Locator: 44424B.

Ford to Norway: link here. Not a good sign. Deliveries begin in 2024.

Space X: a bad day.

WTI: down 2.43% in mid-morning trading; down almost $2 / bbl; trading at $77.24. Rumors: Dylan Mulvaney just endorsed US crude oil.

T: link here. T sells off after earnings report.

TSM earnings. Link here.

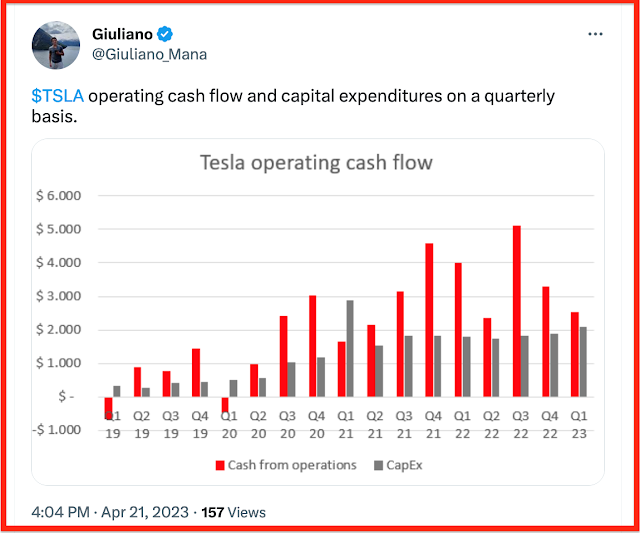

Tesla earnings. Story everywhere. This needs to be fact-checked, but if accurate, wow! That's all I can say. Link here. Tesla shares down about 10% yesterday if one includes after-hour trades? Pre-market today, TSLA down over 7%. What happened? Did Tesla give Dylan Mulvaney a free Tesla?

CLR: to put that Tesla FCF into perspective:

JNJ: raises dividend by 5.3%.

Costco: raises dividend 13.3 percent.

Sunoco: raises dividend, from 49 cents to 51 cents. Disappointing; needs to do better.

US-Mexico LNG, link here.

Wind power: profitably problem. Nothing new. Just an update.

Link here.

********************************

Back to the Bakken

Active rigs: 44.

Peter Zeihan newsletter.

WTI: $77.90.

Natural gas: $2.243.

Friday, April 21, 2023: 39 for the month; 39 for the quarter, 294 for the year

39062, conf, KODA Resources, Bock 3229-2 BH,

37474, conf, Petro-Hunt, Watterud 160-95-11C-2-3H,

Thursday, April 20, 2023: 37 for the month; 37 for the quarter, 292 for the year

38869,

conf, Lime Rock Resources, Neal 4-33-28H-144-95,

37475,

conf, Petro-Hunt, Watterud 160-95-14B-23-3H,

RBN Energy: their finances now stronger than ever, E&Ps assess what's ahead. Archived.

The Shale Revolution transformed the U.S. oil and gas industry

operationally and functionally in the late 2000s and early 2010s, but

the most significant changes occurred years later. Through the middle

and latter parts of the last decade, E&Ps continued to improve their

drilling-and-completion techniques and significantly increased

production as they gained experience.

This production growth was enabled

by — or driven by, depending on the perspective — midstream companies’

aggressive efforts to build out the pipelines, gas processing plants and

other infrastructure required to handle higher production volumes and

exports. More recently, capital market constraints, the Covid pandemic

and a looming ESG narrative have propelled the industry into the next

phase of its evolution, highlighted by fiscal discipline, which delivers

improved shareholder returns through managed capital spending. But how

long will this stage last — and what’s next? In today’s RBN blog, we

examine the energy industry’s maturation and the differences between

this transformation and those in other industries.