Locator: 44407B.

Flashback, link here.

- Peter Lynch oon Louis Rukeyser's Wall Street, June 28, 2002 -- more thhan twenty years ago.

Putin's War: shifting the burden to the population. The Russia File -- from the Wilson Center. Link here.

Lucid: on which planet do these folks live? Link here.

The Lucid Air starts $180,000, though that is the going rate for a Porsche Taycan Turbo S.

The Model S Plaid [Tesla], essentially the car the Lucid likely benchmarked the Air against, starts at around $130,000 when optioned with full-self driving.

Whether the Lucid is worth around $50K more is an interesting question.

The Lucid Air in Grand Touring trim does much more range (516 miles) than the Model S (348 miles).

That being said, if you're in the market for that high-end super performing sedan, electric sedan, the Lucid here is an unbelievable package. And if you're looking for a cheaper version of this car, there's the Pure edition which will start around $80,000 and comes well equipped and offers 400 miles of range.

Renault: in light of Tesla price cuts, Renault reviewing its prices worldwide. Link here.

GM: ditches Apple CarPlay. WSJ. 99% of those commenting at the article consider this a really, really dumb move on the part of GM. Announced by GM's CFO. GM is desperate to cut costs.

Germany shuts down last nuclear reactor. Everyone following this story (rationally) says this was a most stupid move -- to shut down its entire nuclear energy program. On so many levels.

Copper: Teck, Glencore, BHP, Rio Tinto Group, Anglo, Vale SA, Freeport McMoRan -- link here.

HP and Rio Tinto Group have already shown they’re willing to pay hefty premiums

for copper, both doing recent deals for about a 50% premium (Glencore’s

Teck offer is 20% by comparison), but these were relatively small,

bolt-on acquisitions.

A Teck bid would be an order

of magnitude higher, and — unlike the recent deals — would likely

attract competition. It has already been reported that Anglo, Vale SA

and Freeport McMoRan Inc. would be interested in the company’s metals business following a spinoff.

Teck

investors, who get to decide the company’s immediate future at a vote

next week, will now have to weigh up whether the lure of its copper

mines is enough for the big players to break free from the financial

shackles they’ve worn for the past decade and pursue a landmark deal.

Finland: fourteen years delayed!!

Europe’s largest nuclear reactor has begun regular power output 14

years later than planned, boosting the region’s energy

independence. The 1,600-megawatt plant in Finland is the first new

atomic reactor in the Nordic countries since the mid-1980s.

Before market opens:

- SCCO: flat in the pre-market.

- BUD: up 1.1%.

- first time ever, a Budweiser commercial on my twitter feed

- the classical Clydesdale commercial

- SCHW: up 2.0%

- earnings: forecast, 90 cents / share

- beats by 3 cents; link here;

At open, SCHW falls over 2%. Was "up" pre-market and then with announcement about buy-backs, drops. But mid-morning, back up over 3%.

******************************

Back to the Bakken

Active rigs: 41.

Peter Zeihan newsletter.

WTI: $82.01.

Natural gas: $2.181.

Tuesday, April 18, 2023 -- taxes due: 32 for the month; 32 for the quarter, 287 for the year

39217, conf, SOGC (Sinclair), Grasslands Federal 14-15-5H,

Monday, April 17, 2023: 31 for the month; 31 for the quarter, 286 for the year

38866, conf, Liberty Resources, CA S 158-93-21-23-3MBHX,

Sunday, April 16, 2023: 30 for the month; 30 for the quarter, 285 for the year

38638, conf, Whiting, Braaaflat 11-11-3H,

38372, conf, Oasis, Rey Federal 5201 32-11 3B,

Saturday, April 15, 2023: 28 for the month; 28 for the quarter, 283 for the year

None.

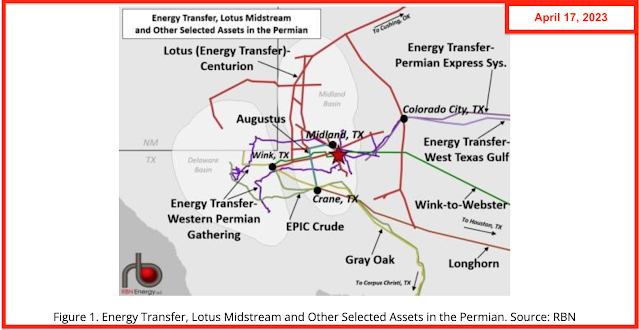

RBN Energy: Energy Transfer steps up its Permian game with Lotus Midstream deal, part 5. Archived.

It’s not just the upstream side of the Permian that’s in the midst of a

major consolidation. Over the past couple of years, a slew of

significant M&A deals have been made in the midstream space, most

recently Energy Transfer’s $1.45 billion plan to acquire Lotus

Midstream. Backed by private equity, Lotus has assembled an impressive

array of crude-oil gathering, storage and long-haul pipeline assets in

West Texas and southeastern New Mexico — including the Centurion

pipeline system that links the Permian with the crude oil hub in

Cushing, OK. In today's RBN blog, we discuss the deal and what it means

for Energy Transfer, whose role in the U.S.’s most prolific

crude-oil-focused production area is poised to expand by leaps and

bounds.