Locator: 48381B.

Note blog's disclaimer before proceeding.

Natural gas companies: ten best for investors, per Insider Monkey, link here. Perhaps here is better.

In reverse order, #10 to #1:

- Williams (WMB)

- moves one-third of all natural gas in the US

- price target raised from $61 to $62

- Canadian Natural Resources Limited (CNQ)

- Shell (SHEL)

- price target, $82

- Duke Energy Corporation (DUK)

- price target $128, recently raised from $123

- OXY

- price target $59, recently raised from $52; "neutral" rating

- Chevron Corporation (CVX)

- share buybacks in 2024: $15 billion

- Targa Resources Corp (TRGP)

- ConocoPhillips (COP)

- price target of $137; currently $103

- Exxon Mobil Corporation (XOM)

- price target of $133;

- Hess Corporation (HES)

- often shows up in these sorts of lists; will likely be acquired by either XOM or HES;

- EPS, 4Q24

- $1.76, easily surpassing forecast of $1.53

- cash flow, 4Q24:

- $4.93 vs $4.29, estimated; pays $2.00 annual dividend

OXY: Vanguard Group buys 10 million shares of OXY. Link here. Archived.

CNBC's Cramer on OXY: no.

******************************

Back to the Bakken

WTI: $69.58.

New wells:

- Friday, March 28, 2025: 81 for the month, 192 for the quarter, 192 for the year,

- 40512, conf, Phoenix Operating, Daniele 26-35 2 5H,

- 40511, conf, Phoenix Operating, Daniele 26-35-2 4H,

- 40510, conf, Phoenix Operating, Daniele 26-35-2 2H,

- 40509, conf, Phoenix Operating, Daniele 26-35-2 1H-LL,

- 40474, conf, Hess, GO-John-156-98-0508H-3,

- 40447, conf, Phoenix Operating, Daniele 26-35-2 3H,

- Thursday, March 27, 2025: 75 for the month, 190 for the quarter, 190 for the year,

- 41073, conf, BR, Tilton Diamond Forest 2A ULW,

- 40219, conf, Hunt, Halliday 146-92-18-1H 1,

- 40218, conf, Hunt, Halliday 146-92-19-36H 1,

- 39319, conf, Grayson Operating, Marilyn 31-33 3H,

RBN Energy: gas producers drive 4Q24 earnings growth as oil prices languish.

Most conversations and analyses around hydrocarbon prices tend to focus on crude oil, if for no other reason than the direct exposure we experience when filling up at the pump. After the commodity price crash in early 2020, which threatened the financial stability of U.S. E&Ps, a subsequent surge in oil prices drove a remarkable recovery, winning back investor confidence in the industry. Crude realizations have subsequently declined, slowly but steadily eroding producer results. Fortunately, the outlook for natural gas, which represents just under half the total output of our 38 U.S. E&Ps, has begun to brighten. In today’s RBN blog, we analyze Q4 2024 results for the major E&Ps we cover with a focus on the impact of rising natural gas prices.

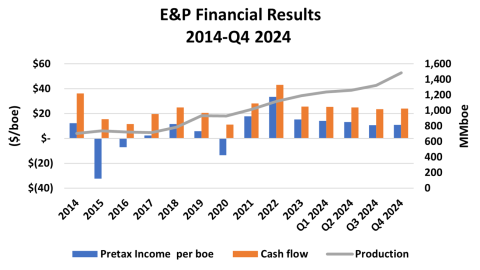

As shown in Figure 1 below, E&P pre-tax operating earnings (blue bars and left axis) rose to record highs in 2021 and 2022, then declined through 2023 and the first three quarters of 2024.

The driver was a drop in crude oil prices from more than $100/bbl in mid-2022 to a $70-$80/bbl range over the last eight quarters. The quarterly average price reached a three-year low of $70.32/bbl in Q4 2024. Despite the substantial dip from $75.26/bbl in Q3 2024, the erosion in profits stopped, as pre-tax income for our universe rose 1.5%, from $10.72/boe to $10.89/boe. Natural gas prices rose from record lows in the first three quarters of 2024, which kept Q4 2024 revenue essentially flat at $35.60/boe despite the 7% decline in average WTI prices.

Figure 1. E&P Financial Results and Production, 2014-Q4 2024.

Source: Oil & Gas Financial Analytics, LLCThe Henry Hub spot price increased from $1.99/MMBtu in August 2024 to $3.01/MMBtu in December. As a result, average realized natural gas prices for major producers increased. For example, EOG’s quarter-over-quarter gas realizations rose by 41%, Devon Energy’s increased by 50% and ConocoPhillips’ jumped by 77%. Permian producers that faced negative pricing at the Waha Hub for long stretches in mid-2024 (see Don’t Blame Me) benefited from a turn to the positive, as Diamondback Energy’s average realization pivoted from a $0.26/MMBtu loss in Q3 2024 to an $0.82/MMBtu gain in Q4 2024.