.