Locator: 46568B.

Houthis: how did this ever happen?

Trump labels the Houthis as a terrorist group. Biden, soon after coming into office, reverses that and takes the Houthis off the terrorist list. Was anyone paying attention? Did anyone care? Whatever. Yesterday, the Biden administration puts the Houthis back on the terrorist list. What's going on here? LOL. Why did Biden care more about the Houthis than the southern surge? Asking for a friend.

Big story today: CRISPR. Transfuion-dependent beta thalassemia. A list price of $2.2 million in the United States. Link here. Think Covid vaccine. Yeah, the dots connect.

******************************

EVs

Updates

Later, 10:05 p.m. CT: link here.

Later, 10:04 p.m. CT: link here.

From the linked article:

Wall Street is downgrading shares of U.S. car manufacturers even though

interest rates are set to decline, easing the burden of car payments.

Auto makers also have a new labor deal that brings some certainty about

costs.

Still, investors woke up to a trio of car-stock downgrades Wednesday, January 17, 2024.

For starters, UBS analyst Joseph Spak cut his rating on Ford Motor

F stock to Hold from Buy. His target for the price stayed at $12 despite

the downgrade.

The share price has rebounded from its November lows of around $10, set

right around the time the United Auto Workers union ratified a new 4½

year labor contract with the Big Three car makers.

Two EV start-ups also caught downgrades. Deutsche Bank analyst Emmanuel

Rosner cut his rating on Rivian Automotive stock to Hold from Buy, lowering his price target to $19 from $29 a

share. Rivian shares were down 4.9% at $16.94 in early trading.

Fisker

stock is down the most, falling 11% to 86 cents a share after TD Cowen

analyst Jeffrey Osborne cut his rating to Hold from Buy and moved his

target price to $1 from $11 a share.

Original Post

Another big story: EVs are cratering.

- exhibit A: Rivian. As bad as it's been this past month -- down 31% in the past month -- RIVN is down another 8% today.

- winter storm stories not helping. Glut of oil not helping; WTI falling in price.

- polls show Americans getting less interested as time goes on

- Telsa cuts prices; headline over at CNBC (?): EV price war begins.

Tesla Cybertruck, link here. Do folks really see the Cybertruck as a serious competitor to legacy ICE pickup trucks? Scathing article from The Verge including some "shenanigans."

Rivian, the darling of Wall Street:

F, another EV company, and another darling of Wall Street, similar ticker action:

Another EV company:

********************************

Back to the Bakken

WTI: $71.83.

Friday, January 19, 2024: 33 for the month; 33 for the quarter, 33 for the year

None.

Thursday, January 18, 2024: 33 for the month; 33 for the quarter, 33 for the year

None.

Wednesday, January 17, 2024: 33 for the month; 33 for the quarter, 33 for the year

39660, conf, EOG, Blueberry 2803-03H,

39659, conf, EOG, Blueberry 2919-02H,

39658, conf, EOG, Blueberry 2919-01H,

39052, conf, Oasis, Bergem 5199 43-33 5B,

38161, conf, BR, Lone Beaver 6-1-17MBH,

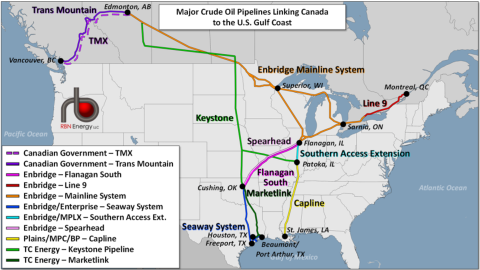

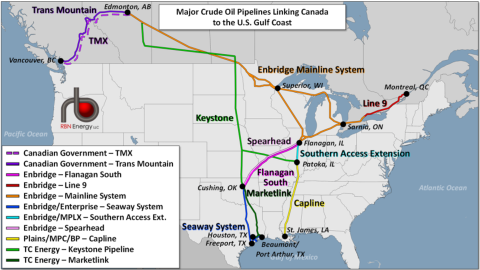

RBN Energy: Trans Mountain expansion will pose a test for US refiners in need of barrels.

The impending startup of Canada’s government-owned Trans Mountain

Expansion Project, better known as TMX, will add exit capacity for

Western Canadian crude oil production and is expected to redirect at

least some of Alberta’s output toward California and Asia and away from

its traditional North American markets, including complex refiners in

Eastern Canada and the U.S. Midwest and Gulf Coast. Among them, Gulf

Coast refiners, who have become the “price-setting” consumers of heavy

Western Canadian crude, are expected to be the hardest hit. In today’s

RBN blog, we examine the Gulf of Mexico production and imported grades

that might become stand-ins for the “lost” Canadian barrels.

The TMX project aims to add 590 Mb/d of egress capacity for heavy

crudes emerging from Western Canada after twinning the existing Trans

Mountain Pipeline (TMP). As discussed at length in West Coast Pipe Dreams, the Trans Mountain system’s former owner, Kinder Morgan, had promoted the TMX project

to the industry more than a decade ago, but only began construction

after getting regulatory approvals from the National Energy Board (the

predecessor of the Canada Energy Regulator, or CER) in May 2016; Canada’s federal government gave its blessings later that year (see One is the Loneliest Customer).

Figure 1. Major Crude Oil Pipelines Linking Canada to the U.S. Gulf Coast. Source: RBN

TMX (dashed purple line at top left of Figure 1) mainly uses the

right-of-way of the existing 300-Mb/d TMP system (dark-purple line) that

runs from Edmonton, AB, to the Burnaby Terminal, the Westridge Marine

Terminal and the Parkland Fuel refinery — all in the Burnaby, BC, area —

and the U.S. border at Sumas, WA, where it connects to Puget Sound

Pipeline for delivery to four Washington state refineries. The completed

project also will add three new ship berths at the Westridge facility

that will boost exports.